Nickel Prices: LME Nickel Contract Continues to Lack Liquidity, Harming Price Discovery

Nickel prices are seeing a lot of attention due to an overall lack of liquidity on the LME contract. But what exactly does this mean? Moreover, what does it mean for buyers looking to mitigate price problems in the face of global supply problems?

The metals market moves fast. Sign up for the weekly MetalMiner newsletter here and never miss another opportunity.

Understanding Price, Procurement, and Price Discovery

Every manufacturing CEO wants their procurement teams to do three things well. First, they want them to understand metal price trends from a short-term perspective. Second, they want them to know where prices will go from a long-term perspective. Finally, they want sound buying strategies based on that forecast.

Why do CEOs want this? Because at the end of the day, they need to better predict their margins if they’re going to keep shareholders happen. After all, there’s no better way to earn the ire of shareholders than poorly projecting profits.

Today, procurement departments with a substantial metal spend as a percentage of the cost of goods sold (COGS), forecast and manage profitability relying heavily on market fundamentals. In short: supply and demand.

Unfortunately, that methodology tends to provide a lot of “false positives. This is when a market based on limited supply indicates high prices, yet they remain low. You also have to contend with “false negatives.” Logically, this is when surplus inventory signals lower prices, but they remain stubbornly high.

The “new” way of forecasting metal prices provides more clarity and, more importantly, allows for more accurate buying decisions. This new methodology uses a mix of Artificial Intelligence (historical prices) and Technical Analysis (the study of price action as traded on exchanges).

A technology-driven approach like this helps buying organizations better understand where prices are most likely to go. In turn, this directs them on which kind of buying decisions to make. However, when an exchange-traded metal price loses its liquidity, the process known as “price discovery” breaks.

What Does Loss of Liquidity Actually Mean?

Simply put: liquidity refers to the number and volume of trades placed by active traders and market makers buying and selling a contract. Before March 8, the LME nickel contract typically had 10-12k contracts traded daily. Since then, LME nickel volumes have declined to around 2-3k contracts a day. This means that the LME has lost over 50% of its nickel liquidity ( a conservative estimate). As one might expect, this lost volume severely impacts price movement.

