Stainless MMI: South Africa’s 21-day lockdown shakes up ferrochrome markets

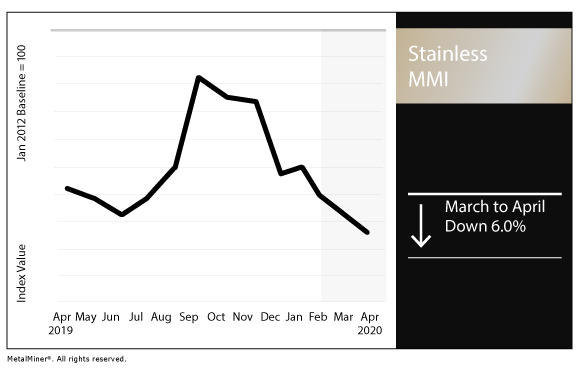

The Stainless Monthly Metals Index (MMI) fell 6.0% this month.

Looking for metal price forecasting and data analysis in one easy-to-use platform? Inquire about MetalMiner Insights today!

South Africa’s 21-day lockdown throws wrench into stainless surcharge fixing

As MetalMiner’s Stuart Burns explained last month, South Africa’s 21-day lockdown in response to the coronavirus pandemic has had a serious ripple effect on the ferrochrome market and, in turn, the setting of stainless steel surcharges.

“Hats off to the president for acting promptly and responsibly, but the knock-on impact is the country’s chrome ore mines and refineries have closed as of the end of March with Glencore’s chrome joint venture with Merafe Resources, Samancor, Tharisa and Jubilee all closing down, with some having to declare force majeure on shipments,” Burns wrote earlier this month.

“South Africa accounts for 60% of the world’s chrome production, Reuters reports, and supplied 83% of China’s imports of chrome ore last year.

“Of the world’s 36 million tons, South Africa produced 23 million tons last year. To put it in perspective, the country’s role in the chrome market is bigger than Saudi Arabia’s to oil or Chile’s to copper.”

Merafe released a statement on the matter April 2.

“In accordance with the Government’s directive, all Merafe’s operations have been placed on care and maintenance until the Lockdown period is lifted or relaxed,” Merafe said. “The Company has been engaging and will continue to engage with the relevant authorities, unions and other stakeholders in order to manage the impact of the Lockdown on the Company.

“Merafe will continue to communicate with its suppliers and customers to ensure they remain informed and where Merafe is unable to perform under contracted obligations, the Company will declare Force Majeure and suspend its obligations under such contracts.”

The lockdown, which was scheduled to end this week, has been extended until the end of April, creating further uncertainty regarding the state of chrome prices.

South African President Cyril Ramaphosa made the extension announcement April 9.

“We will use the coming days to evaluate how we will embark on risk-adjusted measures that can enable a phased recovery of the economy, allowing the return to operation of certain sectors under strictly controlled conditions,” Ramaphosa said.

Meanwhile, nickel prices have continued their relentless fall, now down to around $11,500/mt.

While chrome forms by far the larger part of the stainless surcharge, falling nickel prices also undermine price support, particularly for the higher nickel-bearing grades.

As for China, stainless production is recovering but is still well below 2019 levels; a full recovery there is likely to take several quarters.

NAS to use temporary April surcharge

Circling back to the issue of the still undetermined European benchmark ferrochrome price, stainless steel producers have thus been in a tricky spot in terms of fixing alloy surcharges.

North American Stainless, for example, announced it will use a temporary surcharge for April until a second-quarter value can be fixed.

“As a result of the impact of Covid-19, the determination of the European benchmark ferrochrome price for the second quarter of 2020 has not been finalized and is still under review,” NAS said in an April 3 release. “This published price is a critical component of the supply chain as it becomes a baseline figure in determining mill raw material pricing along with being the baseline value in determining the chrome portion of the alloy surcharge. Due to the delay in publishing of this figure we must provide a temporary surcharge value for April until a formal second quarter value is determined. As such we will publish an April surcharge today utilizing the first quarter value of $1.01 and begin the process of invoicing April shipments accordingly.”

Given the extension of the lockdown in South Africa, it remains to be seen when the surcharges can be fixed on a permanent basis.

Allegheny Technologies Incorporated (ATI) released a similar announcement April 7.

“The need to invoice critical customer shipments has resulted in our decision to issue a temporary April surcharge,” ATI said. “This temporary April surcharge will be based on the most current raw material values except for ferrochromium which will retain the published Q1 European ferro chromium price of $1.01/lb. Once the European ferrochrome benchmark price for the second quarter of 2020 is published, the April surcharge table will be updated accordingly.”

ATI cites lack of Section 232 tariff relief in idling of Midland plant

In other ATI news, the firm announced March 31 it would idle its direct roll anneal and pickle (DRAP) operations in Midland, Pennsylvania, as a result of a lack of relief from the Trump administration’s Section 232 tariffs.

“The unfortunate impact on these hard-working employees is an unintended consequence of the blunt nature of tariffs,” ATI President and CEO Robert S. Wetherbee said in a prepared statement. “We have no viable alternative to imports, yet have suffered unsustainable losses under this economic policy. Since March 2018, we have sought unsuccessfully to obtain a tariff exclusion, with our latest request still unanswered by the Department of Commerce. While we firmly believe we meet the criteria for an exclusion, we cannot wait any longer. Without a tariff exclusion, we have no choice but to idle the Midland operations.”

The idling process will continue through the end of June. However, the idling process will take place in a manner that would allow operations to resume “if tariff policies were substantially changed,” the company said.

Metal prices fluctuate. Key is knowing when and how much to buy with MetalMiner Outlook. Request a free trial.

Actual metals prices and trends

Allegheny Ludlum 304 and 316 surcharges remained at $0.84/pound and $0.59/pound, respectively.

Meanwhile, Chinese 316 CR coil fell 1.3% month over month to $2,929.88/mt as of April 1, while 304 coil fell 1.3% to $2,132.11/mt.

LME three-month nickel dropped 7.8% to $11,298/mt at the start of the month.

Chinese primary nickel fell 8.2% to $13,230.37/mt. Indian primary nickel fell 1.0% to $11.44/kilogram.

Leave a Reply