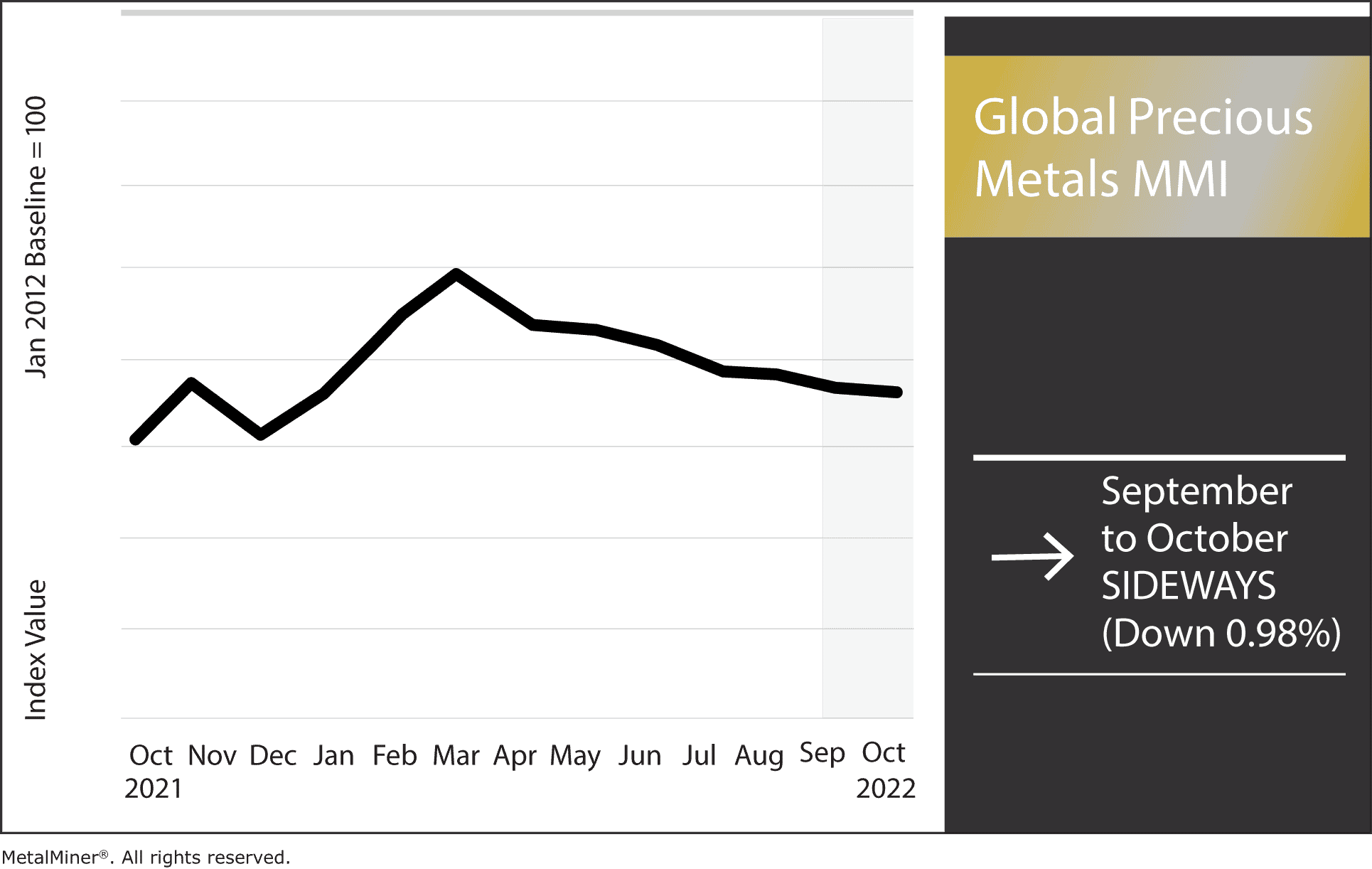

Global Precious Metals MMI – Are High Interest Rates Causing Precious Metal Investment Risks?

October’s Global Precious Metals MMI (Monthly MetalMiner Index) traded sideways, falling slightly by 0.98%. The index held higher than other October MMI’s (a majority of which fell in price) due to high interest rates, recession fears, and slowing economic activity. Due to these the current economic climate, investors sought out precious metals for investment reasons more than in previous months. However, most precious metals, save for platinum, remain within a steady downward trend.

