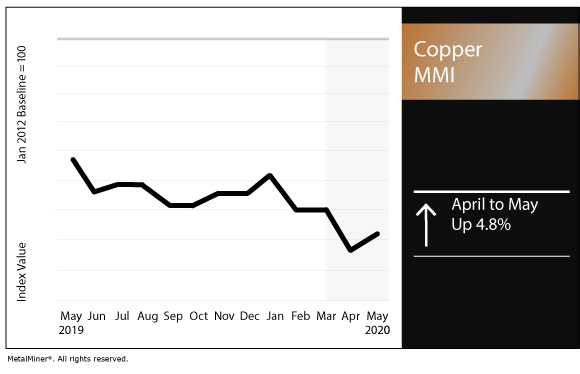

Copper MMI: Copper prices show tentative signs of bounce-back

The Copper Monthly Metals Index (MMI) moved up 4.8% this month.

Copper price shows signs of recovery

While the copper price has not quite recovered to pre-coronavirus levels, the metal made significant gains through the course of April.

Looking for metal price forecasting and data analysis in one easy-to-use platform? Inquire about MetalMiner Insights today!

After starting the month at $4,772/mt, LME copper closed April at $5,231, up nearly 10%.

LME copper had hit its 2020 low March 23, dropping to $4,617/mt.

This week, the price jumped to its highest level in about eight weeks, about a week prior to the aforementioned 2020 low.

Copper in Cornwall

Last month, MetalMiner’s Stuart Burns delved into the potential discovery of a significant deposit of lithium and copper in Cornwall.

“While prospecting for lithium brines in Britain’s extreme southwest county of Cornwall, Cornish Lithium’s initial boreholes hit big — not just in lithium, but for copper, too,” Burns wrote.

“The lithium brines were indeed present at some 500 meters down and deeper, an article by ProactiveInvestor reports.”

As Burns noted, the region is not new to copper discoveries.

“The drill site is smack dab in the middle of venerable old mining sites, such as United Mines, the Wheal Jane Mine and the Consolidated mine — sites that have delivered up not just copper, but also tin and zinc for centuries and at one time made Cornwall one of the preeminent mining areas in the world,” he wrote.

“The last of those mines was closed back in 1987, when cheaper to operate large open-pit mines did away with labor-intensive underground sites that seemed to have largely exhausted their richest seams.

“But Cornish Lithium’s find ranks as world-class — at least in terms of grades, the article states.”

Copper mine production ticks up slightly in January

In production news, the International Copper Study Group (ICSG) reported global copper mine production in January rose 0.5% year over year.

The ICSG said the global copper market was balanced in January but posted a surplus of 65,000 tons when accounting for changes in Chinese bonded stocks.

Meanwhile, refined copper production rose 3% year over year, with a 5% jump from primary production and a 3% decline in scrap production.

Glencore posts copper production decline of 9%

Glencore reported Q1 copper production of 293.3 kt, down 9% from Q1 2019.

“The global impact of the COVID-19 pandemic is an unprecedented challenge for individuals, governments and companies alike,” CEO Ivan Glasenberg said. “Disruptions to our business have, to date, been manageable and the majority of our assets are operating relatively normally, a credit to our people that have stepped up to the challenge of a changed working environment, especially those who continue to carry out their work on site at our industrial assets – Glencore’s frontline. Some industrial assets have been temporarily suspended, generally in line with national and regional lockdowns. Our updated full year production guidance reflects these impacts.”

In other news, operations at the Antamina copper and zinc mine in Peru were temporarily halted last month.

“Operations were initially halted for a two-week period from 13 April,” Glencore said in its quarterly report. “This has now been extended, with restart timing subject to Antamina being able to ensure the workforce’s ongoing health and wellbeing.”

The Antamina mine is a joint venture in which Glencore has a 33.75% stake, with other stakeholders being Teck Resources (22.5%), BHP Billiton (33.75%) and Mitsubishi Corporation (10%).

Freeport-McMoRan reports Q1 results

Miner Freeport-McMoRan also recently released its Q1 results, reporting copper sales of 355 million pounds in Q1.

The miner forecasts copper sales of 1.04 billion pounds the remainder of the year for a full-year total of 1.40 billion pounds, which would mark a 12% decline from the full-year estimate in January.

The miner reported a net loss of $491 million in Q1.

Like other miners, the company has assessed its operations and adjusted its operations to account for headwinds related to the ongoing COVID-19 crisis.

“FCX has completed a review of mine plans at each of its operating sites in North America to target a lower cost mining configuration, defer all nonessential projects and preserve long-term value in the long-lived resources,” the firm said in its quarterly report. “Under the revised plans, mining and milling rates for the year 2020 have been reduced by approximately 20 percent, resulting in a projected 12 percent decline in North America copper sales for the year 2020 (compared to the January 2020 estimate), lower unit net cash costs and lower capital spending requirements.

“The plans take into account the impact of currently suspended operations at the Chino mine. FCX is currently assessing options and future timing of restart of the Chino mine, which will take into account health and market conditions. FCX has also deferred approximately $0.3 billion in capital projects from 2020 to future periods for the North America copper mines.”

Lower your metal spend. Trial MetalMiner’s monthly metal buying outlook now.

Actual metals prices and trends

Chinese copper scrap ticked up slightly to $5,442.69/mt as of May 1.

U.S. copper producer grades 110 and 122 rose 5.0% to $3.18/pound. Producer grade 102 rose 4.4% to $3.40/pound.

Chinese primary cash copper jumped 9.1% to $6,104.60/mt.

LME primary three-month copper also recovered, jumping 8.4% to $5,215/mt.

Leave a Reply