Global Precious MMI: Gold prices rise; COMEX suspends Russian gold, silver producers

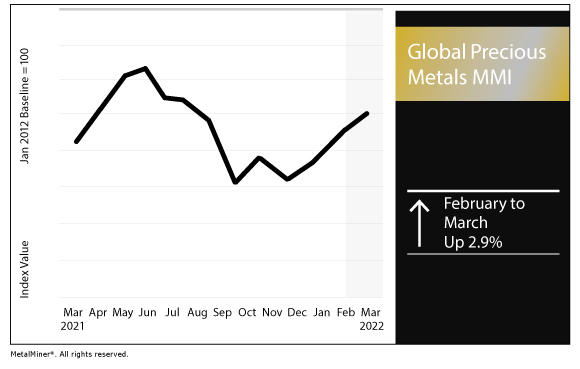

The Global Precious Monthly Metals Index (MMI) rose by 2.9% for this month’s value, as gold prices picked up amid the ongoing Russia-Ukraine war.

The March 2022 MMI report, featuring all 10 MMI indexes, will be available for download later today.

Gold prices rise

February proved a difficult month for stocks, as the S&P 500 fell over 5% and the Dow Jones Industrial Average fell 6%.

In times of volatility, investors often flock to safe-haven assets, including gold. On top of historic levels of inflation — at 7.9%, the highest in over 40 years — the Russian invasion of Ukraine introduced another jolt of volatility to markets.

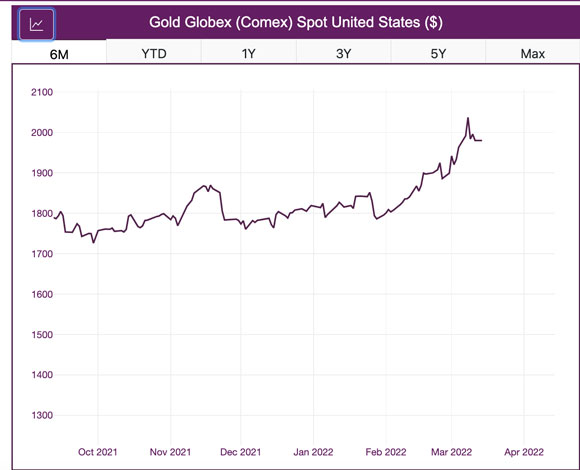

The U.S. gold price opened February at just over $1,800 per ounce before rising through the rest of the month.

Gold prices have continued to surge in March. The price reached $1,980 per ounce to close last week, marking an 8.39% month-over-month rise.

COMEX suspends Russian producers

However, on March 7, COMEX announced it would suspend the “approved status for warranting and delivery” for several Russian gold and silver companies, including:

- JSC Krastsvetmet

- JSC Novosibirsk

- Moscow Special Alloys Processing Plant

- Prioksky Plant of Non-Ferrous Metals

- Shyolkovsky Factory of Secondary Precious Metals, SOE

- JSC Uralelectromed

According to United States Geological Survey data, Russian gold mine production totaled 310 metric tons in 2019. Global gold mine production in the year totaled 3,300 metric tons. As such, Russian gold mine production accounted for 9.4% of the global total.

“Russia is a significant gold producer but still in single-digit percentages globally,” MetalMiner’s Stuart Burns explains. “Much more significant is palladium, where they produce 40% of global supply, and platinum, which is less but still very significant. The implications for the catalyst markets are real.”

As such, while the COMEX move may have some impact on gold (and silver prices), the greater impact from the Russia-Ukraine war is on platinum-group metals (PGMs) platinum and palladium (and, by extension, the automotive sector).

As the situation in Ukraine unfolds, keep an eye on metals prices, including precious metals, on the MetalMiner Insights platform, which features a suite of precious metals prices.

Lawmakers introduce ‘Stop Russian GOLD’ Act

Meanwhile, also last week, several U.S. senators introduced the Stop Russian Government and Oligarchs from Limiting Democracy (GOLD) Act.

According to a statement from Texas Sen. John Cornyn, the legislation would “apply secondary sanctions to anyone transacting with or transporting gold from Russia’s central bank holdings or selling gold physically or electronically in Russia.”

“Currently, Russia is exploiting a loophole in the sanctions placed on its central bank that are allowing the government and oligarchs to launder money through gold,” the statement continued. “The Russian Federation is purchasing gold to offset the devaluation of its currency, the ruble, and is then selling that gold on international markets in exchange for high-value currency.”

The Russian ruble has plunged in value, falling approximately 30% in February.

The MetalMiner team will continue to break down the Russia-Ukraine war’s impacts on commodities markets in the MetalMiner weekly newsletter.

Palladium, platinum impact

As we noted in the Automotive MMI report, Russia is a major producer of platinum and palladium.

Palladium is a critical material for use in automotive exhaust systems. As Burns explained earlier this month, the Russian invasion and potential disruption of palladium supply could hit western European automakers.

“At some stage, automakers in western Europe could also be hit by a lack of palladium supply,” Burns wrote. “Russia produces some 40% of global supply. South Africa is the next largest producer. However, South Africa does not have the ability to ramp up to cover the shortfall.”

The U.S. palladium price has jumped over 30% month over month. The price closed last week at $2,972 per ounce.

However, the London Platinum and Palladium Market last week announced no change to the accreditation of Russian platinum and palladium refiners.

“Due to the terrible events taking place in Ukraine, the LPPM has reviewed its Good Delivery list and the US, EU and UK sanctions,” the LPPM said in a short statement last week. “Following that review it has decided to make no changes to the Good Delivery list.

“We will however continue to monitor and review the situation.”

MetalMiner technical analyst Jimmy De Leon Chiguil noted such a removal would have significant ramifications.

“A widespread removal of palladium refiners would trigger a strong rally for Palladium,” he notes. “Therefore, market authorities did not suspend platinum and palladium refiners in trading, as that would trigger a scenario nickel was just in.”

Actual metals prices and trends

The U.S. silver price rose by 9.04% month over month to $24.42 per ounce as of March 1. Meanwhile, the U.S. gold price rose 5.67% to $1,909 per ounce.

The U.S. platinum bars price rose 0.68% to $1,039 per ounce. Meanwhile, the U.S. palladium bars price increased 6.85% to $2,419 per ounce.

The Chinese gold bullion price rose 4.26% to $61.36 per gram.

One Comment

Thank you so much for providing such update on most of the metals price trending.

Very useful for me to gain a lot of insights