Do you have precious metal contract negotiations coming up for 2023? Learn all of the best contract negotiation strategies in MetalMiner’s free November workshop 2023 Metal Contracting Strategies.

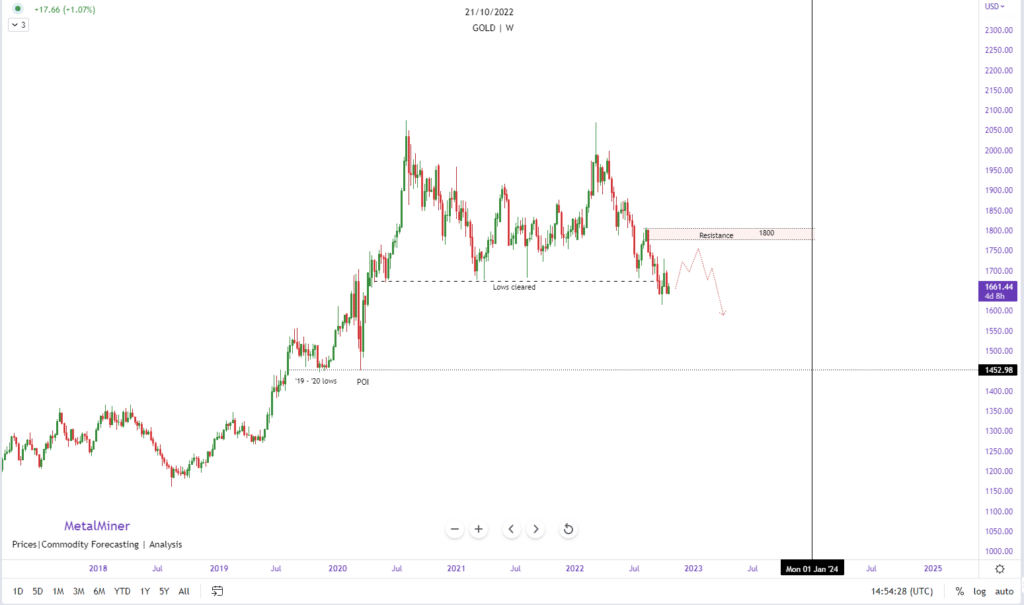

New Lows Cleared for Gold

(Click image for larger view)

Early in September, gold prices cleared previous lows and created new ones. As of October 4, however, gold briefly spiked before dropping in price again. Recessionary fears typically drive precious metal prices up. This is because investors often exchange currency for precious metals like gold to hedge against inflation. However, many global factors, such as the war in Ukraine, energy shortages, and supply chain disruptions continue to pull metal markets in different directions.

Get precious metal forecasts, specific monthly buying strategies, should-cost models, and more on MetalMiner Insights! Request a 30-minute demo of the MetalMiner Insights platform now.

Precious Metals: Palladium

(Click image for larger view)

Much like gold, palladium prices continue to seek new lows, declining slowly off short-term resistance levels. If these new lows form it will also confirm lower highs. Ultimately, this indicates a slow decline toward $1,500 per ounce.

