Renewables/GOES MMI: Re|Source, Tesla partner on cobalt supply chain pilot

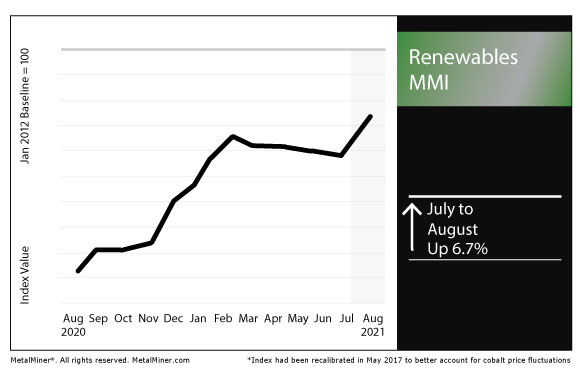

The Renewables Monthly Metals Index (MMI) jumped by 6.7% for this month’s reading.

(Editor’s note: This report also includes the MMI for grain-oriented electrical steel, or GOES.)

The MetalMiner Best Practice Library offers a wealth of knowledge and tips to help buyers stay on top of metals markets and buying strategies.

Re|Source, Tesla team up on cobalt

Electric vehicle maker Tesla is teaming up with Re|Source to implement a pilot project that will seek to trace responsibly sourced cobalt from mine to electric vehicle.

Re|Source is a collaboration of Glencore, ERG, CMOC, Umicore, Tesla, the Cobalt Institute, JM, Nornickel and the Responsible Labor Initiative.

“The pilot is being tested in real operating conditions, from upstream cobalt production facilities in the Democratic Republic of the Congo (DRC) to downstream electric vehicle productions sites,” Glencore said in a statement on its website. “Multiple on-site pilots have already commenced in the DRC and Europe, and plans are in place to commence further pilots in Asia and the US later this year.”

The final pilot project across the entire Tesla supply chain is expected to take place in the fourth quarter of this year, the Glencore statement noted.

Tesla announces Q2 production figures

Speaking of Tesla, the EV maker said it produced 206,421 vehicles in the second quarter.

“Our teams have done an outstanding job navigating through global supply chain and logistics challenges,” the EV maker said.

Tesla reported production of 2,340 Model S/X vehicles. Meanwhile, it produced 204,081 Model 3/Y.

The automaker reported production of 180,338 vehicles in Q1 2021.

China Molybdenum seeks to boost cobalt output at DRC mine

As we noted earlier this week, China Molybdenum announced plans to invest $2.5 billion in upgrades to the Tenke Fungurume mine in the Democratic Republic of the Congo. The Chinese firm has an 80% stake in the mine, while the DRC’s Gecamines holds the remaining 20%.

China Molybdenum is the second-largest cobalt producer in the world.

The massive Tenke Fungurume mine produced 177,956 tonnes of copper and 16,098 tonnes of cobalt in 2019, according to information on the China Molybdenum website.

Cobalt price gains

After dropping in Q2, the cobalt price has recovered thus far in Q3.

The LME cobalt price surged to nearly $53,000 per metric ton in March before falling to $42,500 in June.

Since then, however, the price has recovered nearly all of those losses, closing Wednesday at $52,350.

Representatives propose tax credit for domestic rare earths production

As noted in the Rare Earths MMI, U.S. Reps. Eric Swalwell (CA-15) and Guy Reschenthaler (PA-14) recently introduced the Rare Earth Magnet Manufacturing Production Tax Credit Act.

Currently, no domestic production of rare earths magnets exists. The legislation proposes a tax credit to incentivize production of rare earths magnets in the U.S.

The bill proposes a $20 per kilogram production tax credit for magnets that are manufactured in the United States. Furthermore, it proposes a $30 per kilogram for magnets that are “both manufactured in the United States and for which all component rare earth material is produced and recycled or reclaimed wholly within the United States.”

Among a number of other applications, rare earths magnets are used in renewable energy installations, including wind turbines.

GOES

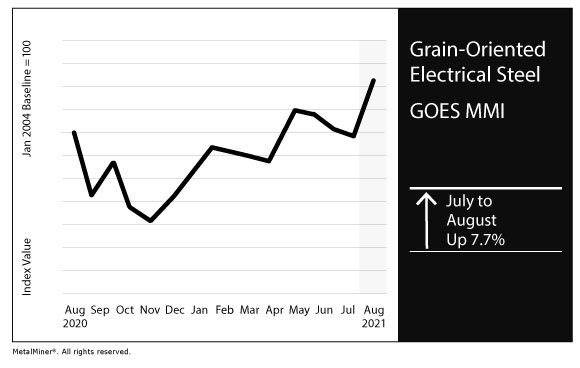

The GOES MMI, the index for grain-oriented electrical steel, rose by 7.7% for this month’s reading.

The GOES coil price rose 7.8% month over month to $2,514 per metric ton.

Actual metals prices and trends

The Japanese steel plate price rose by 1.3% month over month to $802 per metric ton as of Aug. 1. Meanwhile, the Korean steel plate price fell 5.7% to $1,068 per metric ton.

Chinese steel plate rose by 8.6% to $947 per metric ton.

U.S. steel plate jumped 3.5% to $1,553 per short ton.

Receive the latest short-term and long-term outlook for the full range of industrial metals (base and ferrous) at the annual MetalMiner Forecasting Workshop on Aug. 25.

Leave a Reply