Rare Earths MMI: DoD reverses decision to fund two U.S. rare earths separation facilities

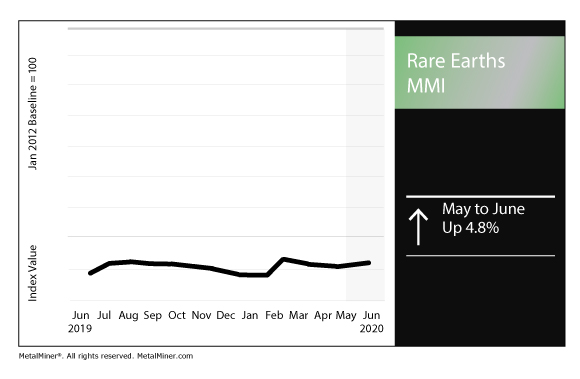

The Rare Earths Monthly Metals Index (MMI) ticked up 4.8% this month.

U.S. rare earths projects hit a roadblock

China’s overwhelming dominance of the global rare earths mining and processing sectors has left the U.S. in a difficult position, particularly as the Trump administration has engaged China in a trade war that has resulted in the imposition of hundreds of billions of dollars’ worth in tariffs.

Looking for metal price forecasting and data analysis in one easy-to-use platform? Inquire about MetalMiner Insights today!

Rare earths are coveted for their use in a variety of high-tech capacities, including consumer technologies — like laptops and cellphones — and military uses.

As such, the Pentagon has taken an interest in pursuing potential partnerships to secure new rare earths supplies and draw down the U.S.’s reliance on China for rare earths.

In late April, Australian rare earths miner and processor Lynas Corporation — the world’s largest outside of China — announced the U.S. intended to offer a Phase 1 contract for the buildout of a heavy rare earths separation facility in the U.S. (Lynas previously announced a partnership with Texas-based Blue Line Corp.).

In addition to Lynas, the U.S. Department of Defense granted a Phase 1 contract to MP Materials — owner and operator of the Mountain Pass mine in California — for a rare earths separation facility in California.

However, almost a month later, the DoD has decided to freeze the programs, Reuters reported.

According to the report, a Chinese firm’s minority stake in MP Materials generated concern among officials in the Department of Energy.

Meanwhile, in response to the news, Lynas remained optimistic about the project.

“Lynas remains one of two companies selected for Phase 1 of the project, however Lynas understands that the U.S. government’s progress on Phase 1 is currently on hold while those political issues are addressed,” Lynas Corp. said in a May 22 release. “We are committed to developing our Heavy Rare Earth separation facility and work is continuing on the plant design and engineering. We continue to regard our Heavy Rare Earth separation facility as an attractive strategic project.”

Last month, Sen. Ted Cruz (R-Texas) introduced legislation — called the Onshoring Rare Earths Act of 2020, or ORE Act — calling for an end to U.S. dependence on China for rare earth elements and other critical minerals “used to manufacture our defense technologies and high tech products.”

“Our ability as a nation to manufacture defense technologies and support our military is dangerously dependent on our ability to access rare earth elements and critical minerals mined, refined, and manufactured almost exclusively in China,” Cruz said. “Much like the Chinese Communist Party has threatened to cut off the U.S. from life-saving medicines made in China, the Chinese Communist Party could also cut off our access to these materials, significantly threatening U.S. national security. The ORE Act will help ensure China never has that opportunity by establishing a rare earth elements and critical minerals supply chain in the U.S.”

Hastings signs long-term supply deal with German automotive Tier 1 supplier

On June 3, Australian firm Hastings Technology Metals Ltd. announced a long-term supply deal with German Tier 1 automotive supplier Schaeffler Technologies AG.

Over an initial period of 10 years, Hastings will supply Schaeffler with mixed rare earth carbonate (MREC) mined and processed at its Yangibana project in Western Australia.

“This contract represents a very important milestone in the development of Hastings as an emerging supplier of rare earth carbonate from Australia to Germany, an industrialised nation with a growing demand for a critical raw material used in many advanced technologies where a permanent magnet is needed,” said Charles Lew, executive chairman of Hastings. “We look forward to strengthening our cooperation with Schaeffler in the years to come.”

Hastings, which aims to become the largest producer of neodymium and praseodymium outside of China, last year signed a memorandum of understanding that called for the two firms to “work together on a long term partnership to enable Schaeffler to develop an independent supply chain for its e-motor business for the emerging Electric Vehicle industry.”

Metal prices fluctuate. Key is knowing when and how much to buy with MetalMiner Outlook. Request a free trial.

Actual metals prices and trends

The Chinese yttrium price fell 1.4% month over month to $31.53/kg as of June 1. Terbium oxide rose 5.4% to $584.97/kg.

Neodymium oxide fell 0.8% to $39,231.84/mt.

Europium oxide fell 1.1% to $29.42/kg. Dysprosium oxide rose 7.4% to $271.82/kg.

Leave a Reply