Construction MMI: December U.S. Construction Spending Up 1.6% Year Over Year

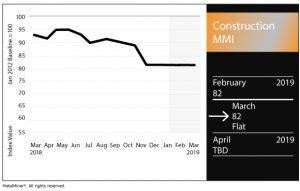

The Construction Monthly Metals Index (MMI) held flat for an MMI reading of 82 this month.

Need buying strategies for steel? Request your two-month free trial of MetalMiner’s Outlook

U.S. Construction Spending

According to Census Bureau data released earlier this week, U.S. construction spending in December 2018 reached an estimated $1,292.7 billion, down 0.6% from the previous month but up 1.6% year over year.

Construction value in 2018 surged 4.1% from 2017, according to the Census Bureau release, up to $1,297.7 billion from $1,246 billion.

Broken down by type, spending on private construction hit $991.2 billion, down 0.6% from November’s estimate of $997.1 billion.

Within private construction, residential construction hit $536.7 billion in December, down 1.4% from the November estimate of $544.2 billion. Nonresidential construction reached $454.5 billion in December, up 0.4% from the revised November estimate of $452.9 billion.

Meanwhile, public construction spending in December was $301.5 billion, down 0.6% from the revised November estimate of $303.5 billion. Within public construction, educational construction reached $77.5 billion, holding flat from November spending. Highway construction reached $89.1 billion, marking a decrease of 0.9% from November’s estimate of $89.9 billion.

Billings Growth Strong to Start 2019

According to the monthly Architecture Billings Growth Index (ABI) released by the American Institute of Architects, billings growth was strong in January.

The January ABI came in for a reading of 55.3, up from 51.0 the previous month (anything above 50.0 indicates billings growth).

The strong month comes despite the partial government shutdown that extended into late January. According to the AIA release, the January score of 55.3 was the highest ABI value in more than two years.

Speaking of the government shutdown, this month’s ABI survey question asked respondents about the impact of the shutdown on their business. According to the release, a majority of respondents said the shutdown had no impact. However, 12% said the shutdown had a direct impact on at least one of their projects and 10% said it had an indirect impact (meaning contractors and/0r clients were impacted by the shutdown).

In addition, according to the survey results, firms with a residential specialization were slightly more likely than firms of other specializations to have been directly impacted by the shutdown.

By region, the South and Midwest posted the strongest billings growth in January. The four regions tracked in the ABI posted January values of:

- South: 54.7

- Midwest: 54.4

- Northeast: 52.4

- West: 51.5

Actual Metal Prices and Trends

Chinese rebar steel increased 1.3% to $566.49/mt as of March 1. Chinese H-beam steel jumped 1.0% to $564.99/mt.

U.S. shredded scrap steel jumped 5.7% to $332/st.

European commercial 1050 sheet aluminum increased 1.5% to $2,603.37/mt. Chinese aluminum bar jumped 1.5% to $2,185.24/mt.

MetalMiner’s Annual Outlook provides 2019 buying strategies for carbon steel

Chinese 62% iron ore fines increased 0.2% to $78.47/dry metric ton.

Leave a Reply