Automotive MMI: With fewer selling days, August 2020 U.S. sales decline

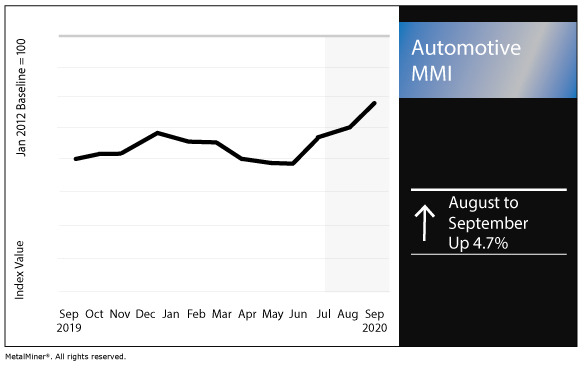

The Automotive Monthly Metals Index (MMI) rose 4.7% for this month’s reading.

We’re offering timely emails with exclusive analyst commentary and some best practice advice – and you choose how often you receive it. Sign up here.

U.S. automotive sales

Among automakers still reporting sales on a monthly basis, Honda reported its August sales fell 21.9% year over year. Its car sales fell 29.6%, while truck sales fell 16%.

Hyundai reported total sales fell 8% year over year in August, while retail sales dipped 2%.

However, when accounting for extra selling days in August 2019, August 2020 retail sales increased 7% year over year. SUVs represented just over two-thirds of Hyundai’s U.S. retail sales in August.

“Despite a down market, our SUVs continue to drive sales and deliver results for us and our dealers,” said Randy Parker, vice president of national sales for Hyundai Motor America. “Our entire line up performed well, but Palisade led the pack and is one of the fastest selling vehicles in the industry. Sonata sales were up, because customers still want great, high-quality, safe sedans.”

Subaru’s U.S. sales, meanwhile, fell 17% year over year to 57,885 units in August.

“Thanks to the dedicated efforts of our retailer network, we are able to count August as the best sales month of 2020,” said Thomas J. Doll, president and CEO of Subaru of America, Inc. “Our retailers are continuing to sell at very high levels of sales efficiency given their on-ground inventory levels while at the same time providing a Love Promise customer experience. We are grateful for their outstanding efforts.”

August 2020 sales forecast to decline

While automotive sales have recovered somewhat over the summer months, August 2020 sales remained down year over year.

According to a forecast released jointly by J.D. Power and LMC Automotive, retails sales were expected to fall 3.7% compared to J.D. Power’s pre-virus forecast to 1.17 million units.

Total sales were expected to reach a seasonally adjusted annualized rate of 15.1 million vehicles, or down 2 million units from a year ago.

“Given the ongoing disruption that COVID-19 has on the industry, the fact that retail sales of new vehicles are only 4% below the pre-virus forecast is evidence of strong consumer demand for vehicles,” said Thomas King, president of the data and analytics division at J.D. Power. “The modest decline also is a result of significant inventory constraints.”

Toyota, Mazda JV announces $830M additional U.S. investment

A joint venture of Toyota and Mazda, Mazda Toyota Manufacturing, last month announced an additional investment of $830 million in its U.S. facility in Huntsville, Alabama.

The investment will contribute to “cutting-edge manufacturing technologies to its production lines and provide enhanced training to its workforce of up to 4,000 employees,” Toyota said in a release.

The additional $830 million comes on top of the $1.6 billion investment originally announced in 2018.

“The new facility will have the capacity to produce up to 150,000 units of a future Mazda crossover vehicle and up to 150,000 units of the Toyota SUV each year,” Toyota said. “MTM continues to target up to 4,000 new jobs and has hired approximately 600 employees to date, with plans to resume accepting applications for production positions later in 2020.”

Chinese sales gain again

Meanwhile, automotive sales in China gained in July for a fourth consecutive month.

According to the China Association of Automobile manufacturers, sales rose 16.4% year over year in July.

The rise comes on the heels of year-over-year increases in April, May and June.

Actual metals prices and trends

The U.S. HDG price rose 5.6% month over month to $736 per short on as of Aug. 1.

LME primary three-month copper fell 4.1% to $6,702 per metric ton.

U.S. shredded scrap steel rose 4.2% to $248 per short ton.

The Korean 5052 aluminum coil premium rose 2.4% to $3.03 per kilogram.

Are you under pressure to generate steel cost savings? Make sure you are following these 5 best practices!

Leave a Reply