Aluminum MMI: China’s latest five-year plan could support aluminum prices

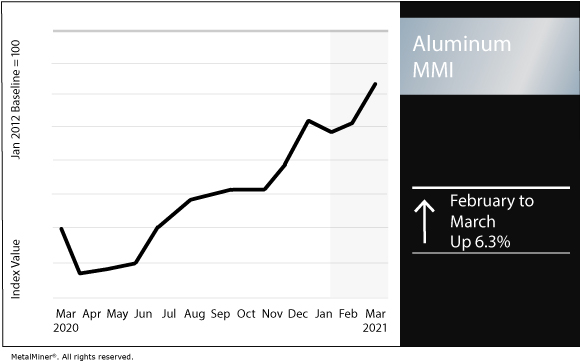

The Aluminum Monthly Metals Index (MMI) picked up 6.3% for this month’s reading, as the China aluminum sector could get a price boost from the 14th Five-Year Plan. Furthermore, the Department of Commerce made anti-dumping and countervailing duty determinations on aluminum sheet.

Don’t miss the MetalMiner analyst team on March 24 at 10 a.m. CDT for a 30-minute metals market forecast and strategies to deploy in falling markets: https://zoom.us/webinar/register/WN_6J8wAyYySfihVk3ZUH9yMA.

China’s 14th Five-Year Plan

By virtue of its having the largest aluminum and steel sectors in the world, China also faces a massive pollution problem.

Particularly given coal’s ongoing prevalence in the country, pollution is a problem Beijing is seeking to solve.

While some might question if the latest five-year plan goes far enough on climate, it is, at least, a step in the right direction.

As MetalMiner’s Stuart Burns explained yesterday vis-a-vis steel, the impact of the plan will be similar for aluminum.

In short, it could mean a tightening of supply and potentially rising prices in the medium term.

“The environmental targets are part of the new Five Year Plan and, as such, will evolve over the coming years rather than be applied over coming months,” Burns noted regarding the plan’s impact on aluminum. “But it may add a little fuel to investors’ interest in a tightening supply market narrative that underpinned copper and nickel prior to the recent selloff, and to a lesser extent that for aluminum.”

Overall, Burns said he expects China’s latest plan to be supportive rather than outright bullish in the short to medium term.

Xinhua, the state-run news agency, reported this month that China’s 14th Five-Year Plan will promote “green development and facilitate the harmonious co-existence between human and nature during the 14th Five-Year Plan (2021-2025) period, according to a government work report submitted Friday to the national legislature for deliberation.”

DOC makes anti-dumping, countervailing subsidy determinations for aluminum sheet

The Department of Commerce last month issued affirmative final determinations in its anti-dumping and countervailing subsidy investigations related to imports of aluminum sheet from 18 countries.

The anti-dumping case covered imports from:

- Bahrain

- Brazil

- Croatia

- Egypt

- Germany

- India

- Indonesia

- Italy

- Oman

- Romania

- Serbia

- Slovenia

- South Africa

- Spain

- Taiwan

- Turkey

Meanwhile, the countervailing subsidy case covered imports from Bahrain, India and Turkey.

Furthermore, petitioners in the case were the Aluminum Association Common Alloy Aluminum Sheet Trade Enforcement Working Group and its individual members: Aleris Rolled Products, Inc. (Richmond, Virginia); Arconic, Inc. (Pittsburgh, Pennsylvania); Constellium Rolled Products Ravenswood, LLC (Ravenswood, West Virginia); JW Aluminum Company (Williamsport, Pennsylvania); Novelis Corporation (Atlanta, Georgia); and Texarkana Aluminum, Inc. (Texarkana, Texas).

In addition, by value, the US imported the most aluminum sheet from Germany in 2019 ($286.6 million). Trailing Germany were Bahrain ($241.2 million) and Oman ($200.2 million).

Future of Section 232 aluminum tariff

Last month, we noted the Biden administration’s decision to reverse the Trump administration’s decision to rescind the Section 232 aluminum tariff.

The Trump administration imposed the blanket Section 232 tariff of 10% on imported aluminum in 2018.

However, Biden’s move marked a strong indicator that his administration likely will not reverse the tariffs.

MetalMiner’s Stuart Burns weighed in on the Section 232 tariff last month.

“But even accepting that the COVID-19 pandemic made 2020 a far from typical year, it has become clear the tariff strategy has not worked on a number of levels,” he wrote.

“While the inflationary cost of finished goods has been minor, the aluminum content even of a can of beer is a small fraction of the total product cost. It remains true that consumers have had to foot the bill.

“It was always the intention that domestic producers would raise their prices to the import plus tariff price. The corresponding uplift was what was supposed to allow them to operate profitably again, to arrest the decline and reopen idled capacity.”

Actual metals prices and trends

In China aluminum prices, scrap fell 0.6% month over month to $2,054 per metric ton as of March 1.

In addition, the Chinese primary cash price jumped 11.3% to $2,366 per metric ton. Chinese aluminum billet fell 0.7% to $2,373 per metric ton.

Meanwhile, LME three-month aluminum rose 10.8% to $2,203 per metric ton.

Indian primary cash aluminum gained 4.9% to $2.35 per kilogram.

Lastly, European commercial 1050 aluminum sheet rose 8.5% to $3,200 per metric ton.

Are you under pressure to generate aluminum cost savings? Make sure you are following these five best practices.

Leave a Reply