America is Picking the Right Fight with the Wrong Enemy

The above headline is true, assuming the U.S.’s avowed aim is the health and future of the American steel industry and its workers.

Need buying strategies for steel in 2018? MetalMiner’s Annual Outlook has what you need

No one would dispute the idea that the world has too much steelmaking capacity. Many emerging markets and all mature markets are in agreement that excess steelmaking capacity depresses global prices and begats a beggar-thy-neighbor attitude to world trade.

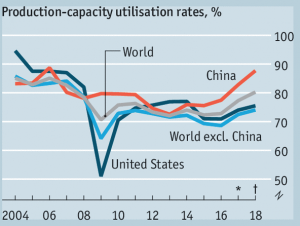

Even taking the elephant in the room out of the assessment, The Economist estimates, by excluding China, global capacity use fell from 86% in 2004 to 69% in 2016, underlining how severe and widespread the problem is.

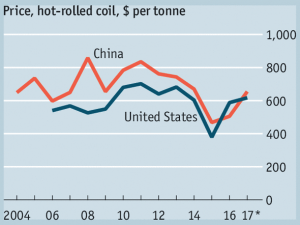

Recent cutbacks in China, recent research from Bank of America Merrill Lynch suggests, mean it is on track to use a full 88% of its capacity in 2018. Steel prices have rallied, mostly due to broad-based rising global growth.

While there are no guarantees that older, less environmentally friendly steel plants closed in the last 12 months will not be replaced by new, more efficient and less-polluting steel plants in the future, recent directives from Beijing suggest it is applying pressure to state governments to limit the permitting of new steel mills.

Past anti-dumping action has been so successful at limiting Chinese steel imports into the U.S. that many argue the Trump administration is now targeting the wrong threat (at least when it comes to steel).

Much of America’s steel imports are made up of material from the European Union and Canada. To have any logic to it at all, action resulting from the Trump administration’s Section 232 investigation launched last April will have to be applied to all steel imports, falling predominantly on U.S. allies and trading partners. The U.S. Department of Commerce sent the results of its findings to President Donald Trump last week — the president now has 90 days to respond.

The more time that goes by, the more the impression will grow that the response will be muted. Specific action against China, from which only some 3% of imported U.S. steel is supplied, would be hard to argue as a logical response, and would likely invite legal challenges at the WTO.

Wondering how your stainless steel prices compare to the market? Benchmark with MetalMiner

There’s nothing wrong with seeking to protect the U.S. steel industry — just pick the right target.

One Comment

The steel industry in the U.S. A. in all aspects should be self sufficient. The U.S. should use its own resources, to manufacture as many goods as possible.

The federal government of the U.S. should underwrite all parts of iron/steel economy making possible the growth and development of support industries as well as the increase in number of jobs for a wide range of employment age citizens. A bigger iron/steel economy will create a healthier U.S. economy.