Global Precious Metals MMI: Gold Hits Yearly Low

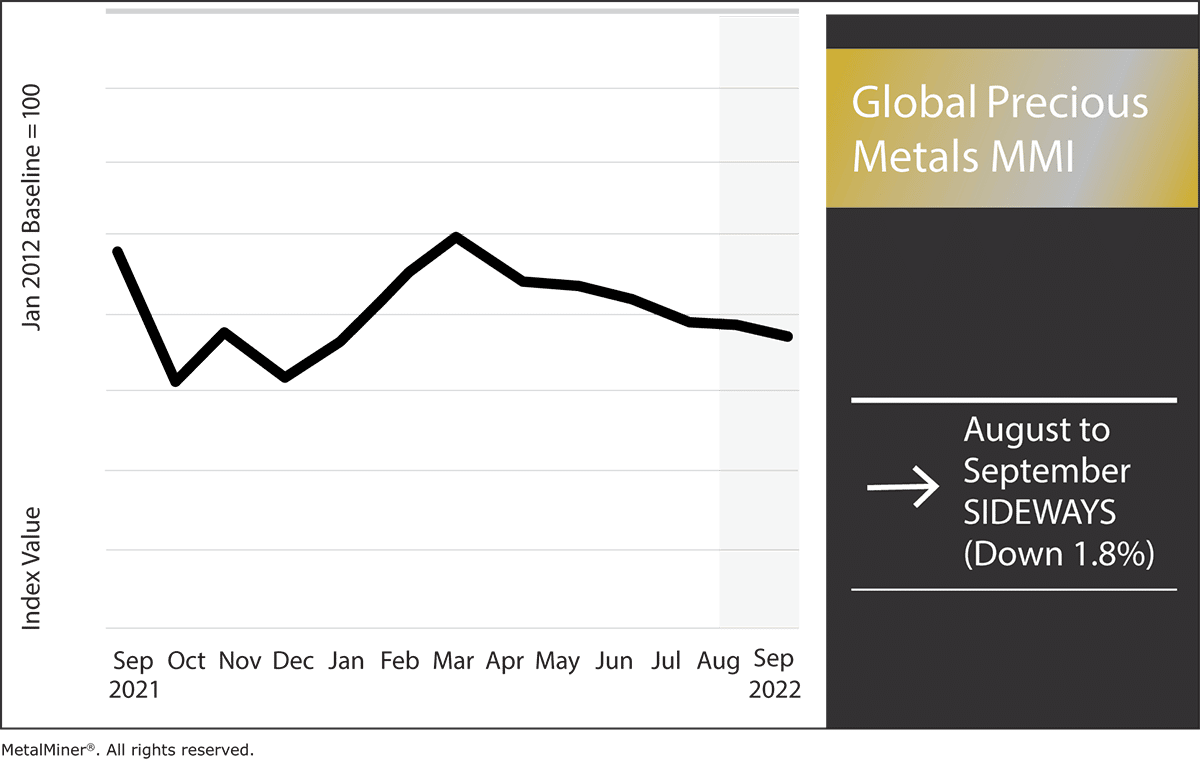

The September Global Precious Metals MMI (Monthly Metals Index) moved sideways, dropping by just 1.8%. Despite the slight loss, month-over-month, gold prices hit lows not seen in around two years.

MetalMiner’s FREE September webinar is tomorrow! Learn how to gauge metal prices and explore battery metal pricing. Sign up here!

Gold Hits Yearly Low Amid Economic Woes

Around May, gold began a long-term, downward trend. In June, gold enjoyed a small rebound, but it transitioned into a steep decline come July. Furthermore, between July and September, prices began to rise significantly, instilling fresh hope in many investors. However, the rise was evidentially a dead cat bounce. As September approached, prices continued their long-term downward yet trend again.

As of mid-September, gold officially hit its yearly low, confirming the dead cat bounce theory. Whether or not this will prove true for other precious metals remains unseen. While gold prices were in decline before mid-September, recent reports regarding the US economy and inflation severely impacted the gold market. Furthermore, it’s worth noting that Gold prices had been trading in historically high price ranges. Bullish strengths began to die off after a rally, leading to exhaustion. Historically, this leads to a downside reversal, which the gold market saw this past week.

Precious Metals Biggest Price Moves:

- US palladium bars dropped in price by 2.19%. Prices at the beginning of September sat at $2,009 per ounce.

- Additionally, US gold bullion fell in price by 3.12%. Prices at the month’s start were at $1,711 per ounce.

- Indian gold bullion also dropped in price by 2.59%, hitting $630.22 per 10 grams.

- In addition to this, US platinum bars saw a large drop in price by 5.13%. Prices at the beginning of September fell to $850 per ounce.

Keep yourself informed of all the latest global precious metals price trends and news with MetalMiner’s monthly MMI Report. Sign up here to begin receiving it completely FREE of charge. If you want a serious competitive edge in the precious metals industry, try a demo/tour of our revolutionary insights platform here.

Leave a Reply