Global Precious MMI: Gold price surged during pandemic, but what’s in store for 2021?

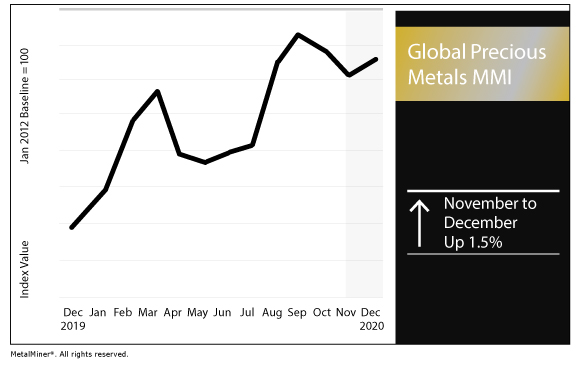

The Global Precious Monthly Metals Index (MMI) gained 1.5% for this month’s index value, as the gold price has lost some of its gains from the summer.

Sign up today for Gunpowder, MetalMiner’s free, biweekly e-newsletter featuring news, analysis and more.

Gold price gains

MetalMiner’s Stuart Burns recently checked in on the gold price and where it might be expected to go in 2021.

As precious metals watchers know, the gold price has enjoyed a sharp rise this year amid the global pandemic.

“The bulls are predicting a resurgence in the price to U.S. $2,300 per troy ounce in 2021,” Burns wrote.

“Goldman Sachs stated last month they had a target of $2,300, as recovery from the coronavirus-related recession fuels higher inflation next year. Goldman’s economics team sees inflation rising to 3% next year before weakening through year-end. Further fuel could be added from a recovery in demand from India and China.”

However, in the short term, the gold price has retraced since its August peak.

“Investors rotated out of safe havens into riskier assets on hopes of a vaccine-induced economic boom next year,” Burns explained.

“The story here is more conflicting. Yes, vaccines appear to be coming faster than London buses in rush hour.

“However, so are infection rates and hospitalizations.”

So, as with most commodities and commercial sectors, much of what happens next depends on the the world’s ability to get the pandemic under control and begin to return to pre-pandemic routines of life.

Newmont releases long-term outlook

Aside from the gold price, gold giant Newmont Corporation earlier this month released its 2021 and longer-term outlook.

The firm issued gold production guidance of 6.5 million ounces for 2021 and between 6.2 million and 6.7 million ounces through 2023.

“Newmont’s outlook remains strong and stable as we apply the rigor and discipline of our proven operating model across our world-class portfolio. Our five-year outlook reflects improving production and costs as we continue to deliver value from superior operational and project execution,” President and CEO Tom Palmer said. “Our strong financial position allows us to continue investing in profitable, organic growth while simultaneously returning cash to shareholders through our industry leading dividend framework.”

Dollar weakens

In other indicators to watch for precious metals, the U.S. dollar has continued to weaken.

Historically, the dollar and precious metals, like the gold price, are inversely correlated.

Earlier this month, the dollar index fell to its lowest level in 2 1/2 years. The dollar index hovered around 90.50 as of Tuesday afternoon.

PGM prices

Meanwhile, palladium prices continue to soar. After dipping last month, the U.S. palladium bar price jumped to its highest level since April.

Palladium, used in catalytic converters for gasoline-powered vehicles, has enjoyed a surge amid a corresponding bump in automotive demand in the U.S.

After two-month production suspensions by major automakers earlier this year, U.S. demand appeared to be relatively strong throughout the summer and showrooms operated with tight inventories. As noted in the Automotive MMI report, J.D. Power and LMC Automotive forecast November sales would be down 0.7% from November 2019 (when adjusted for differences in selling days).

Meanwhile, the platinum price also posted a significant gain in November. The World Platinum Council forecast a 2020 global platinum deficit of 1.2 million ounces.

Q3 2020 and loosening COVID-19 restrictions boosted platinum’s fortunes. Platinum demand surged 75% in Q3 2020, while supply increased 48%, the Council reported.

Furthermore, the Council forecast platinum demand from the Chinese jewelry market is set to increase in 2021 for the first time in seven years.

Actual metals prices and trends

The U.S. silver price dropped 4.4% month over month to $22.60 per ounce as of Dec. 1.

U.S. platinum bars jumped 14.3% to $960 per ounce. Meanwhile, the U.S. palladium price rose 7.8% to $2,249 per ounce.

Lastly, the U.S. gold price slipped 5.5% to $1,776.20 per ounce. Meanwhile, the Chinese gold price fell 5.1% to $56.62 per gram.

Do you know the five best practices of sourcing metals?

Leave a Reply