Stainless MMI: LME nickel prices grow for second consecutive month

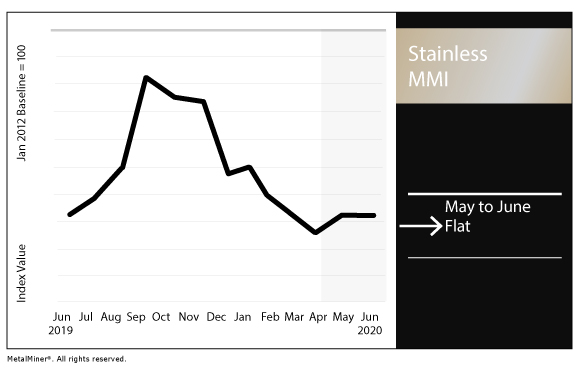

The Stainless Monthly Metals Index (MMI) held flat this month.

Fears over nickel shortage may increase stainless steel consumption

As major stainless steel producers publish their first quarterly reports of 2020, sales held flat compared to last year — this was the case for Outokumpu, Aperam and Acerinox, to name a few.

Metal prices fluctuate. Key is knowing when and how much to buy with MetalMiner Outlook. Request a free trial.

Meanwhile, Steel & Metal Market Research, estimated there will be a 7-million-ton reduction in 2020 stainless steel demand for 2020. We also reported the post-pandemic recovery in consumer demand across all sectors — never mind challenging products, like electric vehicles (EVs) — is going to take two or three years.

So why are producers not seeing sales declines?

It might be due to concerns over a nickel shortage in the near future.

After all, Indonesia, the world’s largest nickel producer, banned the export of nickel ore back in January. Even when the Indonesian nickel miners association (APNI) proposed in April that the country lift the ban, the Ministry for Maritime Affairs and Investment rejected the proposal.

Moreover, SHFE nickel inventory has fallen to just 27,000 tons, while the LME has some 230,000 tons of stock.

Stainless steel makers in China might not be affected by Indonesian export ban

According to Argus Media, Indonesia exported 20.72 million tons of nickel ore and ferro-nickel in 2019, from which 19.9 million tons were delivered to China.

Even though there are some fears over the undersupply of nickel ore, some ferro-nickel traders in Europe and China believe producers are well-stocked — meaning that, in the short term, the nickel shortage should not be an issue.

As it happens, the export ban might accelerate the construction of nickel smelters. At the beginning of the year, an Energy and Mineral Resources Ministry official reported at least four smelters would be completed by the end of 2020, which would add a total of 200,923 tons of capacity. Moreover, these four smelters add to a list of 29 smelters expected to be operational by 2022.

Chinese stainless steel companies have already established their presence in Indonesia. Tsingshan owns the Indonesia Morowali Industrial Park and Delong Holdings has a joint venture at Dexin Steel.

Philippines might provide some supply relief

As the Philippines began to reopen after being constrained due to coronavirus measures, mines were allowed to operate at full capacity.

According to the United States Geological Survey, the Phillipines was the second-largest nickel producer — after Indonesia — with an estimated 420,000 tons of nickel in 2019, representing approximately 16% of the total global production.

Moreover, the Phillipine Nickel Industry Association expected production to increase by over 8% from 2020 to 2028 despite policy uncertainty that could limit project development.

This could translate into an advantage for Philippines nickel exports, as Indonesian mines might operate below their production capacity as they wait for the completion of new smelter capacity.

Looking for metal price forecasting and data analysis in one easy-to-use platform? Inquire about MetalMiner Insights today!

Actual metals prices and trends

The Allegheny Ludlum 316 stainless surcharge rose 9.0% month over month to $0.79/pound. The 304 surcharge rose 7.9% to $0.58/pound.

LME primary three-month nickel fell 0.1% to $12,192/mt.

Chinese 316 and 304 cold-rolled coil fell to $2,886.34/mt and $2,010.63/mt, respectively.

Chinese primary nickel fell 0.3% to $14,354.65/mt. Indian primary nickel rose 2% to $12.62/kilogram.

FeCr lumps fell 1.1% to $1,457.18/mt.

Leave a Reply