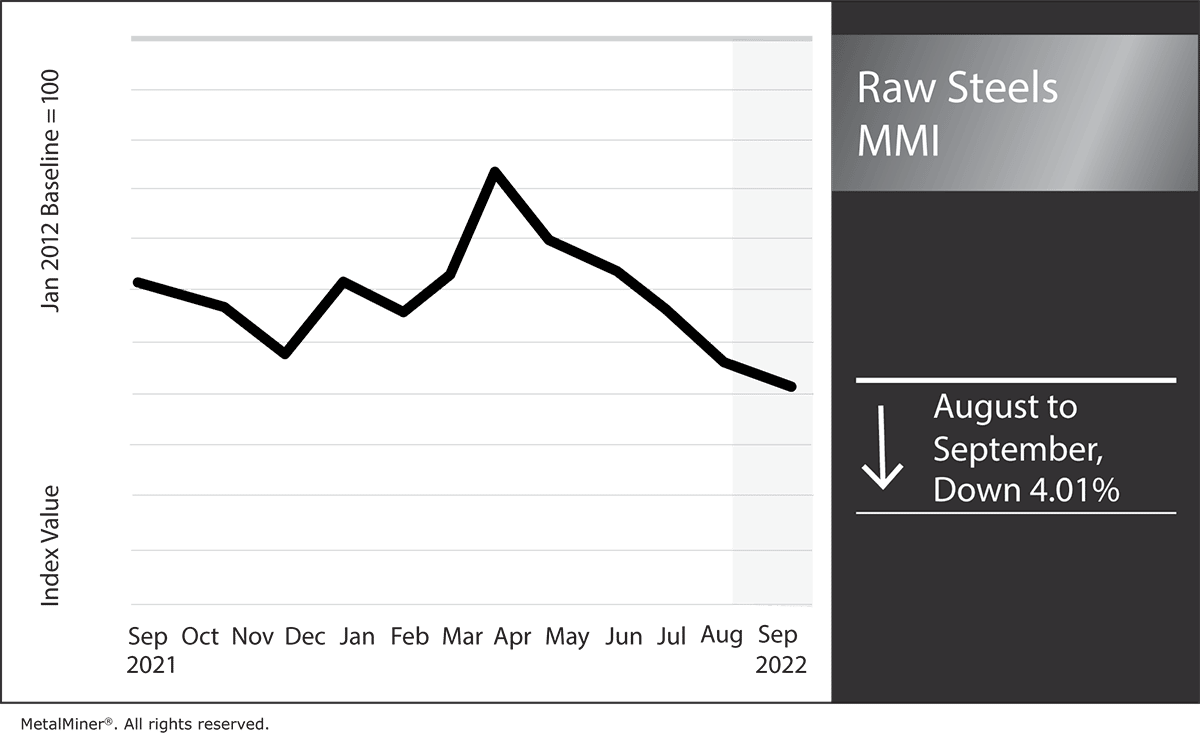

Raw Steels MMI: Steel Prices Decline, Pace Slows

U.S. steel prices continue to search for a bottom, although the pace of declines began to slow as August saw the smallest month-over-month percent decrease since May. Nonetheless, by early September, hot rolled coil prices fell beneath the $800/st mark for the first time since December 2020. Plate prices also trended downward last month, dipping below $1,800/st. They now sit nearly 11% beneath their all-time high.

In total, the Raw Steels Monthly Metals Index (MMI) fell by 4.01% from August to September.

MetalMiner’s free weekly newsletter provides up-to-date metal price intelligence.

Energy Crisis Hits European Steel Prices

The European steel industry became the latest casualty of the ongoing energy crisis. In late August, Europe’s largest (and world’s second-largest) steelmaker, ArcelorMittal, announced plans to increase its steel prices. November deliveries of hot rolled coil will see a 13% price hike, while prices for other products (including commodity-grade long steel) will rise by $150 per ton.

Production will see an impact too. In early September, ArcelorMittal announced the shutoff of one of the two furnaces at its Bremen, Germany, steel mill, lasting from the end of September until “further notice.” This is in addition to plans for idling blast furnaces at its Asturias plant in Spain and its Dunkirk plant in France. The company’s Hamburg direct reduction plant will also shutter starting in Q4. According to CEO Reiner Blascheck, “with a tenfold increase in gas and electricity prices, which we had to accept within a few months, we are no longer competitive in a market that is 25% supplied by imports.”

Energy costs throughout Europe experienced considerable volatility in recent months. Prices have so far skyrocketed by over 400% since Russia’s invasion of Ukraine. However, since Aug. 26, Dutch TTF Natural Gas Futures dropped by over 36%. This came after Gas Infrastructure Europe reported EU gas reserves reached 78% by late August. That figure is incredibly close to the country’s 80% target by Nov. 1. Unfortunately, those declines may prove short-lived. After previous cuts to 20%, Russia halted flows entirely through the Nord Stream 1 pipeline last week for maintenance.

U.S. Hot Rolled Coil Steel Prices Now Beneath European Prices

Since September 2020, U.S. hot rolled coil prices held a substantial premium over their European counterparts. The considerably sharper increase in U.S. prices after the pandemic saw the spread between the two reach over $1,000/mt at its highest. For the first time in nearly two years, U.S. hot rolled coil prices now sit beneath European prices.

As the spread between the two ballooned, steel imports from the EU began to rise. An eroded discount on European steel due to increased input costs will likely see those imports start to trend downward in the coming months.

Are you under pressure to generate steel cost savings? Make sure you are following these five best practices.

The Future Impacts

As European energy prices push steel prices upward, they will also pressure demand. While concerns of a global economic slowdown continue, Europe appears most immediately at risk of a recession. Collapsing demand will limit the upside to the continent’s steel prices, as steelmaker profitability determines the bottom. While this doesn’t necessarily mean a shift in trend for domestic U.S prices, the competitive effect that European prices once had on U.S. steel prices has likewise evaporated.

The MetalMiner Annual Outlook consolidates our 12-month view and provides buying organizations with a complete understanding of the fundamental factors driving prices and a detailed forecast that can be used when sourcing metals for 2023 — including expected average prices, support and resistance levels.

Biggest Raw Material and Steel Price Moves

- LME primary three-month scrap prices saw the largest rise within the index as they increased by 6.55% to $374 per metric ton by September 1.

- Standard Korean steel prices also rose 4.08% to $230.33 per metric ton.

- Meanwhile, Chinese billet prices declined 4.43% to $549.8 per metric ton.

- U.S. Midwest three-month HRC futures fell 9.94% to $806 per short ton.

- Most substantially, Chinese coking coal prices declined 14.81% to $356.07 per metric ton.

Leave a Reply