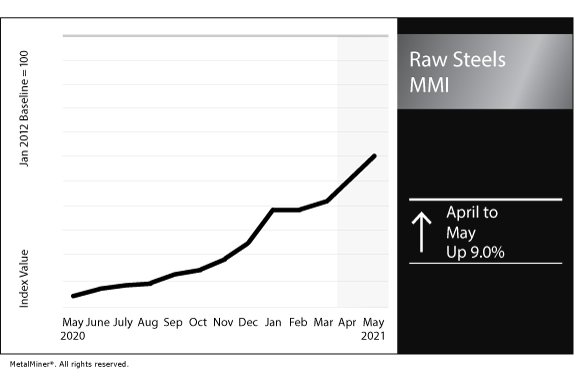

Raw Steels MMI: Steel prices continue to skyrocket in April, early May

The Raw Steels Monthly Metals Index (MMI) picked up 9.0% for this month’s reading, as steel prices continued ascending this past month.

With volatile steel markets, knowing which strategy to execute and when can make all the difference between saving and losing money. See how MetalMiner looks at different market scenarios.

US steel prices continue to rise

For buyers waiting to see a peak in steel prices: keep waiting.

At least for now, steel prices continue to rise, posting double-digit month-over-month price gains. Price rises took somewhat of a pause from late March into mid-April, but it proved temporary.

The US hot rolled coil price, for example, closed Tuesday at $1,456 per short ton, or up 10.39% from a month ago.

Meanwhile, cold rolled coil reached $1,645 per short ton, or up 8.8%. US hot dipped galvanized rose by 10.69% to $1,770 per short ton.

Iron ore booms in Asia

Similarly, steel prices are also surging in Asia.

That is reflected in a skyrocketing iron ore price, too, MetalMiner’s Stuart Burns explained earlier this week.

“Iron ore prices’ relentless rise this year went into overdrive Monday, hitting a +10% limit up and prompting the Dalian Commodity Exchange to raise trading limits and margin requirements in an effort to calm speculation,” he wrote.

“Separately, the Shanghai Futures Exchange said it would set fees for closing positions on its steel rebar and hot-rolled steel coil futures contracts at 0.01% of the total transaction value. Those transactions had previously been free.”

In turn, Chinese steel prices have also surged, with some forms jumped by double-digit percentages this week alone.

Chinese HRC reached $1,018 per metric ton Tuesday, up by 21.37% month over month. Meanwhile, Chinese CRC reached $1,096 per metric ton, or up 19.75% month over month.

Global steel production jumps 15.2% in March

Global crude steel production jumped by 15.2% year over year in March, the World Steel Association reported last month.

Output reached 169.2 million metric tons. Meanwhile, Q1 output reached 486.9 million metric tons, up 10.0% year over year.

China produced 94.0 million metric tons, which marked an increase of 19.1% year over year. China’s Q1 production totaled 271 million metric tons, up 15.6% year over year.

USTR: Section 232 needs modernization

United States Trade Representative Katherine Tai on Wednesday, speaking before the Senate Finance Committee, said the law behind the Section 232 metals tariffs requires modernization, Reuters reported.

In 2018, then-President Donald Trump imposed tariffs on imported steel and aluminum of 25% and 10%, respectively. Trump deployed the infrequently used Section 232 of the Trade Expansion Act of 1962 to impose the duties.

According to the report, Tai said the US needs “2021 tools” rather than “1962 tools” to tackle today’s challenges in trade.

Nucor announces upgrades for Nebraska bar mill

Steelmaker Nucor said it plans to upgrade its engineered bar mill in Norfolk, Nebraska, with a $58 million investment. It plans to complete the upgrades by Q4 2022.

The upgrades to the engineered bar mill will help it better serve the automotive market, Nucor said.

Upgrades to the mill will include a new reheat furnace, new intermediate mill, and coil inspection and trimming station.

Actual metals prices and trends

As mentioned, April proved to be a dynamic month for steel prices, in both the US and China.

The US three-month HRC price rose by 19.1% month over month to $1,525 per short ton as of May 1. Meanwhile, US shredded scrap steel dipped 1.6% to $436 per short ton.

Chinese coking coal jumped 19.5% to $416 per metric ton. Chinese steel billet gained by 1.3% to $545 per metric ton. In addition, the Chinese steel slab price rose by 7.6% to $860 per metric ton.

Do you know which market conditions are best with different steel contracting mechanisms? Check out our best practices on this topic.

One Comment

This is the start of hyper inflation, and prices will continue to rise ,until higher interest rates