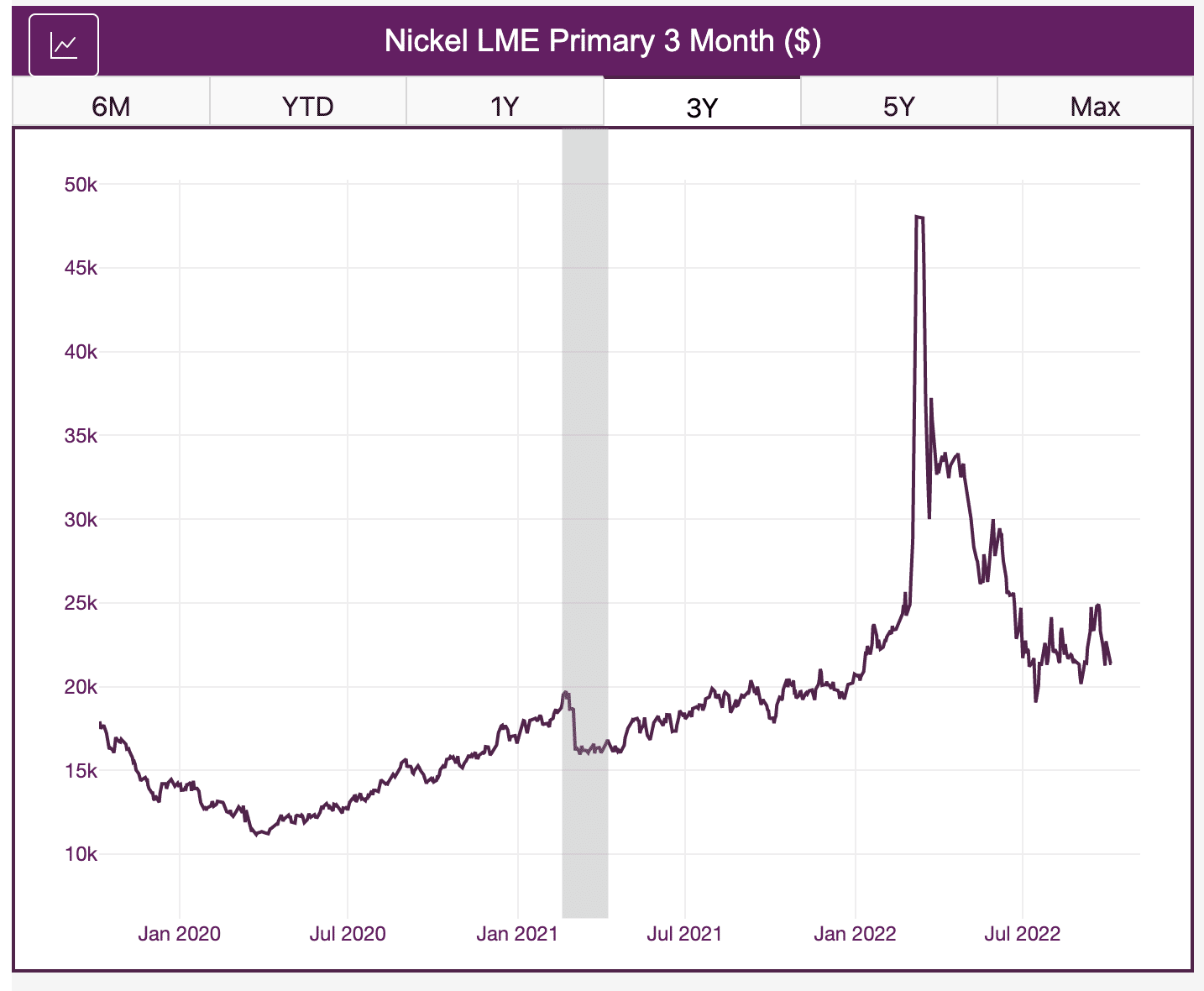

Let’s look at what happened to LME Nickel contracts after prices soared to over $100,000/mt:

As you can see, when liquidity disappears, industrial buying organizations purchasing nickel (or stainless steel containing nickel) have a harder time mitigating price risk.

Now, market makers and corporates are still trading at normal volumes on other contracts like aluminum, copper, and zinc. But in terms of nickel, SHFE contracts have not gained enough volume momentum to become significantly higher than the LME.

MetalMiner Insights tracks nickel and other contracts and lets buyers know when and how much they should buy.

Therefore, the future of the LME nickel contract will depend on how much volume/liquidity becomes openly available. If little to no volume returns, prices will move very slowly. In that case, the risk for the LME increases as low liquidity signals a lack of price discovery on the exchange.

Nickel Prices Will See Ramifications for Some Time

All of that said, buying organizations can still hedge against nickel using the SHFE contract. In fact, MetalMiner’s own trading desk has also traded JJN, a nickel-based ETF.

As previously reported by MetalMiner, the LME made a big mistake supporting Tsingshan, the nickel stainless producer that placed big bets on nickel prices falling. The company was over collateralized/margin called instantly once the LME nickel contract began to skyrocket.

Also, the LME retracted trades made off that price move. That means the ones left holding the bag made no profit, even though they were on the right side of the coin, so to speak. What should have happened was Tsingshan facing a margin call, losing, and paying out the profits the buyers deserved.

While some market observers may feel Tsingshan was “too big to fail,” the move by the LME has created a lot of distrust. Many market makers have fled the exchange altogether, ruining the possibility of a future influx of high volume/liquidity from retail.

Currently, it appears the LME nickel contract will suffer the balance of this year and possibly next year with low liquidity. You may remember the same thing happened with GME (Gamestop) back in 2021. When Robinhood halted trading of GME and AMC, it fostered a ton of distrust in the app.

Ask yourself: who would want to buy into the Robinhood-Marvin Capital scandal of the metals market?

You can keep yourself informed about all the latest metal news with MetalMiner’s monthly MMI Report. Sign up here to begin receiving it completely FREE of charge. If you want a serious competitive edge in the metals industry, try a demo/tour of our revolutionary insights platform here.

Leave a Reply