Aluminum MMI: Aluminum Prices Stabilize as Midwest Premium Hold onto Gains

The Aluminum Monthly Metals Index (MMI) appeared increasingly bearish with a 3.08% decline from April to May. What do other metal and commodity market trends mean for aluminum trends? Track other MetalMiner monthly indexes here, and compare how the overall industrial metal market is performing.

Aluminum Prices Stabilize Following Post-Tariff Drop

Aluminum prices found an at least short-term bottom in early April, as the market managed to stem the sharp declines that followed the implementation of aluminum tariffs. Tariffs saw prices plunge to their lowest level since August as markets priced reflecting lower demand expectations. By April 9, however, the market began to stabilize around the $2,400/mt level.

Last month’s decline in aluminum prices were largely echoed by the entire base metal category. By early April, a drop in the U.S. dollar index, which trades inversely to commodity prices, offered a sufficient counterweight. This helped prices within the base metals category either stabilize or rebound to the upside.

Uncertainty over U.S. policymaking, including attacks on the chairman of the Federal Reserve, Jerome Powell, by President Trump, saw investors flee from the U.S. dollar index (DXY). This caused the DXY to break below its long-term sideways range, falling beneath the 100 mark for the first time since July 2023.

By early May, the DXY managed to regain some of its losses after the Federal Reserve opted to forgo an interest rate cut. The recent U.S.-UK trade deal offered further support, albeit not enough to see the DXY form an uptrend. MetalMiner’s covers weekly discussions on the latest news events in aluminum prices and other industrial metals in its free weekly newsletter.

Aluminum Prices: Midwest Premium Holds Steady Amid Sideways Market

Meanwhile, the Midwest Premium witnessed a modest decline following the implementation of tariffs, but unlike exchange prices, the premium largely held onto tariff-induced gains that occurred since the start of the year. The premium now sits around 74% higher than where it stood at the end of December at $0.3875/lb.

Buyers had rushed into the market to secure material ahead of tariffs, followed by a brief pause in purchasing activity once tariffs finally hit. Brokers characterized post-tariff demand conditions as sideways, albeit below ideal levels. The pause in purchasing proved relatively short, which explains the only modest decline in the premium thus far.

U.S. demand has yet to experience a sharp drop-off. While service centers purchased significant tons during Q1 as they rebuilt their inventories, their buying activity has yet to meaningfully slow in Q2. Ryerson’s recent quarterly report saw aluminum sales improve during Q1.

While still down year over year, net aluminum sales rose 16.5% from Q4, with shipments rising by 14.3%. In its investor presentation, the company expects its total metal shipments to remain relatively stable during Q2, not anticipating significant demand destruction despite significantly higher prices.

Global Aluminum Premiums Appear Bearish

The U.S. premium comes in stark contrast to its global counterparts, which could signal downside ahead for the Midwest Premium. The Main Japanese Port premium fell 20% from Q1 to Q2, while Europe’s duty unpaid premium has nearly halved, falling over 41% from where it closed 2024.

While the aluminum Midwest Premium reflects the newly added tariffs, demand conditions globally appear weak. How global premiums behave is somewhat nuanced. Often, a higher premium in one region can offer support to premiums elsewhere as they need to compete to secure imports. However, a significant arbitrage alone may not be enough to boost a premium if regional demand conditions are sufficiently weak.

Thus far, import data suggests that U.S. imports remain relatively stable. Regardless of tariffs, the U.S. requires imports to meet its consumption needs. While they noted some concern that tariffs could result in demand destruction, brokers noted that the new duties posed no risk of shutting out the global market. While tariffs can offer U.S. aluminum producers a helpful buffer, higher energy and labor costs in the U.S. make aluminum production in the U.S. challenging from a profitability standpoint.

What’s Next for the Midwest Premium?

While thus far the market remains sideways, the next few months could challenge the current market stability. Also impacted by tariffs, the U.S. steel market has started to see post-tariff price declines accelerate. This could prove a leading indicator for the Midwest Premium.

Some leading end-use demand sectors, like aerospace, remain strong, which will offer steady aluminum demand. However, others, like automotive, face a number of headwinds. Last month saw the U.S. manufacturing sector fall deeper into contraction, according to data from the Institute of Supply Management.

This could prove a bearish market signal for U.S. aluminum demand should that trend continue. As occurred back in 2018, the Midwest Premium experienced a strong increase as a result of tariffs until high prices began to weigh on demand enough to pull the premium back to its pre-tariff range.

Biggest Aluminum Price Moves

- The Korean 5052 coil premium over 1050 aluminum coil rose by 3.15% to $4.44 per kilogram as of May 1.

- The Korean 3003 coil premium over 1050 aluminum coil rose witnessed a 3.14% increase to $4.33 per kilogram.

- Meanwhile, Indian primary cash aluminum prices saw declines accelerate as prices fell 4.98% to $2.78 per kilogram.

- LME primary three month aluminum prices fell by 5.57% to $2,432 per metric ton.

- Lastly, European 5083 aluminum plate prices experienced the largest decline of the overall index, with a 5.84% decrease to $4,573 per metric ton.

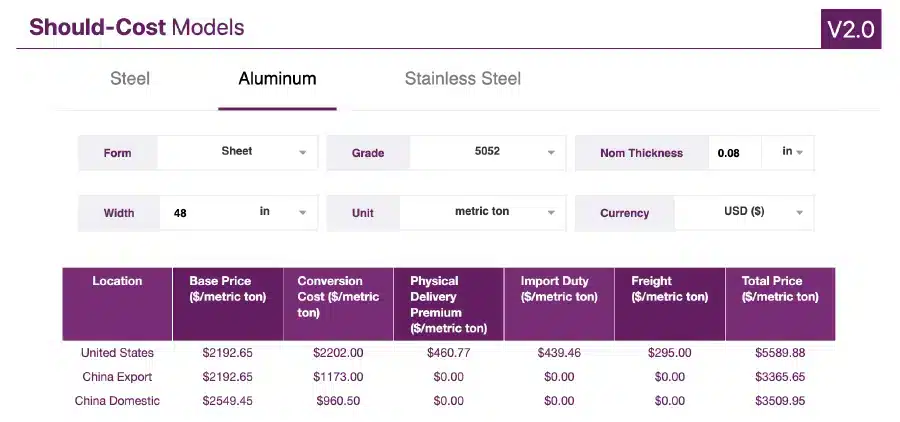

MetalMiner aluminum should-cost models: Give your organization levers to pull for more price transparency, from service centers, producers and part suppliers. Explore the models now.