Aluminum MMI: Following all-time high, aluminum prices plummet

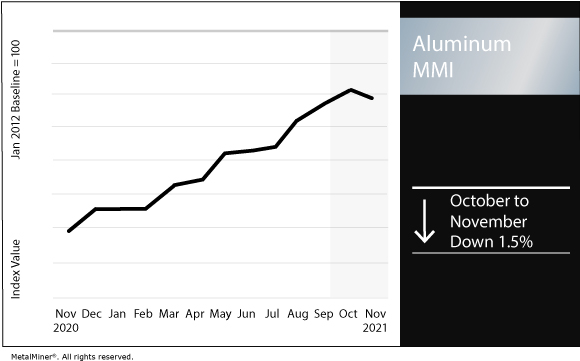

The Aluminum Monthly Metals Index (MMI) fell for the first time in nine months, dropping by 1.5%.

After prices hit the record peak in late October, aluminum started to face some speed bumps when the price attempted to continue to trade upward.

Since Beijing’s intervention into the coal market, LME aluminum prices began to retrace back to mid-August prices. This follows an impressive rally that extended more than a year and saw aluminum outperform nearly all base metals (with the exception of tin).

From a technical perspective, aluminum prices currently lack sufficient bullish signals. October’s price action indicates a substantial risk for an overall trend reversal.

Stay up to date on MetalMiner with weekly updates – without the sales pitch. Sign up now.

Section 232 tariffs resolution

A much-anticipated agreement was reached regarding the Section 232 tariffs between the U.S. and the European Union.

Former President Donald Trump imposed the tariffs in 2018, citing national security concerns under Section 232 of the Trade Expansion Act of 1962. The import duties came in at 25% for steel and 10% for aluminum. In 2020, the Trump administration went on to add tariffs on certain derivatives of aluminum and steel.

Under the new resolution announced in late October, the existing tariffs will be replaced with a tariff-rate quota (TRQ) effective Jan. 1, 2022.

For aluminum, the TRQ will apply to historically-based volumes of E.U. aluminum. Excess volumes that enter the U.S. market will still be subject to a duty of 10% (unless they are subject to an exclusion).

Additional requirements include that nothing beyond 60% of the quota be filled within the first half of the year. For unwrought aluminum under two product categories, the TRQ is 18,000 metric tons. The quota extends to 366,000 metric tons for semi-finished (wrought) aluminum under 14 product categories.

The deal, which aims to improve trade and diplomatic relations, will narrowly avert a doubling of retaliatory tariffs from the E.U. on a multitude of U.S. goods. Those duties would have gone into effect Dec. 1.

According to the American Primary Aluminum Association (APAA), the implementation of the Section 232 tariffs successfully protected domestic primary aluminum smelters threatened by excess global capacity. The tariff also led to additional domestic capital investments (upstream and downstream) totaling more than $6 billion, the APAA argued.

China’s power crisis

The power crisis that has gripped China in recent months came to a head in October and caused metal prices to surge to record heights.

The origins of the current crisis could be seen as early as May, with reports of factories using diesel generators to mitigate rising energy prices and coal shortages, according to Forbes.

A combination of flooding that derailed China’s coal production, global demand recovery, as well as missteps in China’s energy policies have left energy markets problematically tight. To combat power shortages, China imposed various energy usage restrictions throughout its provinces. This caused disruptions to production for industries, including aluminum smelters.

By Oct. 18, the LME three-month aluminum price had reached a staggering $3,200/mt.

On Oct. 19, however, the National Development and Reform Commission (NDRC), China’s state planner, announced it would consider an intervention to curb rising coal prices. Chinese thermal coal futures dropped overnight and aluminum prices, in turn, plummeted. While warnings over coal price speculation seem to have effectively dragged down prices, China seeks to further increase coal supply, including increasing coal production to leaning on imports to meet the shortfall, CNBC reported.

Magnesium production returns

Amid China’s power crisis, concerns mounted over magnesium shortages, an industry hard hit by production curbs. China, which has a near monopoly on the industry, produces almost 90% of global magnesium. Furthermore, China accounts for roughly 95% of the E.U.’s supply.

The European Automobile Manufacturers’ Association warned in late October that “Europe is expected to run out of magnesium stocks by the end of November.”

In the U.S., similar messages of caution were issued. The leading producer of aluminum billet in the U.S., Matalco Inc., noted in an Oct. 13 letter, “in the last several weeks, magnesium availability has dried up and we have not been able to purchase our required Mg units for all of 2022,” mining.com reported.

Output began to return at the start of October, however. Producers in Shaanxi, which accounts for beyond 60% of China’s magnesium production, are now operating at between 70-80% of capacity. Prices for Chinese magnesium have also subsequently retraced after having ascended to CNY 65,000-70,000/t on Sept. 23.

Actual metals prices and trends

The LME three-month aluminum price decreased by 5.2% month over month to $2,730 per metric ton as of Nov. 1.

Chinese primary cash aluminum fell by 9.5% to $3,167 per metric ton. Chinese aluminum scrap dropped by 9.3% to $2,320 per metric ton from $2,558 per metric ton last month. Meanwhile, Chinese aluminum billet fell by 10.3% to $3,165 per metric ton.

European 1050 aluminum sheet dropped by 4.9% to $4,488 per metric ton.

Indian primary cash fell by 4.0% to $2.94 per kilogram.

Stop obsessing about the actual forecasted aluminum price. It’s more important to spot the trend.

Leave a Reply