Rare Earths MMI: Greenland party opposed to rare earths mine project wins election

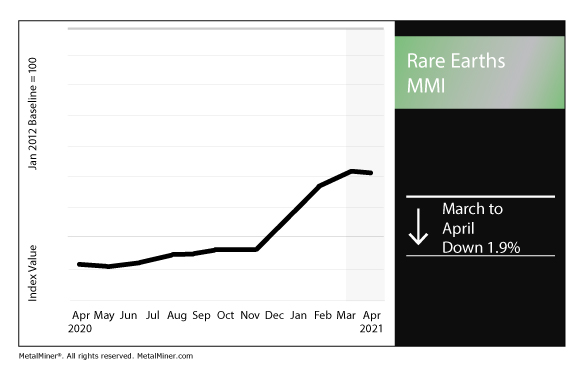

The Rare Earths Monthly Metals Index (MMI) fell by 1.9% for this month’s reading, as the Greenland elections this week could have significant ramifications for a rare earths project in the country.

The MetalMiner Best Practice Library offers a wealth of knowledge and tips to help buyers stay on top of metals markets and buying strategies.

Left-wing party against rare earths mine wins Greenland elections

Rare earths mining stood front and center in Greenland’s elections earlier this week.

The left-wing Inuit Ataqatigiit party emerged victorious with 37% of the vote, Reuters reported.

What does Greenland’s election have to do with rare earths? The prevailing party ran on opposition to a mining project at Kvanefjeld on the southern tip of the island.

On its website, Australia-based Greenland Minerals Ltd. says the complex could be the most significant source of rare earths in the Western world.

Kvanefjeld offers “massive bulk resources,” the firm indicates, in addition to access to year-round direct shipping.

However, the election result could prove to be a significant blow to the site’s prospects.

Reuters quoted party leader Mute Egede, who said the project “won’t happen.”

Supply squeeze

The election result may come as discouraging news to those in industries that desperately need rare earths.

That is especially true for Europe and the US, both of whom must develop alternative sources of rare earths in order to mitigate their dependence on China, which dominates a vast majority of the global rare earths market.

Earlier this week, MetalMiner’s Stuart Burns outlined the supply chain challenges Western nations face. That challenge is made greater in the face of China’s expansion of its rare earths capacities, particularly via Chinese companies’ exploratory ventures in Africa.

“Demand for metals like copper, cobalt, nickel and lithium will rise sharply in coming years,” Burns wrote. “Maybe not with the imminent demand late last year’s bull run in prices, widely perceived to be in part on the back of anticipated electric vehicle (EV) growth — but in the medium term, demand will rise as surely as night follows day.

“The World Bank estimates 3 billion tons of minerals will be needed in the overhaul to meet Paris climate agreement targets by 2050. That includes a fivefold increase in demand for some products, according to The Telegraph.

“More specifically, the Faraday Institution estimates the UK will need 14,000 tons of cobalt, 75,000 tons of lithium and 86,000 tons of nickel to produce 92 Gigawatt hours (GWh) of electric vehicle batteries in 2035 if it is to maintain an automotive industry.”

China to build rare earths innovation center

Speaking of China, Beijing plans to build an innovation center for rare earths research and development, state-run news agency Xinhua reported.

Per the report, China’s Ministry of Industry and Information Technology said the center will focus on research and development and manufacturing of new rare earths materials and “high-tech rare earths functional materials.”

Guorui Sci-tech Rare-earth Functional Materials Co. will operate the innovation center.

Actual metals price and trends

The Chinese yttrium price dipped by 1.2% month over month to $32.79 per kilogram as of April 1.

Meanwhile, terbium oxide fell by 3.2% to $1,472 per kilogram. The neodymium oxide price dropped by 9.6% to $95,312 per metric ton.

Europium oxide fell by 1.2% to $29.74 per kilogram. Dysprosium oxide rose by 4.2% to $466 per kilogram.

Join the MetalMiner LinkedIn group today. Because you do NOT want to miss out on daily MetalMiner news and content!

Leave a Reply