New China tariffs may soon change the country’s steel market tactics. China continues to sit on a stockpile of steel, and it has no idea what to do with most of it. The exception, however, seems to be dumping it into foreign markets for cheap under the guise of “exportation.” China remains unable to use […]

Category: Macroeconomics

Global Precious Metals MMI: Gold Prices Surge, But is It a Gold Rush, or Gold Bust?

Month-on-month, the Global Precious Metals MMI (Monthly Metals Index) rose by 8.25%. However, shortly after April 1, precious metal prices, particularly gold and silver, began surging as investors flocked to purchase as many gold bullions as possible. The reasons for this newfound “gold rush” include inflation hedging, anticipation of interest rate cuts, and geopolitical uncertainty. […]

Aluminum MMI: Prices Inch Toward 2023 High Amid China Supply Cut

Overall, the Aluminum Monthly Metals Index (MMI) remained sideways, with a 2.03% rise from March to April. Aluminum prices outperformed all base metals throughout March, with a 4.71% rise from the close of February. Prices continued their rally throughout April, hitting their highest level since February 2023 by April 8. Aluminum Prices Chase 2023 Highs […]

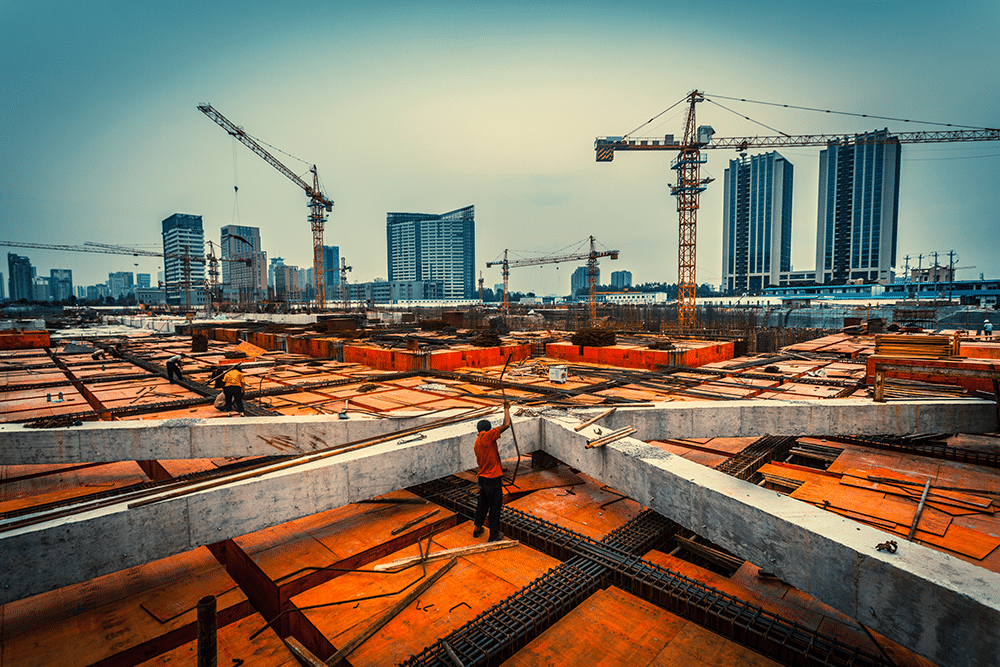

Construction MMI: Manufacturing Boom Helping Industrial Metal Demand, Construction Delays Hurting It

Month-over-month, the Construction MMI (Monthly Metals Index) moved sideways for the fourth month in a row, only sliding down a slight 2.87%. Of all industrial metals, iron ore suffered the worst drop in price by far, hitting a 10-month low before a slight rebound. The main component holding the index up was aluminum 1050 sheet […]

Raw Steels MMI: Steel Prices Flatten, Is an Uptrend Next?

The Raw Steels Monthly Metals Index (MMI) moved sideways, with a modest 1.38% decline in steel prices from March to April. U.S. flat rolled steel prices continued to trade down throughout March. Meanwhile, HRC prices fell 8.35% to close the month at a new lower low. However, hot rolled coil prices traded up during the […]

Subdued Market Reaction So Far to China’s Targeted 2024 Growth Rate

Investors, traders, and the metals community continue to anticipate fresh stimulus measures from China’s top leaders, which could potentially kickstart economic growth, increase metals consumption, and affect metal prices. However, they remain rather disappointed with Beijing’s target 5% growth for 2024. Moreover, demand has remained subdued since the Lunar New Year holiday. Almost everyone was […]

Copper MMI: Copper Prices Rise to Highest Level Since April Amid Supply Concern

By mid-March, copper prices hit their highest level since April 2023. Prices previously found a bottom in early February before strong upside momentum saw them topple previous peaks within their long-term sideways trend. While prices clocked a moderate1.74% month-over-month decline throughout February, they rose 4.12% during the first two weeks of March. Overall, the Copper […]

Global Precious Metals MMI: Gold Sees a Strong Rally

Once again, the Global Precious Metals MMI (Monthly Metals Index) failed to exhibit strong bearish or bullish pressure. The index remained sideways throughout February, budging down a mere 0.65%. Despite this, some bullish pressure did seep into precious metal prices at the beginning of March, when numerous precious metals began to rally. Gold prices, in […]

European Aluminum Industry Faces Existential Threats

The European aluminum manufacturing industry is under attack from two short- and medium-term threats, both of which have the potential to significantly impact aluminum consumers across the region. Threat #1: Potential Russian Aluminum Ban, Aluminum Manufacturing Shortage The first threat is the widely debated possibility of the EU banning Russian aluminum. While the UK has […]

Geopolitical Tensions and Dollar Strength: Uncertainty Looms in Light of February Markets

The start of the new year presented mixed signals for the global economy and overall financial markets. An optimistic government outlook and positive US economic data initially fueled enthusiasm and anticipation for future developments. However, interest rate fears, rising geopolitical tensions, and concerns regarding future economic growth overshadowed many of these positive perspectives. This resulted in […]