Automotive MMI: Toyota edges GM in 2021 US auto sales

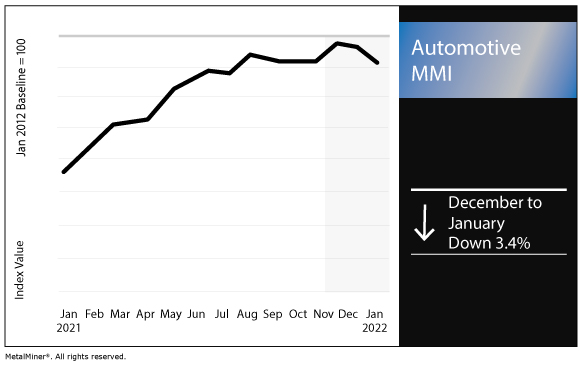

The Automotive Monthly Metals Index (MMI) fell by 3.4% for this month’s reading, as auto sales continued to slump in the face of ongoing supply and inventory constraints.

Stay up to date on MetalMiner with weekly updates – without the sales pitch. Sign up now.

US auto sales

In the U.S. market, General Motors reported Q4 2021 sales of 440,745 vehicles, or down 43% year over year.

Despite the decline, the automaker indicated the semiconductor supply shortage improved in the fourth quarter.

“GM entered the quarter with record low inventories; however, the company’s fourth-quarter production and wholesale deliveries were up significantly from the third quarter as semiconductor supply conditions improved,” GM said in a release.

However, Toyota outsold GM in the U.S. in 2021, marking the first time GM did not hold the top sales spot since 1931, according to Reuters.

Toyota sold 2,332,262 vehicles in 2021 compared to 2,218,228 vehicles for GM.

Meanwhile, Ford reported its total December sales fell 17.1% to 173,740 vehicles. Truck sales fell 15.5%. SUV sales dropped by 11.1%.

However, while still a relatively small part of the whole, Ford’s electrified vehicle sales jumped by 121.1% to 12,284.

In that vein, Ford announced a commitment to further expand its EV production. The automaker said it plans to nearly double production of the F-150 Lightning pickup to 150,000 vehicles per year at its Rouge Electric Vehicle Center in Dearborn, Michigan.

Fiat Chrysler reported Q4 sales of 411,513 vehicles, or down 18% year over year. For the full year, its sales fell 2% year over year.

Honda reported December sales fell 23%. However, the automaker’s 2021 sales came in up 8.9%.

“While we’re not out of the woods yet with supply issues or the global pandemic, I thank our procurement and production team, suppliers, and dealers for braving the difficult obstacles to get products to our customers at this unprecedented time,” said Dave Gardner, executive vice president of national operations at American Honda.

Forecast: new-vehicle retail sales down 17.4%

According to a monthly forecast released by J.D. Power and LMC Automotive, U.S. new-vehicle retail sales in December were expected to come in down 17.4% year over year.

The decline for Q4 2021 came in at 17.7% year over year.

“Despite inventory shortages constraining December sales volumes, there are several good news stories for the industry,” said Thomas King, president of the data analytics division at J.D. Power. “Retail inventory is showing some improvement, tracking at just more than one million units for the first time since July and transaction prices and retailer profits are at record highs.”

GM, MP Materials reach rare earths supply deal

In other GM news, the automaker reached an agreement with MP Materials to form a “strategic collaboration to develop a fully integrated U.S. supply chain for rare earth magnets.”

“Under the long-term agreement, MP Materials will supply U.S.-sourced and manufactured rare earth materials, alloy and finished magnets for the electric motors used in the GMC HUMMER EV, Cadillac LYRIQ, Chevrolet Silverado EV and more than a dozen models using GM’s Ultium Platform, with a gradual production ramp that begins in 2023,” GM said in a release last month.

Through the collaboration, the parties would aim to restore domestic production of neodymium-iron-boron magnets.

MP Materials owns the Mountain Pass mine in California. The site is the only developed rare earths mine in the U.S.

Actual metals prices and trends

The U.S. hot dipped galvanized steel price fell 2.6% month over month to $2,050 per short ton as of Jan. 1.

U.S. palladium bars rose 5.0% to $1,845 per ounce. U.S. platinum bars increased by 3.2% to $963 per ounce.

Meanwhile, the LME three-month copper price rose 1.3% to $9,682 per metric ton.

The Korean 5052 coil premium over 1050 fell by 2.9% to $4.21 per kilogram.

Get social with us. Follow MetalMiner on LinkedIn.

Leave a Reply