Rare Earths MMI: U.S. Drops Rare Earths From $200B Tariff List

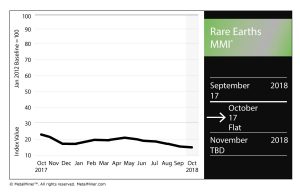

The Rare Earths Monthly Metals Index (MMI) stood pat this month for an MMI value of 17.

Need buying strategies for steel? Request your two-month free trial of MetalMiner’s Outlook

Pentagon Reviews Critical Materials Dependence

Tariffs have been flying left and right this year, impacting a wide range of products, from steel and aluminum to everyday consumer goods.

Last month, the Trump administration imposed an additional $200 billion worth in tariffs on Chinese goods, marking a significant escalation of trade tensions between the two countries (the U.S. had already imposed a total of $50 billion in tariffs on Chinese goods).

But one sector that has avoided tariffs is perhaps not so difficult to guess: rare earths.

Given China’s overwhelming dominance of the market and the U.S.’s position as a relative non-factor in the industry (the U.S.’s only rare earths mine closed in 2015), the U.S. is thus dependent on China for many critical rare earths.

According to the U.S. Geological Survey, 78% of the total amount of U.S. rare earths imports from 2013-2016 came from China, followed by: Estonia (6%), France (4%), Japan (4%) and other sources (8%). The value of imports of rare earth compounds and metals reached $150 million in 2017, up from $118 million in 2016.

A number of rare earths were on an initial list of products set to be targeted for $200 billion in tariffs, but those items were dropped from the final list, which went into effect late last month.

That dependence, paired with the rising trade tensions between the countries, has forced the U.S. to reconsider its sourcing of a number of critical materials, particularly from China, according to a Reuters report.

Per the report, the Pentagon has conducted a review that has identified hundreds of instances in which the U.S. military has depended on foreign sources for important materials.

According to the report, the findings of the Pentagon review are expected to be released in the coming weeks.

Malaysia to Look Into Radioactive Emissions at Lynas Corp Plant

The Malaysian government plans to conduct a review of radioactive waste emissions from Lynas Corp Ltd.’s rare earths processing plant in the country, Reuters reported.

According to the report, a politician who has been critical of the plant will head the committee that will conduct the review, a fact that has raised concern at Lynas.

Actual Metal Prices and Trends

Yttrium fell $0.13 to $32.75/kilogram. Terbium oxide dropped 0.4% to $425.73/kilogram.

Neodymium oxide dropped 0.4% to $46,066.60/mt.

Want to a see Cold Rolled price forecast? Get two monthly reports for free!

Europium oxide also fell 0.4%, down to $42.94/kilogram, while dysprosium oxide fell .03% to $167.24/mt.

Leave a Reply