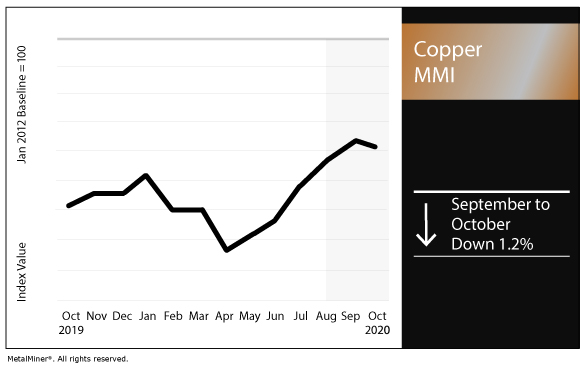

Copper MMI: Copper demand outlook shows strength

The Copper Monthly Metals Index (MMI) decreased 1.2% for this month’s value, even as the copper demand outlook shows signs of strength.

The MetalMiner 2021 Annual Outlook consolidates our 12-month view and provides buying organizations with a complete understanding of the fundamental factors driving prices and a detailed forecast that can be used when sourcing metals for 2021 — including expected average prices, support and resistance levels.

Prices and warehouse stock correlation

Our technical analysis focuses on price movement and volume to scrutinize supply and demand fundamentals.

However, this month MetalMiner carried out a correlation analysis between LME copper prices and LME warehouse stock levels.

The correlation analysis found an 86.06% inverse correlation between LME copper prices and its warehouse stock (at least, for the past year). That means that when prices rise, stock inventories decrease, and vice versa.

In this case, the correlation does not include any lag for either the price or stock inventories.

Copper inventories in LME warehouses decreased slightly to 73,625 metric tons, down for the fourth consecutive month. However, stocks spiked Sept. 28 and closed at 165,600 metric tons. During that time, LME copper prices traded slightly up but mostly sideways for most of the month. The copper price sharply declined Sept. 23.

Ultimately, the copper price dropped below the $6,600/mt mark. Another important event was the large number of deliveries that occurred Sept. 28.

This shows there is a strong relationship in the copper market between prices and stock inventory. As prices continued to go up, regular copper deliveries occurred from LME warehouses and stocks declined. As the price dropped, some buyers took advantage of the lower prices to cover their demand. However, that window closed in five days and followed the rapid increase in stocks.

The data suggest that, in the case of the copper market, prices and warehouse stocks follow the market’s demand. However, MetalMiner will continue to carry out another correlation analysis for a wider time frame to confirm that the correlation holds over time.

Demand expected to keep growing

Pan Pacific Copper, No. 2 smelter Sumitomo Metal Mining and Furukawa Co Ltd announced their plans to bring up production through Q4 2020 and Q1 2021. Pan Pacific Copper, the largest refined copper producer, expects Chinese demand will make up for the demand lost in other parts of the world due to the pandemic.

Japan has the second-largest smelter capacity and the third-largest refined capacity in the world.

This seems to be in line with the rise of imports in China, as its recovery remains steady. The National Bureau of Statistics reported China’s manufacturing purchasing managers index rose to 51.5 in September.

Additionally, Chinese imports seem to be incentivized by the LME and SHFE arbitrage.

Strikes looming over Chilean supply

After increasing production by approximately 3.7% in the first half of 2020 — despite the pandemic — Chilean copper supply is threatened by strikes.

Two out of the five labor unions at Lundin’s Candelaria operation rejected a contract offer. As a result, workers went on strike Oct. 8.

Escondida, the largest copper mine in the world, is also in negotiations with its labor unions. Back in 2017, Escondida had a 43-day strike; at the time, the mine accounted for 5% of global supply.

However, could these strikes help 2021 benchmark TC/RCs negotiations and incentivize refined copper production?

Actual copper prices and trends

The LME copper price decreased by 2.1% over last month.

Japan’s primary cash price decreased 1.0% month over month to $6,828/mt.

U.S. producer copper grades 110, 102 and 122 decreased by 0.5%, resulting in a $0.02/pound decrease for all three to $3.83/lb, $4.05/lb and $3.83/lb.

Indian copper cash prices decreased by 1.7% to $7.07 per kilogram.

Korean copper strip increased by 3.0% to $8.85 per kilogram.

China’s copper price decreased by 1.4% to $7,549/mt.

We’re offering timely emails with exclusive analyst commentary and some best practice advice. Sign up today.

Leave a Reply