Aluminum MMI: US reinstates tariff on aluminum imported from UAE

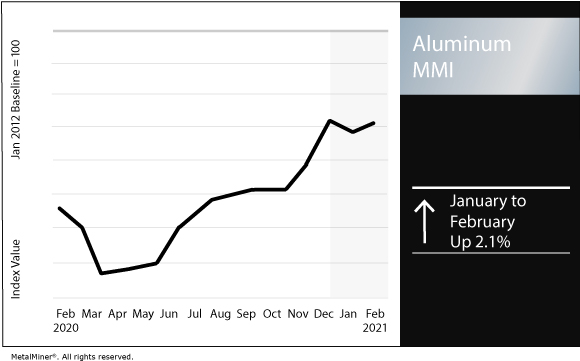

The Aluminum Monthly Metals Index (MMI) increased by 2.1% this month, as LME aluminum prices traded sideways and the US reinstated the Section 232 aluminum tariff on imports from the United Arab Emirates.

U.S. aluminum reinstates aluminum tariff on UAE

On Feb. 1, President Joe Biden reinstated the 10% aluminum tariff on imports from the United Arab Emirates.

Former President Donald Trump had lifted the aluminum tariff on his last day in office. The reinstated aluminum tariff went into effect Feb. 3.

The reinstatement suggests that it is unlikely the Biden administration will remove the aluminum tariffs imposed by the previous administration. However, as of today, no further decisions were announced on aluminum tariffs.

In addition, Biden’s “Buy American” plans could impact the U.S. domestic aluminum market. The plan will likely promote the manufacturing of essential components in construction, appliances and electronics in the US.

These measures are welcomed at the primary production level. However, not all end-product manufacturers are on board, as they claim these government interventions will artificially inflate the Midwest Premium.

The new administration also announced the delay of the effective date of the Aluminum Import Monitoring and Analysis (AIM) system that the U.S. Department of Commerce created. The Department of Commerce originally said the system would be available Jan. 25. However, it is delaying the launch until March 29. Licenses will not be required for covered aluminum imports until the new effective date.

Are rising MW premiums causing concern? See how service centers take advantage of that.

High aluminum scrap demand

A Midwest-based trader told Construction & Demolition Recycling that demand for aluminum scrap remains high at secondary smelters that supply the automotive industry in the US

Chad Kripke, an executive vice president of Kripke Enterprise, a nonferrous scrap brokerage firm, confirmed that many sellers are relying on the spot market rather than signing contracts for 2021. This signals that it is a seller’s market.

This market environment is due to the reduced flows of scrap, which has caused spreads to tighten. As a result, secondary producers are opting to purchase scrap at what they might view as high prices rather than risking a lack of material.

New on MetalMiner Insights

This month, MetalMiner added additional U.S. aluminum prices to its Insights platform.

Besides the U.S. Midwest Premium Futures, the platform now includes prices for some of the most common forms of aluminum sheet and coil. It includes prices for: 1100 H14, 3003 H14, 5052 H32, 5083 H321, 6061 T6 and 6061 T651.

Price data goes back to Jan. 1, 2020.

Actual metals prices and trends

The Chinese aluminum scrap price increased 0.4% month over month to $2,067/mt as of Feb. 1. Meanwhile, LME primary three-month aluminum increased 0.4% to $1,988/mt.

Korean commercial 1050 aluminum sheet remained flat at $3.30/kg. However, its European equivalent increased 8.3% to $2,948/mt.

Chinese aluminum billet and aluminum bar rose 0.4% to $2,389/mt and $2,489/mt, respectively.

Chinese primary cash aluminum dropped 2.4% to $2,365/mt. Meanwhile, its Indian counterpart declined 2.2% to $2.24/kg.

Want MetalMiner directly in your inbox? Sign up for weekly updates now.

One Comment

Great information about lme