Steel Prices Pick Up Momentum to Kick Off 2018

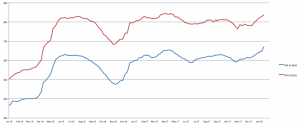

Steel price momentum appears significantly stronger with the start of the year. Steel price momentum shifted in December, showing stronger upward movement.

Need buying strategies for steel? Try two free months of MetalMiner’s Outlook

Despite the momentum, MetalMiner remains cautious about steel prices.

The U.S. Department of Commerce’s Section 232 outcome might also add some support to steel prices this month and until the president makes a final decision. Secretary of Commerce Wilbur Ross released the report to President Trump on Jan. 11. The president has 90 days as of receipt of the report to take action. The contents of the report have not been divulged.

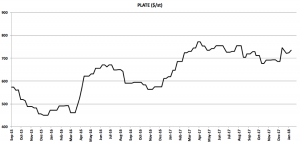

Plate Prices Move Up

Domestic plate prices increased again this week. Prices increased at the very end of 2017; plate momentum seems to have recovered from its previous downtrend.

Plate prices tend to abruptly change price direction. Will this new set of prices signal a continuous uptrend movement for the steel industry? Steel price performance in Q1 will provide buying organizations with clues and road signals.

What About Chinese Steel Prices?

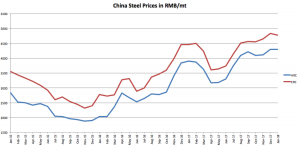

Chinese steel prices, however, currently trade lower than they did in December.

Contrary to U.S. steel prices, Chinese steel prices have held in an uptrend longer than U.S. steel prices. Therefore, we would expect some sideways movements.

Chinese capacity closures might offer additional support to steel prices this year. However, the Chinese government will maintain the current steel output and ensure steel quality meets the required standards.

Last week, the Ministry of Industry and Information Technology stated that China will have stricter rules to build new steel production capacity. Just up to one ton of new capacity will be built for each 1.25 tons of old capacity closed in environmentally sensitive regions. This measure will start this year, which may add support to steel prices.

MetalMiner’s Annual Outlook provides 2018 buying strategies for carbon steel

What This Means for Industrial Buyers

As domestic steel price dynamics showed strong upward momentum this month, buying organizations may want to closely understand price movements to decide when to buy some volume. Despite slowing Chinese momentum from the previous quarter, prices still remain strong. Buying organizations can expect some additional upward price movement this month.

For specific industrial buying strategies, take a free trial now to our Monthly Metal Buying Outlook. In addition, our February Monthly Outlook will include a detailed analysis of the Section 232 outcome.

Leave a Reply