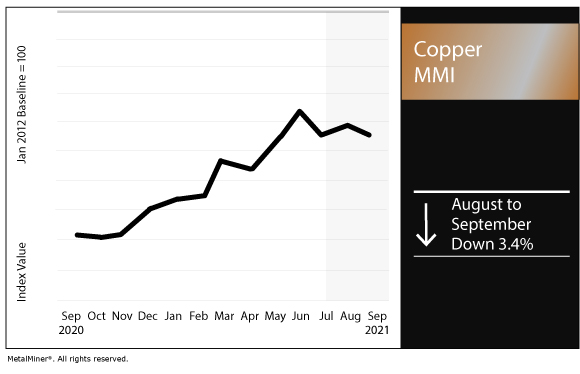

Copper MMI: Copper prices continue to decline

The Copper Monthly Metals Index (MMI) decreased by 3.4% in August, as forms of the metal included in the index dropped (with the exception of Chinese copper scrap).

We’re offering timely emails with exclusive analyst commentary and some best practice advice. Sign up here.

Copper prices trend downward

Similarly to the index, LME copper prices dropped by 3.3%. LME trading volumes spiked as the price declined from Aug. 16-19. This sell-off signaled a strong negative trend.

Since then, prices recovered. However, trading volumes remained muted, reinforcing the negative market sentiment.

SHFE prices behaved similarly to LME prices. Meanwhile, the volatility of the dips did not appear as strong. The SHFE’s heaviest trading volumes occurred toward the end of the month, when prices jumped, thus signaling a strong positive indicator.

Sentiment change

Several metal prices took a dip mid-August, likely due to concerns over Federal Reserve tapering, a resurgent delta variant and Chinese measures to slow economic growth. While other metals managed to recover by or over 100%, copper did not.

Additionally, as Reuters reported, traders might be concerned over manufacturing data coming from China. Other Asian countries — such as Japan, South Korea and Taiwan — expanded at a slower rate due to the aforementioned concerns, plus supply bottlenecks and chip shortages.

Hurdles in Chile

After BHP and Escondida union workers reached an agreement, other mine unions rejected new wage offers.

Such was the case at Andina and Salvador, owned by Codelco, Cerro Colorado of BHP and Caserones of JX Nippon Mining & Metals.

Codelco also started conversations with El Teniente’s union.

Additionally, Chile passed a bill that would create the heaviest tax burden on large copper producers in a new royalty system. The bill currently includes sales tax brackets that increase as copper prices rise. Industry insiders believe the move will deter investment and competitiveness. Proponents say it would replace the current taxes on profit. However, so far, no bill has been presented to do so.

These potential supply constraints do not seem to concern the market. Traders are focused on economic cues, particularly from China.

Actual metals prices and trends

The LME three-month copper price decreased by 4.8% month over month to $9,311 per metric ton as of Sept. 1.

Chinese copper scrap went up by 0.3% to $9,845 per metric ton. Similarly, Chinese primary cash copper decreased by 3.1% to $10,773 per metric ton.

U.S. copper producer grades 110 and 122 dropped 4.0% to $5.10 per pound. Producer grade 102 decreased by 4.2% to $5.30 per pound.

All the metals intelligence you need in one user-friendly platform with unlimited usage. Request a MetalMiner Insights platform demo.

Leave a Reply