Global Precious MMI: Gold price flat in March before early April bounceback

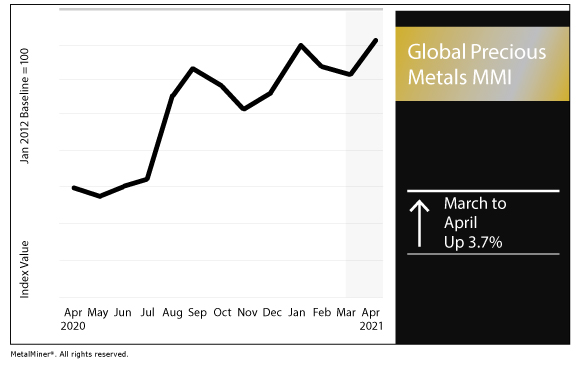

The Global Precious Monthly Metals Index (MMI) rose by 3.7%, as the gold price trended sideways in March.

Sign up today for Gunpowder, MetalMiner’s free, biweekly e-newsletter featuring news, analysis and more.

Gold flat in March, picks up in April

Late last year, MetalMiner’s Stuart Burns touched on the gold price’s prospects in 2021.

Gold surged above $2,030 per ounce last August amid ongoing economic uncertainty and well before the rollout of COVID-19 vaccines.

Since then, however, the gold price has cooled significantly. From the aforementioned peak, gold has dipped approximately 15%.

The gold price trended sideways throughout March, settling in around $1,730 per ounce. Despite a dip in treasury yields — which gold typically moves inversely to — the price largely held in place, as the US dollar strengthened.

The US dollar index rose to 93.30 in late March before retreating in the first week of April (coinciding with a modest bounceback for gold and silver).

So far this month, however, gold has shown some upward momentum. The gold price picked up Thursday, approaching the $1,760 per ounce mark.

Like gold price, silver price bounces back in April

Meanwhile, the silver price narrative followed a similar theme to that of the gold price.

After reaching $28.10 per ounce in February, the silver spot price fell to just below $25.00 per ounce to start April. Over the last week, silver has clawed back some gains, reaching around $25.50 per ounce Thursday.

While silver is often most thought of for its use in jewelry and kitchen utensils, the precious metal does have high-tech industrial applications.

As MetalMiner’s Stuart Burns noted earlier this week, nations around the world will need to secure their supply chains for the next industrial revolution, whether it’s the broader push toward renewable energy or the automotive sector’s transition toward electrification.

Among other uses, silver is used in semiconductors. As we’ve discussed at great length in recent months, the semiconductor shortage continues to weigh on automotive manufacturers.

30-year treasury yield declines

Meanwhile, the 30-year treasury yield has slipped over the last few weeks. Generally, higher yields serve as an indicator of economic confidence (as opposed to the gold price).

The 30-year yield reached a high of 2.45% on March 19.

This week, the yield fell to 2.32% on Thursday, down from 2.35% the previous day.

The 10-year yield fell to 2.22% on Thursday, down from a March peak of 2.36%.

The minutes of the Federal Open Market Committee’s meeting in March make reference to the March rise in yields.

“In the United States, the trend toward higher longer-term yields observed in recent months accelerated over the intermeeting period, and far-forward real rates based on Treasury Inflation-Protected Securities (TIPS) rose considerably,” the minutes indicated. “Market participants highlighted an improving economic outlook, bolstered by passage of the American Rescue Plan (ARP) and progress on vaccinations, as underlying the increase in yields.”

Sibanye-Stillwater announces strategic partnership with Johnson Matthey

Sibanye-Stillwater recently announced a strategic partnership with British sustainable technology company Johnson Matthey.

Through the partnership, the South African mining giant said it aims to “develop solutions to drive decarbonization.”

Furthermore, the parties will explore more efficient use of PGMs and other metals in battery technology.

“Johnson Matthey and Sibanye-Stillwater will collaborate on the sourcing and application of PGMs and metals used in battery technology to enable the development and commercialisation of low carbon technologies, with a focus on circularity and sustainability,” Sibanye-Stillwater said in its release. “In addition, the companies will examine potential opportunities to apply their collective experience to support the development of more sustainable supply chains for battery materials.”

Actual metals prices and trends

The US silver price dipped by 8.6% month over month to $24.41 per ounce as of April 1.

The US platinum bars price held flat, closing the month at $1,180 per ounce. Meanwhile, US palladium bars rose by 14.0% to $2,540 per ounce.

The Chinese gold price fell by 1.8% to $55.41 per gram. The US gold price fell by 1.6% to $1,709 per ounce.

The MetalMiner Best Practice Library offers a wealth of knowledge and tips to help buyers stay on top of metals markets and buying strategies.

Leave a Reply