Chinese HRC Prices Continue to Rise on the Back of Government Stimulus Measures

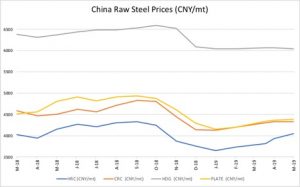

Chinese HRC prices increased again this month, while other forms of steel stayed flat overall.

Need buying strategies for steel? Request your two-month free trial of MetalMiner’s Outlook

Looking more closely at HRC — along with CRC, HDG and plate — prices generally remain lower than a year ago on a year-on-year basis, with the exception of HRC due to the recent price increases. However, they all are generally hovering at similar prices levels, with HDG showing the biggest change.

The spread between U.S. HRC and China HRC rests at $122/st, the lowest level since February 2018. However, recently the yuan weakened against the dollar, which will effectively increase the spread once more. A weaker yuan means Chinese prices will be cheaper.

China’s Economic Indicators Flattened in April

China’s Caixin Manufacturing PMI reading decreased unexpectedly for April, dropping to 50.2 from March’s eight-month high of 50.8. With the forecast value at 51.0, the drop surprised the market. Weakness came from decreased output and orders. Additionally, export sales dropped for a second straight month due to weaker overseas demand.

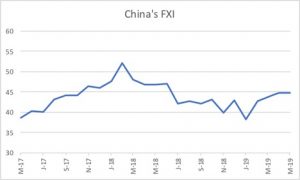

The FXI, an index of China’s large-cap companies, also showed flat growth recently after increasing since the start of the year.

Crude Steel Production Increases Continued in March

According to the World Steel Association, China produced around 80.3 million metric tons of crude steel during March, an increase of 10% compared to March 2018. For the sake of comparison, the U.S. produced 7.8 million metric tons of crude steel in March, an increase of 5.7% compared with March 2018.

In late April, China’s Iron and Steel Association once again issued a statement indicating the industry faces risks due to ongoing excess capacity, sluggish demand and increased raw material costs.

According to the association, fixed asset investment in the sector increased by 30.6% during Q1 2019. Some of the capacity increase harks back to less environmentally friendly induction furnace production, as companies looking to boost output turned to cheaper production methods. The industry organization came out in a public statement advocating that companies refrain from illicit capacity increases.

According to a recent Reuters report, the organization warned against structural issues in the industry as demand weakens. In addition, profitability suffered due to rising iron ore prices.

China’s Baoshan Iron and Steel Co Ltd (Baosteel) recently announced that profits fell during Q1, the first such drop since 2015. The company cited higher raw material costs and weaker automotive demand as the key causal factors, while demand for steel for infrastructure remained strong.

The company expects to produce 45.46 million metric tons of iron and 48.18 million metric tons of steel in 2019, with an expectation of strong infrastructure demand. Baosteel also expects sales of steel for automotive production to remain a challenge due to the EV transition and due to the impact of tariff-related policy changes.

Want to see an Aluminum Price forecast? Take a free trial!

China’s automotive sales declined by 11.3% during the first quarter compared with the same period of 2018, according to the China Association of Automobile Manufacturers (CAAM).

Leave a Reply