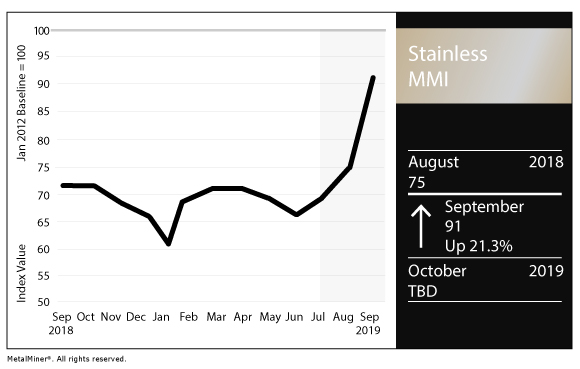

Stainless MMI: Index Jumps 16 Points on Nickel Price Surge

The Stainless Monthly Metals Index (MMI) followed last month’s six-point increase with a 16-point jump this month.

Once again, the index surge came as a result of strong nickel price gains, even though a slim majority of global prices in the index declined (albeit mildly compared to nickel price increases).

Need buying strategies for steel? Request your two-month free trial of MetalMiner’s Outlook

LME nickel prices increased 28.5%, based on supply disruption news. Nickel prices in China and India also reacted strongly, increasing by 25.9% and 24.1%, respectively.

SHFE Nickel Prices Surged

The Indonesia nickel ore export ban will now take effect two years earlier than planned, on Jan. 1, 2020. SHFE prices surged just prior to, and during the day or so around, the actual approval of the ban date by the Indonesian government.

Higher Nickel Prices Look Set to Stick for the Near Term

Opinions appear mixed as to whether prices will drop back down anytime soon, with some analysts foreseeing further price increases.

Indonesia produced around 26% of global mine supply last year, according to the International Nickel Study Group.

It is possible ramped-up production of nickel pig iron in Indonesia will stave off further price increases from supply shortages. According to Reuters, large mining companies reportedly welcomed the ban and plan to increase smelting output.

Also, higher ingot prices higher, incentivizes mine production; as such, increases could also come from other sources.

According to a recent Reuters report, Dante Bravo, president of the Philippine Nickel Industry Association indicated mine production looks set to ramp up in 2020, but constraints, such as government-imposed mining curbs, will limit growth. Bravo added mining volume most likely peaked with 2014’s record-setting high of 50 million tons.

The Philippines produced 11.31 million tons of nickel during the first half of 2019, up by 3% compared with the first half of 2018, Reuters reported.

Domestic Stainless Steel Market

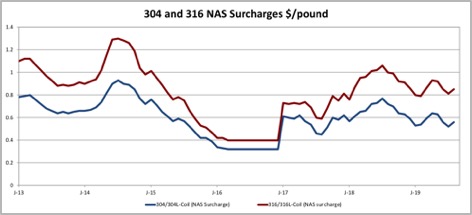

Stainless 304 and 316 NAS surcharges increased in August due to sizable nickel price increases. Next month’s MMI looks set to show a greater impact from surcharges than they showed in August.

What This Means for Industrial Buyers

MetalMiner’s stainless steel price index hit near a five-year high, rising to a value not seen since November 2014’s value of 92. As indicated last month, prices appear speculatively high; premium prices also surged.

Therefore, industrial buyers need to stay alert for the right opportunity to buy.

Buying organizations interested in tracking industrial metals prices with greater ease will want to request a demo of the MetalMiner Insights platform.

Buying organizations seeking more insight into longer-term steel price trends should read MetalMiner’s Annual Metal Buying Outlook.

Looking for metal price forecasting and data analysis in one easy-to-use platform? Inquire about MetalMiner Insights today!

Actual Stainless Steel Prices and Trends

Once again, nickel prices registered double-digit increases for the monthly index reading.

The LME primary three-month nickel price increased by 28.5% to $18,475/mt. China’s primary nickel price increased by 25.9% to $20,601/mt. India’s primary nickel price increased by 24.1% to $17.99/kilogram.

The U.S. 316 and 304 Allegheny Ludlum stainless surcharges increased by 14.1% and 16.6%, respectively, to $1.00/pound and $0.69/pound.

More than half of the prices in the index dropped, albeit mildly compared with the price increases.

Chinese Ferro Alloys FeMo lumps dropped by 4.7% this month, while FeCr lumps dropped by 4%.

Chinese 316 and 304 stainless steel scrap prices both dropped 4%, down to $1,827/mt and $1,401/mt, respectively.

Chinese 304 CR stainless steel coil increased 4.4% to $2,259/mt, while 316 CR coil dropped by 0.8% to $3,081/mt.

Korean prices for 430 CR 2B stainless steel coil and 304 CR 2B stainless coil both decreased by 2.2%, down to $1,195/mt and $2,101/mt, respectively.

Leave a Reply