Goldman Sachs is Bullish on Oil Prices in the Long Term

Judging by the share price of shale oil and gas producers, you would think the industry is one from which to keep well away.

Keep up to date on everything going on in the world of trade and tariffs via MetalMiner’s Trade Resource Center.

Goldman Sachs, however, is recommending clients go long on the premise that the fracking industry, while depressed now, is simply going through a down cycle.

In other words, today’s pain is tomorrow’s gain.

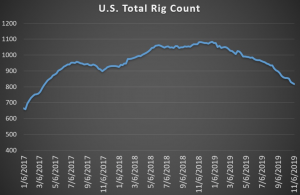

Rig counts are indeed down, as this graph from Oilprices.com shows:

Ample supplies have resulted in falling prices.

Natural gas inventories have surged this year, rising from a low point of 1,155 billion cubic feet (Bcf) in April to 3,724 Bcf at the end of October.

The falling rig count has reverberated down the supply chain.

The cost of consumables, like Permian frack sand, is down about 80% from its peak, Joseph Triepke, president of consultancy Infill Thinking, is quoted as saying.

Prices across the commodity spectrum have been undermined this year by a strong dollar and trade fears creating pessimistic investor sentiment. Oil and natural gas prices, however, have seen short-term support, as supply-side fears have spiked sentiment (only to fall back as fears have proved unfounded).

Having been boosted by the attacks to key Saudi Arabian production infrastructure earlier this summer, global oil prices came under further pressure as Saudi Arabia recovered rapidly in Q3, when output was back up to 10.3 million barrels per day in October.

Meanwhile, Iran announced it had discovered a giant oil field in the country’s south, Oilprices reports. The field may hold as much as 50 billion barrels of oil — almost as big as all of the reserves held in the U.S. (around 61 billion barrels).

If and when oil from Iran’s new field ever reaches world markets, however, is another matter.

Looking for metal price forecasting and data analysis in one easy-to-use platform? Inquire about MetalMiner Insights today!

Indeed, Goldman’s advice appears to be for the long term.

Prices are not expected to recover anytime soon, with the bank suggesting it could be a year or two before falling output brings the market back into sufficient balance for prices to rise.

Leave a Reply