Month-over-month, the Rare Earths MMI (Monthly Metals Index) broke its short-term sideways trend and once again spiked down. Overall, the index witnessed a 10.03% decrease as reduced short-term demand continues to cause more and more supply to build up. This leaves rare earth prices struggling to find support. However, the prospect of China offering a […]

Category: Minor Metals

Another Semiconductor Shortage? What to Expect from China’s Restriction on Gallium and Germanium Exports

China’s announced restriction on the export of gallium and germanium goes into effect in August. Both of these elements are vital to the microchip industry. Many worry that the move will lead to another major semiconductor shortage. As per the new rule, export of these strategic metals now requires Beijing’s permission. Exporters violating the rule […]

How to Track, Forecast, and Create Sourcing Strategies for Opaque Metals

Some of our favorite metal sourcing challenges involve off-the-beaten-path requests for price intelligence regarding “opaque metals.” This term refers to metals that no known exchange-traded price firm or price reporting agency (e.g. MetalMiner and our competitors) publishes. We like to think MetalMiner continues to add price data across a broad range of “obscure” metals. This […]

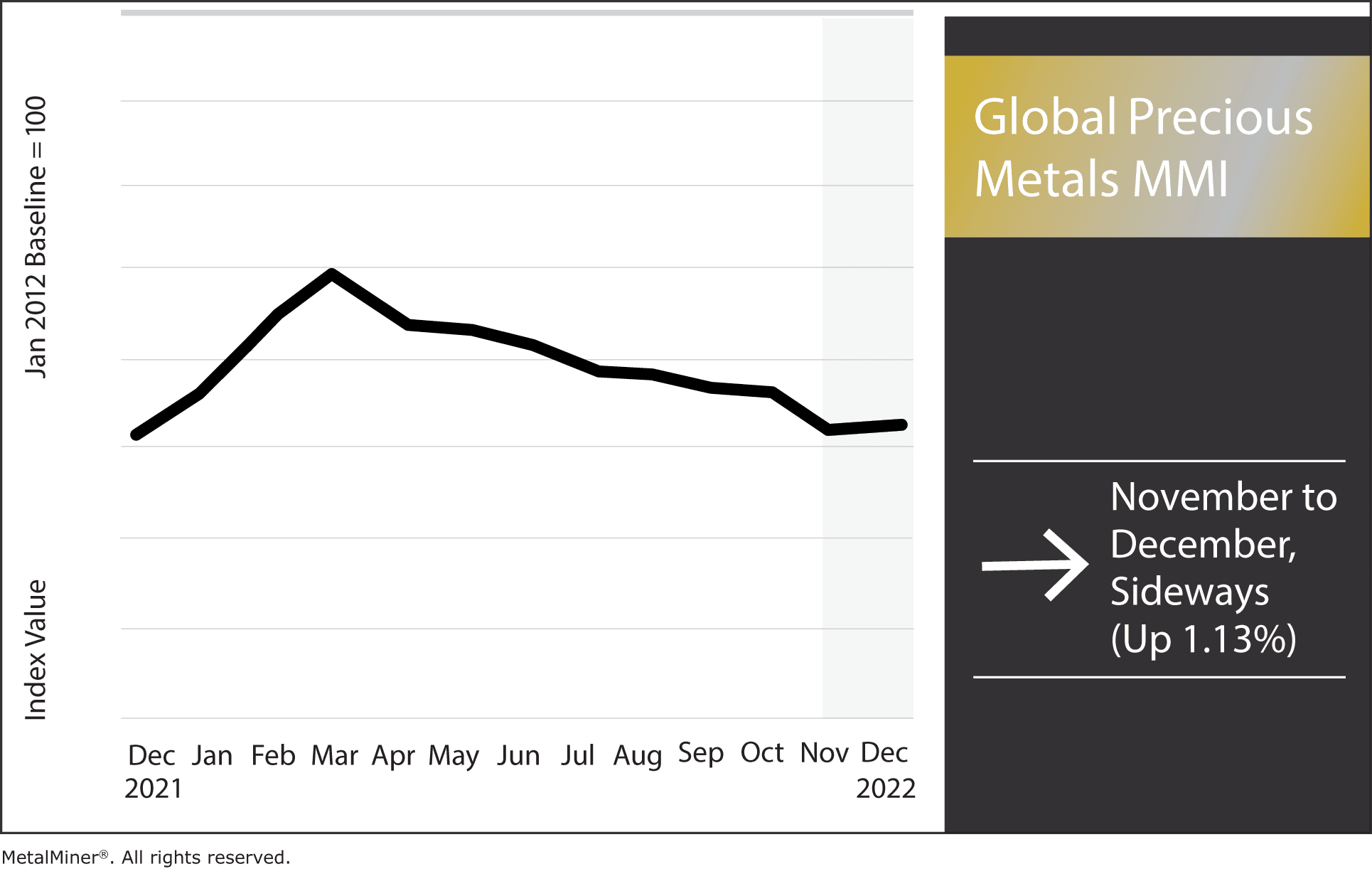

Global Precious Metal MMI: Long Term Price Directions Remain Uncertain

The Global Precious Metals MMI (Monthly MetalMiner Index) stayed within a sideways range this past month. However, precious metal prices did rise by a modest 1.13%. As the US dollar dropped in value over recent weeks, precious metal indexes responded accordingly. Month-over-month, gold, platinum, and palladium all saw a brief rally between Nov 3 – […]

Rare Earths MMI: Global Rare Earth Supply Chains in an Uproar

The December Rare Earths MMI (Monthly MetalMiner Index) traded sideways for the second month in a row. The index dropped 1.55% and MetalMiner anticipates it will continue sideways, most definitely for the short term and possibly in the long term. This is mostly thanks to the supply of global rare earth magnets being interrupted by […]

Rare Earths MMI: Rare Earths Prices Hold Steady Despite Amid Lower Scrap Availability

The Rare Earths Monthly Metals Index (MMI) held flat for a .56 percent change this month. Even so, some rare earths prices have seen significant fluctuation. Praseodymium Neodymium Oxide is one such example. The allow saw a significant price increase over the past month. Check out the MetalMiner forecast track record. By correctly calling the trends MetalMiner […]

Rare Earth Elements About to Get Even Rarer

There’s something afoot on the rare earths front in China. Specifically, the country recently decided that it wants to tighten its export control laws. The regulation passed about two years ago to stop importing countries from diverting “Chinese products for non-intended use.” In most cases, the “products” refer to rare earth elements, of which China […]

Lithium Market or Bust: The US is Staring Down a Big Opportunity

The US could enter the lithium market in a very big way. At least, that’s what some experts are claiming. The global demand for lithium is on the rise, especially in the US. This should come as no surprise, as lithium-ion batteries are essential to electric vehicles and energy storage. Still, the question remains: is […]

Lithium prices outstrip even the base metals bull run

Base metal prices have seen significant increases over recent weeks. However, one metal has outperformed them all this month, lithium. The lithium spot market for battery grade salts, specifically carbonates and hydroxides, surged nearly 15% in just the last week, according to Fastmarkets. Fastmarkets’ price for lithium carbonate, 99.5% Li2CO3 min, battery grade, spot price […]

Rare earth oxide prices drop as China loosens production quotas

China’s rare earth (RE) oxides market is a controlled market — or at least it is today. There was a time it was the mining equivalent of the wild west with multiple operators. There were once zero controls and, as a result, the sector’s operations led to massive environmental damage. The authorities stepped in, consolidated […]