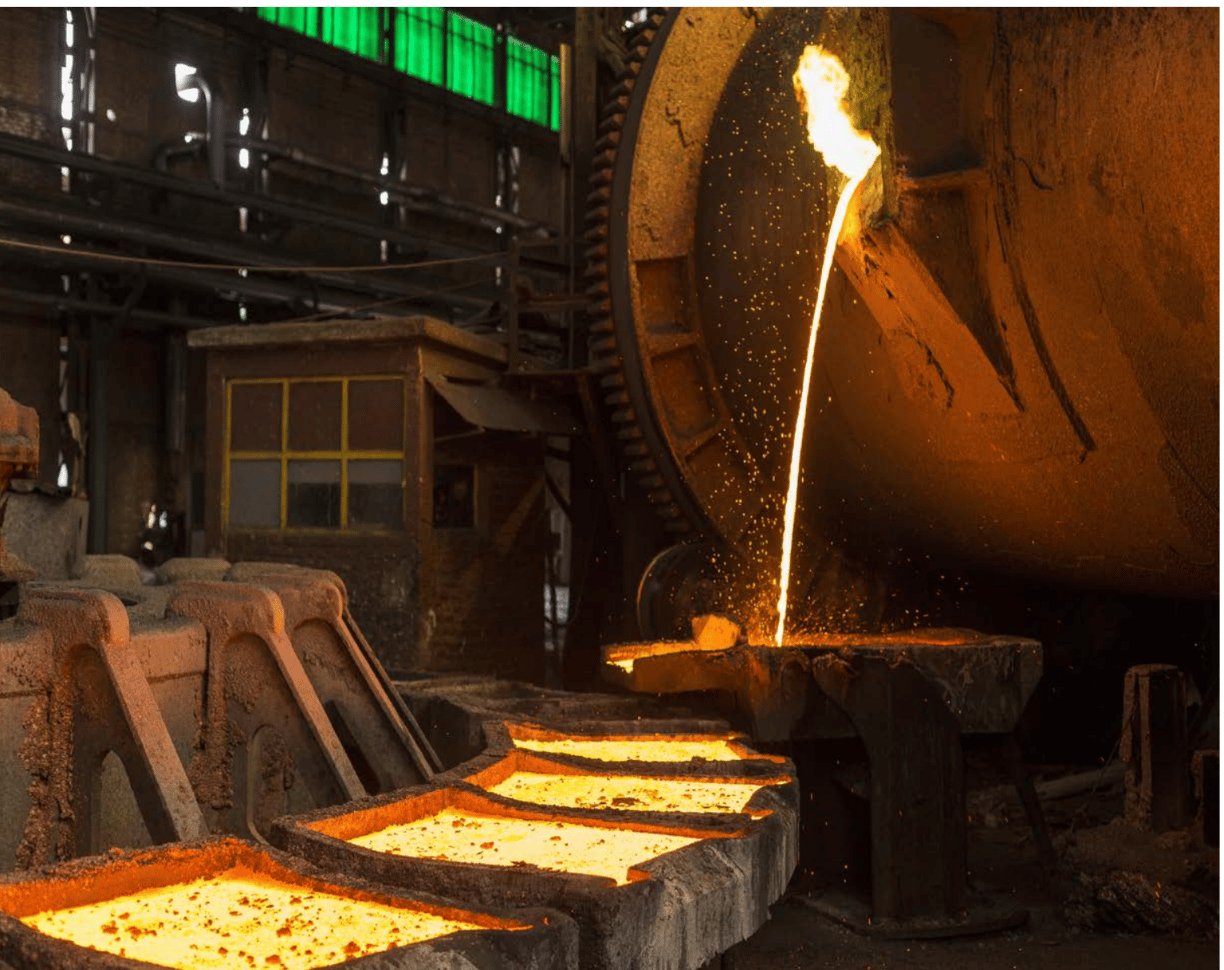

China’s Steel Supply Encounters Significant Hurdles.

Everyone thought a COVID-19 ravaged steel supply market in China took a turn towards recovery. However, many other hurdles now stand in the way, both long & short term.

Power cuts and muted demand driven by the construction crisis in China stand in the path of growth. Even worse, the cascading effect has affected the supply of critical commodities like coking coal and iron ore.

Like India, infrastructure growth plays a major role in China’s consumption of steel. However, because of the post-COVID-19 slowdown and the worsening property crisis the steel sector has not bounced back the way it was anticipated.

The prognosis looks bad, evident from this statement of Li Ganpo, founder & chairman of Hebei Jingye Steel Group. Ganpo reportedly warned at a private company meeting a few weeks ago that almost a third of China’s steel mills could go bankrupt. This would result in massive steel supply chain disruptions.

Learn how to gauge the prices of battery metal indexes and use forecasting methodology for power generation metals and renewable metals in MetalMiner’s free September webinar. Sign up here!

Steel Supply Strain Effecting Banks

Many in China have lost hope in a turnaround in the near future. This pessimism comes the many reports coming out of China.

The real-estate crisis has not only affected property developers and steel makers but even banks. Once one of the largest producers and consumers of steel and related products, Chinese steel mills would regularly manufacture over a billion tons. This accounts for about half of all global output. Now, this seems a distant memory, with the slump affecting iron ore prices and even supply mines in Brazil & Australia.

Although trade relations between China & Australia are low, Australia’s biggest export item, iron ore faces supply chain threats because of the Chinese slowdown. Experts forecast that prices will go down by 50% in 2023 with China’s deepening property crisis. Consumers are either not buying new houses or have defaulted on housing loans.

China remains the largest buyer of Australian iron ore. Prices did rise within the past work after China’s easing of the rules, but this was short-lived.

Chinese Government Looking for Solutions

The People’s Bank of China announced a few measures like slashing the five-year prime mortgage rate and the one-year loan prime rate. However, many feel that it was too little too late. This lobby believes that conditions will not improve for the rest of 2022.

Steel mills were once in the forefront of China’s economic expansion. But now conditions have deteriorated to the point that many are on the verge of closure for lack of takers.

To complicate matters, a heat wave in many parts of China led to electricity rationing. This lead to the temporary shut-downs of various Chinese steel mills recently. About 20 steel mills in China’s southwest regions suspended operations.

The Government there has yet to send out any signals of big bailouts. Unlike the property market crisis in 2015, President XI Jinping now looks reluctant to launch a financial stimulus package that could kickstart infrastructure spending and indirectly revive the steel and ore sectors. This leaves limited room for steel makers to maneuver.

Keep yourself informed of all the latest global steel price trends with MetalMiner’s monthly MMI Report. Sign up here to begin receiving it completely free of charge. If you want serious competitive edge in the metals industry, try a demo/tour of our revolutionary insights platform here.

Leave a Reply