Renewables/GOES MMI: Biden uses Defense Production Act to boost domestic production of battery materials

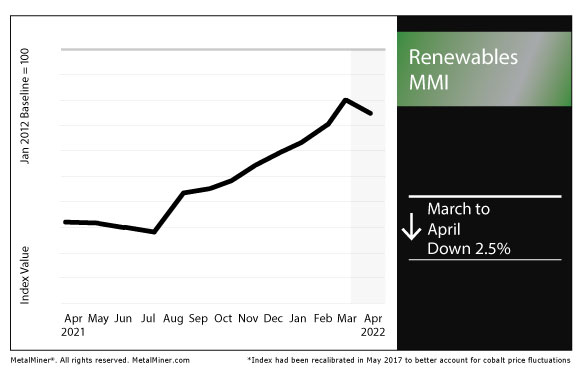

The Renewables Monthly Metals Index (MMI) slipped by 2.5% for this month’s reading.

(Editor’s note: This report also includes the MMI for grain-oriented electrical steel, or GOES.)

Keep up with MetalMiner’s latest analysis of metals markets in the MetalMiner weekly newsletter.

Biden looks to Defense Production Act to boost domestic production

As we noted in the Rare Earths MMI report, President Joe Biden recently called upon a provision of the Defense Production Act to boost domestic production of materials needed for large-capacity batteries and infrastructure.

The move comes over a year after the president’s executive order on supply chains. In that order, Biden called for 100-day reviews of critical U.S. supply chains. The president specifically targeted semiconductors, high-capacity batteries, critical minerals and pharmaceuticals.

Meanwhile, in his use of the Cold War-era Defense Production Act, the president seeks to boost domestic production of important battery materials.

“The United States depends on unreliable foreign sources for many of the strategic and critical materials necessary for the clean energy transition — such as lithium, nickel, cobalt, graphite, and manganese for large-capacity batteries,” a March 31 memo from the White House states. “Demand for such materials is projected to increase exponentially as the world transitions to a clean energy economy.”

In the order, Biden calls on the secretary of defense to “create, maintain, protect, expand, or restore sustainable and responsible domestic production capabilities of such strategic and critical materials by supporting feasibility studies for mature mining, beneficiation, and value-added processing projects.”

Furthermore, the secretary will also consult with other agency heads to survey the domestic industrial base “for the mining, beneficiation, and value-added processing of strategic and critical materials for the production of large-capacity batteries for the automotive, e-mobility, and stationary storage sectors.”

The MetalMiner Monthly Metal Outlook (MMO) report includes coverage of steel plate, which is included in the Renewables MMI basket of metals.

Transatlantic collaboration

Meanwhile, the U.S. and E.U. have expressed support for collaboration on battery supply chains.

In a release, the U.S. Department of Energy touted a “global approach” to the challenge of battery supply chains.

“Batteries are critical to a clean energy economy,” the DOE said March 15. “They help decarbonize the transport and energy sectors, by electrifying vehicles and providing stationary storage for the renewable-powered grid. Advancing the battery supply chain therefore requires an all-hands-on-deck, global approach.”

The DOE touted a collaboration between the European Battery Alliance and the U.S. Li-Bridge alliance. The parties will work together to develop supply chains for lithium-ion and next-generation batteries.

“Bolstering the clean energy economy and strengthening the battery value chain is a top priority the United States and the European Union,” the DOE said. “This is in step with their commitment to address the climate crisis and accelerate the transition to clean energy, through renewables, energy efficiency and necessary technologies like batteries.”

Renewables on the rise

Meanwhile, the U.S.’s share of power generation from renewables is on the rise.

According to the Energy Information Administration, renewables accounted for 20% of power generation in 2021. In addition, the EIA forecasts that to rise to 22% in 2022 and 24% in 2023.

“This increase in renewables generation leads to an expected decline in natural gas generation, which falls from a 37% share in 2021, to 36% in 2022, and to 35% in 2023,” the EIA reported.

Furthermore, the U.S. added 14 GW of new wind capacity in 2021. The EIA forecasts the addition of 10 GW this year and 5 GW in 2023.

Meanwhile, the U.S. added 13 GW of utility-scale solar capacity. Furthermore, the EIA forecast an additional 22 GW for 2022 and 24 GW for 2023.

GOES MMI

The GOES MMI, which tracks grain-oriented electrical steel, dropped 14% this month.

Furthermore, the U.S. GOES coil price fell 14% this past month to $3,421 per metric ton.

Actual metals prices and trends

The Chinese neodymium price fell 13.3% month over month to $201,874 per metric ton as of April 1.

Meanwhile, the Chinese steel plate price rose 0.85% to $863 per metric ton. Korean steel plate rose 14.8% to $1,116 per metric ton.

Lastly, U.S. steel plate jumped by 5.4% to $1,961 per short ton.

Leave a Reply