Copper MMI: Comex Prices Hold Premium After Critical Minerals Recommendation

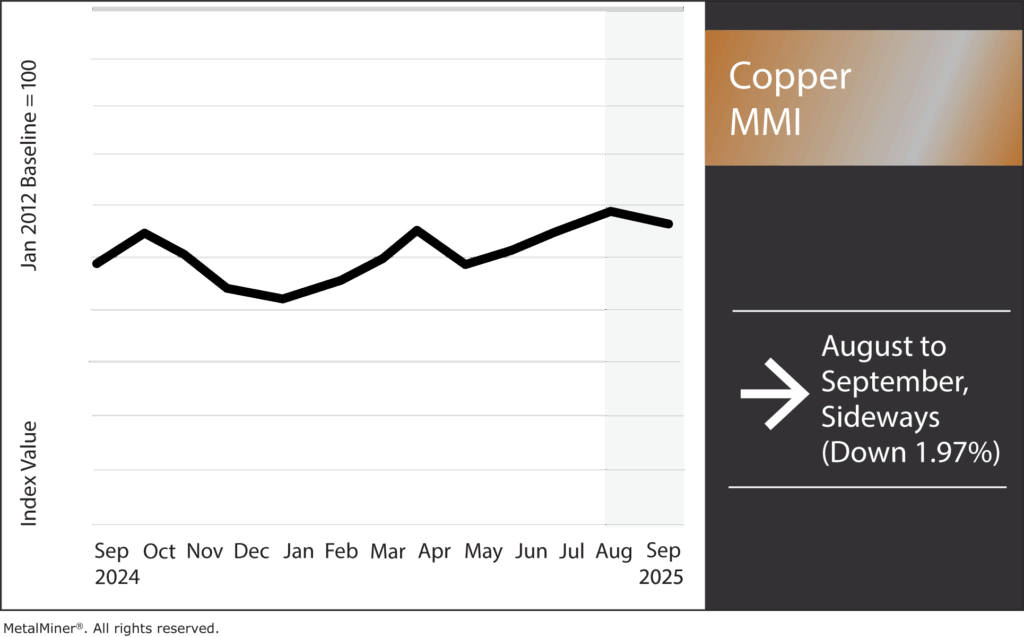

The Copper Monthly Metals Index (MMI) remained sideways, with a 1.87% decline from July to August. Meanwhile, the price of copper saw some notable upticks from August to September, as well as some significant drops. Keep up with why and when the price of copper shifts in 2025. Get the latest updates with MetalMiner’s free weekly newsletter.

The USGS Recommends Copper for Critical Minerals List

Despite being mostly spared from tariffs in months past, the copper market has not lost the attention of the U.S. In its draft list, the U.S. Department of the Interior/U.S. Geological Survey recommended copper be added to the country’s catalog of critical minerals.

The move primarily stems from analyses showing that copper’s supply chain is vulnerable to disruptions that could significantly impact the United States’ economy, defense and green-energy goals. Indeed, copper remains central to electrification, renewable infrastructure and high-tech manufacturing.

Including copper on the critical minerals list signals a recognition that demand is growing rapidly and that domestic supply and processing may not be sufficient or resilient enough to cope with trade shocks, regulatory delays or external dependencies.

Through its modeling of over 1,200 trade‐disruption scenarios, the USGS not only factored in global production shortfalls but also possible choke‐points in transport, refining and import routes. Finally, copper’s addition indicates that the nation might face material risk in sectors with heavy copper reliance under certain disruption scenarios. The way to manage and navigate these copper market challenges are covered monthly in the MMO report.

A Possible Future for “Critical” Copper

The draft list from the USGS also has implications for copper policy and investment. Once the list is finalized, copper’s new status as “critical” could mean increased attention to permitting, mining, processing and recycling efforts in the U.S. This could lead to more funding, tax incentives and prioritization in federal strategy, resulting in the expansion of domestic production and measures to strengthen supply chain resilience.

All of this may eventually translate into new mining projects, the refurbishment of existing infrastructure or increased domestic refining/processing capacity, which would help reduce dependency on foreign sources.

Did Comex Prices Hold a Modest Premium Over LME?

Comex and LME contracts began to bifurcate at the start of the year when the U.S. first began an investigation into copper imports. Markets spent months pricing in possible duties to Comex prices, building a significant premium over their LME counterparts. After refined copper was excluded from Section 232 tariffs in late July, Comex prices witnessed a staggering decline, almost immediately unraveling $3,079/mt from their peak.

By August, the sharp drop in Comex prices saw the two exchange contracts return to near parity, which helped to restore their long-term correlation. This comes as the absence of tariffs on refined copper, combined with a significant glut of copper in Comex warehouse stocks, no longer justifies the considerable delta.

But while the two contracts are now within touching distance, the spread has not completely eroded.

Are you under pressure to generate copper cost savings? Make sure you are following these 5 best practices of sourcing copper.

Refined Copper Still Vulnerable to Tariffs

Prior to 2025, Comex prices held an average $18/mt premium over LME prices. Since Comex prices found their bottom at the start of August, that premium has averaged in at $130/mt.

Unlike what occurred during the first seven months of the year, the post-August spread appears to be relatively stable. While refined copper tariffs are off, copper products remain impacted by 50% duties. Meanwhile, the investigation into copper imports didn’t entirely remove the threat, but instead kicked it down the road until 2027. Per recommendations by the Secretary of Commerce, the U.S. could see “a phased universal tariff on refined copper of 15% starting in 2027 and 30% starting in 2028.” This will likely have significant effects on the overall price of copper at home and abroad.

Funds Retreat After Tariff Chaos

Despite long-term tariff recommendations and making the USGS critical minerals list, markets don’t seem to be biting outside of the modest-but-stable Comex premium. This comes as the tariff exclusion caught investors by surprise, leaving a sizeable loss for those unprepared for the drop. Goldman Sachs was even forced to issue a “mea culpa” after recommending clients go long on copper a day prior.

Meanwhile, investment funds, whose large positions hold a strong influence over prices, have significantly backed away from the market. Naturally, the dropoff became most apparent for Comex, which had the largest upside risk before the tariff exclusion. It remains worth noting that the bias on both contracts remains net long.

Biggest Moves for the Price of Copper

Need to lower copper procurement risk but don’t know which levers to pull? MetalMiner helps you navigate copper sourcing risks with clarity, whether it’s pricing swings, supply disruptions or negotiation gaps. View our full metals catalog.

- Chinese copper wire prices witnessed the largest increase of the overall index, with a 3.0% rise to $11,204 per metric ton as of September 1.

- Chinese copper wire scrap prices moved sideways, with a modest 2.89% rise to $10,862 per metric ton.

- LME primary three-month copper prices increased 2.30% to $9,877 per metric ton.

- Meanwhile, U.S. copper producer prices for grade 102 fell 13.60% to $5.97 per pound.

- U.S. copper producer prices for grades 110 and 122 dropped 14.11% to $5.72 per pound.