Aluminum MMI: MW Premium Finds New High

The Aluminum Monthly Metals Index (MMI) remained sideways with an upside bias. Overall, the index rose 1.99% from June to July as aluminum prices slowed their ascent. Track other MetalMiner monthly indexes here, and compare how the overall industrial metal market is performing.

Midwest Premium Returns to the Upside

Stabilization proved temporary for aluminum’s Midwest Premium. After finding a peak in early June followed by a modest decline, the premium returned to the upside. By early July, it managed to surpass its previous peak in search of a new high.

The short-lived decline occurred as buyers pulled back from the market after Section 232 tariffs doubled in early June. Markets had mostly priced in the increased cost of imports but remained cautious, as trade negotiations posed a risk of altering the tariff landscape once again. Brokers of offshore material appeared hesitant about the premium’s downswing.

Specifically, they noted that the level would be unsustainable absent trade deals with major importers to the U.S. to account for tariffs. The only other option would be for demand to weaken significantly.

Control aluminum costs, reduce sourcing risks and make better buying decisions, even in turbulent aluminum markets by subscribing to MetalMiner’s weekly newsletter.

Trade Negotiations Slow to Finalize

By late June, trade negotiations faced several setbacks. For starters, trade deals had yet to be reached with major exporters, particularly Canada. While Canada offered some concessions, namely forgoing a 3% duty on U.S. tech firms, the July 9 deadline for trade talks eventually passed. Meanwhile, Trump kept retaliatory tariffs on pause, pushing the deadline to August 1st instead.

However, the premium’s recent increase suggests markets remain concerned that no trade deal will be reached, which would lead to significantly higher duties on aluminum imports. Canada remains the overwhelming aluminum supplier to the U.S. Even considering the recent opening of SDI’s Aluminum Dynamics, the U.S. is still a net importer of aluminum. According to data from the U.S. Geological Survey, imports accounted for 47% of the U.S. aluminum supply in 2024.

The fact that trade negotiations remain underway presents a heightened volatility risk for the Midwest Premium. A resolution with Canada would likely place downward pressure on the premium. Conversely, any indication that tariffs will remain as is or increase could see it climb higher.

Access MetalMiner’s Monthly Metals Index Report to understand aluminum price drivers through detailed price charts and expert analysis, enabling smarter aluminum sourcing strategies.

Global Premiums Plummet Amid U.S. Trade Barriers

While the Midwest Premium continued its upswing, aluminum premiums elsewhere have sharply diverged. U.S. trade barriers have led to oversupply. Combined with soft demand, this has caused both Europe’s duty-unpaid premium and the Main Japanese Port premium to drop significantly.

Since the start of 2025, the European aluminum premium has decreased by 56%, while Japan’s has dropped by38%. Meanwhile, the Midwest Premium rose 155% rise during the same period.

LME Aluminum Prices Stable

As of mid-July, aluminum prices have taken at least a short-term pause from their uptrend. Although the long-term trend remains upward, the rate of increase appears to have slowed in recent weeks.

Don’t panic. Learn how to manage aluminum tariff threats with MetalMiner’s free guide.

Despite the global demand remaining slow, prices have found support from tighter LME inventories. These stocks faced considerable declines since May 2024, falling over 70% before finding a bottom in late June. The significant presence of Russian metal in LME inventories worsened these drops, as it remains heavily sanctioned by the U.S. and less desired by other buyers.

Source: Westmetall

Stocks appeared to rebound as of late June, perhaps placing a cap on aluminum prices. Nonetheless, the stock tightness saw the market spend a good portion of the year in backwardation, with primary cash prices trending higher than three-month. This suggests spot market tightness.

As of July 14, the delta remained narrow, but primary cash prices held a modest premium. This suggests that the market remains tight, even with the recent rise in aluminum stocks. Ultimately, this could offer support to aluminum prices.

Biggest Aluminum Price Moves

- European 1050 aluminum sheet prices witnessed the largest increase of the overall index, rising 6.94% to $3,336 per metric ton as of July 1.

- European 5083 aluminum plate prices rose 5.29% to $4,584 per metric ton.

- LME primary three-month aluminum prices rose 5.0% to $2,592 per metric ton.

- Indian primary cash aluminum prices rose 3.26% to $2.90 per kilogram.

- Chinese primary cash aluminum prices rose 2.74% to $2,901 per metric ton.

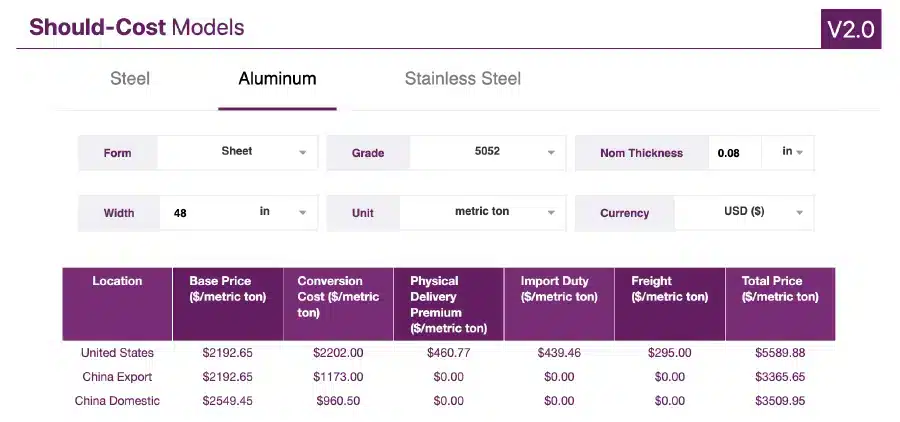

MetalMiner should-cost models: Give your organization levers to pull for more price transparency, from service centers, producers and part suppliers. Explore the models now.