Automakers see 2022 steel price contract negotiations looking brutal

Just over a year ago, MetalMiner commented on the acquisition of most of ArcelorMittal USA’s assets by Cleveland-Cliffs (including potential impacts on steel prices).

At the time, the MetalMiner analyst team suggested, “The deal strengthens the company’s position in the automotive sector. The company likely controls 60%-65% of exposed auto sheet supply (think steel used on the outside of a car).” The analyst team continued, stating, “Biggest loser? Automotive OEMs like General Motors, Ford, Honda and Toyota.”

Fewer suppliers always results in less competition. Always.

Also as predicted by MetalMiner and confirmed by several people familiar with the matter, Cleveland-Cliffs has implemented firmwide standard pricing across all of its assets. As such, any “lower” pricing available previously in the market — through AK Steel, for example — now sells at the ArcelorMittal price (seemingly higher price level). MetalMiner identified that as an obstacle to automakers at the time. The reduction of three behemoth integrated mills to two drastically lowers competition.

At the same time, all of the steel mills have taken a very disciplined approach to adding (or rather, not adding) capacity to the market. The headline capacity utilization rate remains well above 80%. However, the numbers relate to the actual lines in operation, not total U.S. steelmaking capacity.

According to Bloomberg, U.S. steel consumption is estimated to reach 104 million tons this year and 108 million tons in 2022. However, domestic production was forecast to reach 87 million tons, a shortfall of 17 million tons.

Interested in additional perspectives on steel buying strategies outlined in this article? Join Lisa and Don on Thursday September 30 at 11:30

Steel producers enjoying record profits amid strong steel prices

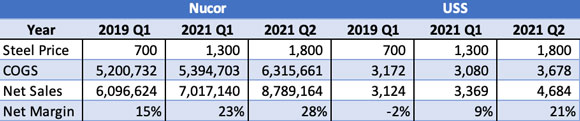

Meanwhile, Nucor expects record earnings in the third quarter of 2021. The chart below shows pre-pandemic quarterly market conditions using Q1 2019 compared with Q1 2021.

In short, two of the largest producers by capacity have both seen record earnings.

Steel producers follow their stainless brethren

Steel producers, according to OEM sources, have begun cherry picking the grades, gauges and sizes of steel that they want to produce.

Unsurprisingly, they have chosen those that maximize profits.

Stainless steel producers have shunned alternative alloys, grades and sizes in favor of standard 304 (where stainless producers generate their greatest profits). Meanwhile, carbon steel producers have not only levied 300%+ price increases on automakers for large volume SKUs, but they have also asked for even greater price increases for the items that do not maximize mill profits.

Every manufacturer, of course, has some “dogs” within their purchase product mix (meaning not every item is a high volume runner, nor is every item designed to optimize mill profitability). In the automotive world, design changes — particularly after a model has moved to production — are costly and time-consuming.

It appears as though steel producers now have all of the negotiation power. However, these producers might want to pay heed to the phrase, “don’t bite the hand that feeds.”

How does this impact automakers?

Automakers, by volume, represent the single largest percentage of total U.S. steel demand at approximately 26%. Producers historically have loved the auto industry because of its attractive volumes, which help keep lines running.

However, in 2022, the auto segment has become less important because producers don’t need this volume to “fill the lines.” Automotive margins are typically less attractive to mills than other industry segments. With demand so high for steel, automakers have less buying power this year.

Every automotive OEM operates a little bit differently. However, in general, automotive OEMs purchase their steel more or less along these lines:

- RFQs for the next calendar year are sent by the OEMs, typically in August or September, based on current market conditions. Deals typically get negotiated and signed between then and the end of the year but can be as late as January.

- New contract pricing goes into effect Jan. 1 of the following year.

- OEMs have used multiple negotiation strategies with some using “should-cost models” and guaranteeing volume in exchange for a fixed price and others negotiating a discount off a published index price in exchange for volume (also at a fixed price).

Some OEMs work on slightly different fiscal years. Several will negotiate now for deals starting Jan. 1. Several other automakers have fiscal years ending March 31. Therefore, they will start negotiations after the start of the year.

Regardless of the specific negotiation strategy, these large-volume buyers remain critical to the entire steel supply chain from producer to OEM across all industries. What the automakers negotiate in terms of volume and price dictates what tonnage at what price is available to the rest of the market.

Domino effect

In the case of the automotive OEMs, companies that enter the negotiation process first for a Jan. 1, 2022 contract start will pave the way for what other automakers will pay when their contracts begin April 1, 2022.

Thus, all eyes are on the OEMs who are currently in negotiations.

Ford has already gone on record indicating that the rising cost of raw materials, specifically aluminum, steel and precious metals, will cost the automaker an additional $2.5 billion.

Moreover, in response to RFQ requests this year, steel producers have taken a more divisive approach to negotiations. We have heard that, in some cases, automotive OEMs have two weeks to sign or risk not having supply.

Moreover, mills have dramatically increased steel prices across the board. Mills have implemented even sharper increases for items that they wish not to produce.

Steel producers should be mindful of demand destruction

With fewer players in the market, automakers have fewer negotiation levers for 2022.

Here are some potential options for OEMs:

- Move tons. This has long been the most effective strategy for OEMs (that is, the threat of moving tons to other suppliers). But this is somewhat of a limited option this year, with fewer market players and current capacity managed so tightly. Automakers have less leverage for 2022.

- PPAP more suppliers going forward (for next year). This strategy essentially is the same as “move tons.” The limiting factor has always been the PPAP process. In essence this strategy can not be used in the short term. OEMs should aggressively PPAP as many suppliers as possible including overseas suppliers to move tons offshore and maximize supply options. MetalMiner sees this as the most viable option. OEMs have confirmed they will undertake this strategy for 2023.

- Adjust to spot but keep adders/extras intact. Steel producers want to renegotiate to bring automotive prices up to the spot market. However, what would be the most prudent win-win strategy for everyone would be to keep the adders/extras and discounts intact. Only this strategy will ensure long-term volumes and strong, healthy ongoing OEM-producer relationships.

Steel price dynamics

Automakers may need to make some long-term shifts in strategy to combat industry consolidation among steel producers. MetalMiner has confirmed automotive OEMs have plans underway to do just this.

Chip shortages have served as the bane of the automotive industry’s existence in 2021. Those shortages have already put a big dent in auto production.

Two key developments from that shortage remain noteworthy.

Firstly, OEMs are looking to vertically integrate chip-making. Second, fewer cars produced results in higher profits for the OEM.

But today’s steel price dynamics appear unworkable for automakers.

The notion of simply passing on rising steel prices to consumers will eventually “bite the hand that feeds” as consumers balk at prices and eventually hold off on purchases.

Though the supply chain shortages for a broad range of commodities looks set to continue for some time, nothing kills high prices like high prices.

With volatile steel markets, knowing which strategy to execute and when can make all the difference between saving and losing money. See how MetalMiner looks at different market scenarios.

One Comment

Being in procurement, I have felt that the Feds insistence that US inflation is transitory is simply wrong. Seems like more proof and that, as procurement professionals, we receive early warning.