Month-on-month, the Global Precious Metals MMI (Monthly Metals Index) rose by 8.25%. However, shortly after April 1, precious metal prices, particularly gold and silver, began surging as investors flocked to purchase as many gold bullions as possible. The reasons for this newfound “gold rush” include inflation hedging, anticipation of interest rate cuts, and geopolitical uncertainty. […]

Category: Metal Pricing

Copper MMI: Sanctions Hit Copper Market, Volatility Ahead

Copper prices continued their breakout during March, rising 4.25%. Prices then formed a second higher high on March 15, followed by a new higher low on March 27. The rally continued throughout April as prices climbed an additional 7.59%. As of April 15, they stand at their highest level since June 2022. Subscribe to MetalMiner’s […]

Aluminum MMI: Prices Inch Toward 2023 High Amid China Supply Cut

Overall, the Aluminum Monthly Metals Index (MMI) remained sideways, with a 2.03% rise from March to April. Aluminum prices outperformed all base metals throughout March, with a 4.71% rise from the close of February. Prices continued their rally throughout April, hitting their highest level since February 2023 by April 8. Aluminum Prices Chase 2023 Highs […]

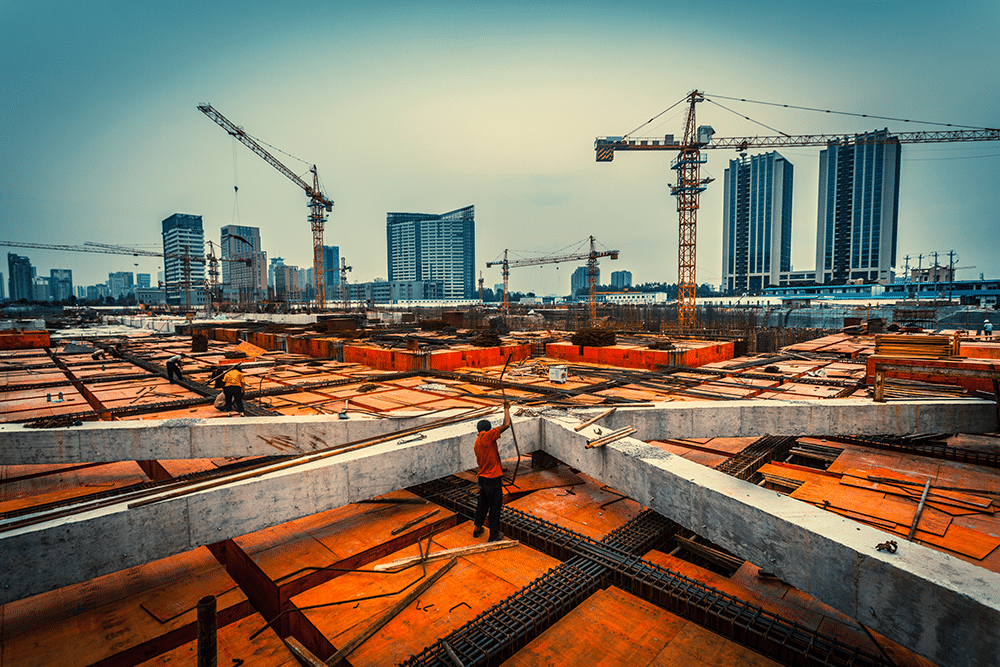

Construction MMI: Manufacturing Boom Helping Industrial Metal Demand, Construction Delays Hurting It

Month-over-month, the Construction MMI (Monthly Metals Index) moved sideways for the fourth month in a row, only sliding down a slight 2.87%. Of all industrial metals, iron ore suffered the worst drop in price by far, hitting a 10-month low before a slight rebound. The main component holding the index up was aluminum 1050 sheet […]

Raw Steels MMI: Steel Prices Flatten, Is an Uptrend Next?

The Raw Steels Monthly Metals Index (MMI) moved sideways, with a modest 1.38% decline in steel prices from March to April. U.S. flat rolled steel prices continued to trade down throughout March. Meanwhile, HRC prices fell 8.35% to close the month at a new lower low. However, hot rolled coil prices traded up during the […]

Stainless MMI: Nickel Prices Retrace Amid Slow Stainless Market

Nickel prices continued to the upside during the first half of March, taking a momentary pause from their long-term downtrend. However, prices found a peak by March 13, reaching their highest level since October 2023. Following that, the rally collapsed, and prices returned to the downside. Overall, nickel prices fell 5.56% month over month. The […]

Rare Earths MMI: Have Rare Earth Prices Finally Found a Bottom?

Month over month, rare earth metals witnessed new price lows not seen since September 2020. While neodymium oxide and praseodymium oxide witnessed the sharpest drop out of all of the components of the Rare Earths MMI (Monthly Metals Index), the index fell by 5.08% overall. But with price points nearing pre-pandemic lows, the index may […]

Automotive MMI: How Will the Port of Baltimore Shutdown Impact Automotive Imports?

Month-over-month, the Automotive MMI (Monthly Metals Index) exhibited little movement. The index trended sideways, only moving up a slight 0.28%. However, recent events continue to raise questions about the future of the industry, especially where automotive imports are concerned. Despite the index itself not witnessing much movement, individual components of the index saw much more […]

Aluminum MMI: Aluminum Prices Rise As China Output Slows

Aluminum prices remain entrenched within a sideways trend. Following a 2.78% month-over-month decline in February, prices retraced throughout the first three weeks of March to where they currently stand: 2.17% above their February close. Overall, the Aluminum Monthly Metals Index (MMI) moved sideways, with a 2.36% decline from February to March. AI vastly improves your […]

Renewables MMI: Is U.S. Renewable Energy Facing Backlash?

After several months of slight upward momentum, the Renewables MMI (Monthly Metals Index) broke the sideways-to-upward trend, declining by 8.89%. Neodymium dropping in price proved to be the main culprit for the index dropping. Every other component of the index either moved sideways or slightly down. Meanwhile, renewable energy news sources continue to keep their […]