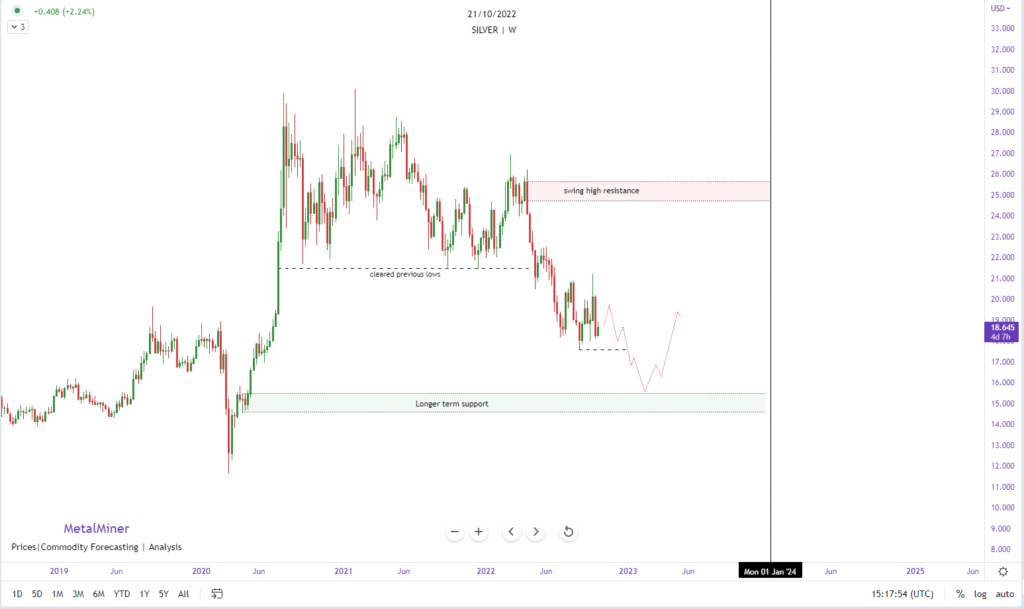

Silver Prices in Slow Decline

Furthermore, silver prices are also in a slow decline, currently seeking a reversal point near support levels. This could undercut the current new lows previously formed at 17.57. However, until then, a reversal confirmation would need to confirm a trend for silver prices in this range.

Stay up to date on MetalMiner and precious metals with weekly updates – without the sales pitch. Sign up for MetalMiner’s weekly newsletter.

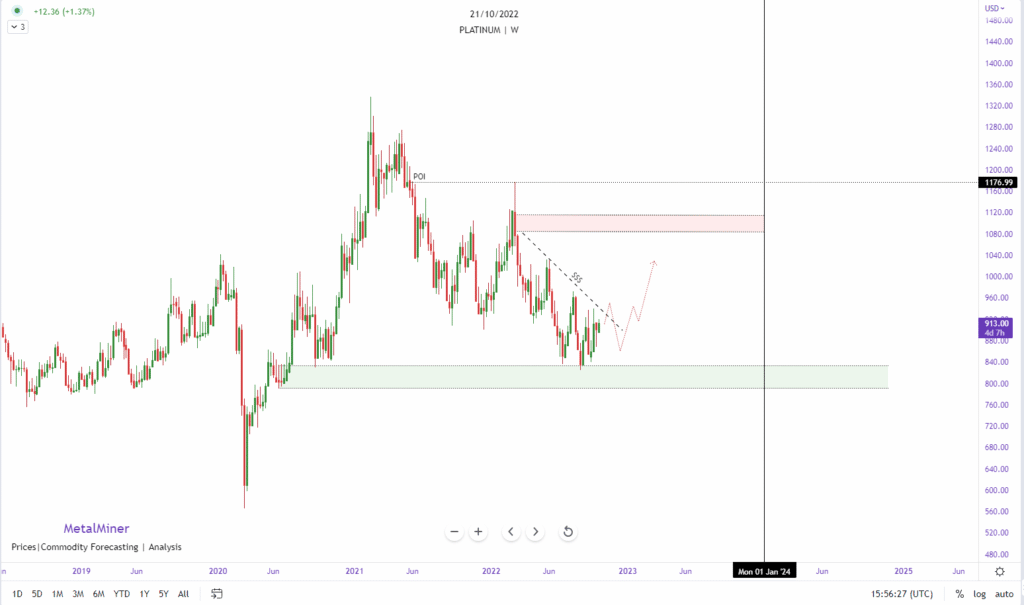

Precious Metals: Platinum

(Click for larger view)

Platinum prices managed to break the trends afflicting its three precious metal siblings. In addition to a price increase, platinum prices consolidated near the 820-860 range support range, where it looked for a break to the upside. Furthermore, short-term confirmation of higher lows will likely lead platinum to the upside. It could also mean that platinum prices will seek further resistance in the long run.

Global Precious Metals MMI: Biggest Price Moves

- Gold bullion dropped in price by 3.6%. Prices at the month’s start sat at $1,661.10 per ounce.

- Furthermore, silver ingot rose in price by 3.4%. Prices at the month’s start sat at $19.02 per ounce.

- Moreover, platinum bars rose in price by 1.4%. Prices at the month’s start sat at $859 per ounce.

Enjoy this article? Get price updates for precious metals and nine other metal industry areas by subscribing to the MetalMiner Monthly Index Report. Click here to sign up.

Article written by Jimmy Chiguil and Jennifer Kary

Leave a Reply