Stainless MMI: LME Nickel, Stainless Surcharges Fall Back

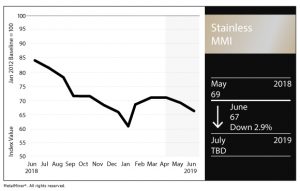

The Stainless Steel Monthly Metals Index (MMI) dropped two points again this month, now down to 67. The index stayed relatively flat during the past few months since jumping in February from 61 to 68.

Need buying strategies for steel? Request your two-month free trial of MetalMiner’s Outlook

Several prices in the index dropped significantly this month. Most prices declined more moderately, in the 1% to 3% range, with a couple of prices holding steady.

The LME nickel price declined 2.5% between May and June. During the first week of June, LME nickel prices dropped further but still managed to hold above $11,600/mt as of press time.

According to the International Stainless Steel Form (ISSF), stainless steel melt shop production increased by 5.4% to 50.7 million metric tons in 2018, up from 48.1 million metric tons in 2017. The organization forecasts continued growth in 2019.

In 2018, China accounted for 52.6% of global stainless steel production, according to ISSF. The U.S., meanwhile, accounted for 5.5% of global production. In absolute terms, the United States produced approximately 2.8 million tons of stainless steel last year, including slab and ingots.

Nickel pig iron production from China and Indonesia will increase in 2019, as it did during 2017 and 2018, which will contribute to lower prices, according to ISSF.

As reported by Reuters, the nickel market deficit narrowed during the first two months of the year, dropping to 5,700 metric tons from 24,400 metric tons during the same period of 2018.

However, LME and SHFE nickel stocks remain at historically low levels.

Domestic Stainless Steel Market

Stainless steel surcharges gave up some of their recent gains but still remain higher than at the start of the year.

Prices also remain higher from a longer-term perspective when compared with 2016 lows of around $0.40 per pound for 316/316L-Coil and $0.32 per pound for 304/304L-Coil. Nickel ore prices remain lower, causing the recent price weakness.

What This Means for Industrial Buyers

Like other steel prices, stainless steel prices showed weakness this month, following from weaker global demand combined with lower input prices.

For buying guidance, including resistance and support levels by metal, industrial buying organizations seeking more pricing guidance should try a free two-month trial of our Monthly Metal Buying Outlook report.

Buying organizations will want to read more about our longer-term steel price trends in our free Annual Outlook.

MetalMiner’s Annual Outlook provides 2019 buying strategies for carbon steel

Actual Stainless Steel Prices and Trends

This month, Chinese non-ferrous FeCr lumps decreased by 12.5% to $1,644/mt, the largest drop in the index.

The 316 Allegheny Ludlum stainless surcharge fell from $0.95/pound to $0.89/pound this month, a 6.3% decrease. The 304 Allegheny Ludlum Surcharge dropped back to $0.61/pound from $0.68/pound last month, a 7.8% decrease.

Chinese primary nickel decreased by 4.9% to $14,057/mt.

China 304 CR coil dropped 3.5% to $2,158/mt.

The remaining price declines ranged between 1.0% and 3.0%.

The exceptions were Indian primary nickel, up by 0.9% to $12.52/kilogram, and Chinese non-ferrous FeMo lumps, with flat pricing this month at $17,956/mt.

Leave a Reply