The European aluminum manufacturing industry is under attack from two short- and medium-term threats, both of which have the potential to significantly impact aluminum consumers across the region. Threat #1: Potential Russian Aluminum Ban, Aluminum Manufacturing Shortage The first threat is the widely debated possibility of the EU banning Russian aluminum. While the UK has […]

Category: Environment

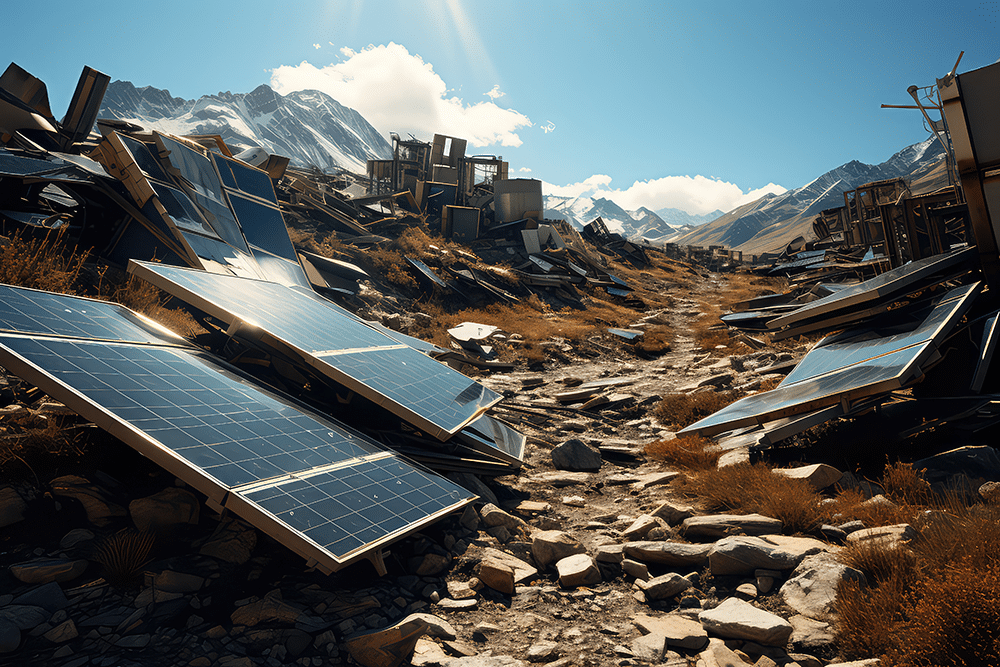

Renewables/GOES MMI: The “Dirty” Business of Disposing of Solar Panels

Numerous factors continue to pull at the Renewables MMI (Monthly Metals Index) as it moves through Q1. This past month, the index largely moved sideways, only exhibiting a slight upward movement of 1.66%. Meanwhile, renewable energy news indicated that metals like cobalt and silicon could remain in oversupply for some time. Moreover, expanding mining operations […]

Ironing Out the Future of the Battery Market: How Rusty Batteries Could Power Our Lives

In an electrifying twist of fate, the global battery market is buzzing with excitement over a technology designed to make things rust on purpose. We’re talking about iron-air batteries. Leading this “rusty revolution” is Form Energy, a company that clearly didn’t get the memo about rust being a bad thing. Form’s team recently completed work […]

UK to Impose Carbon Tax for Steel and Aluminum Production

HM Treasury recently announced that the UK plans to enact a carbon tax on certain metals and natural resource imports into the country by 2027. The December 19 announcement said that steel, aluminum, and iron ore will be subject to the tax. This tax is currently known as the Carbon Border Adjustment Mechanism (CBAM). “Goods […]

Copper MMI: Possible Deficit Shifts Copper Price Outlook

Still short of a breakout, current copper prices lifted off their October lows during November and have yet to see a major downside correction. Nonetheless, copper prices remain sideways and sit only 1.5% above where they stood at the start of 2023. An increase among all of its components helped the Copper Monthly Metals Index (MMI) […]

Renewables/GOES MMI: Index Drops & Green Energy Faces Challenges

The Renewables MMI (Monthly Metals Index) took a noticeable dive month-over-month, dropping by 10.41%. Indeed, neodymium, cobalt, and steel plate all suffered drops in price, making them the main culprits for the index falling. Meanwhile, the latest renewable energy news sources suggest green initiatives could be in for a rocky ride in 2024. This is […]

India and China Plan to Discuss Carbon Tax with the EU

Both India and China continue to denigrate the Carbon Border Adjustment Mechanism (CBAM), or “carbon tax” as it has come to be known, proposed by the European Union. Meanwhile, the EU claims the new scheme is integral to its plan to achieve zero emissions across six earmarked industries. The new tax regime recently moved into […]

Rare Earths MMI: Burmese Mining Suspension Causes Prices for Rare Earth to Shoot Up

The Rare Earths MMI (Monthly Metals Index) witnessed yet another steep increase month-over-month. Indeed, supply disruptions remain a massive concern in the rare earths industry, so rare earth magnets and other materials witnessed renewed bullish strength across the board over recent months. In August, market worries arose prior to a planned environmental inspection of China’s […]

What We Know About 2024 Metal Prices Through Metal Mining

As we approach 2023, the metal mining industry teeters on a precipice of unprecedented change and challenge. Such challenges range from economic instability, environmental regulations, and labor shortages to disruptive technological advancements and heightened market competition. These dynamic factors pose incredible business risks that require strategic management for success in the coming years. While it […]

UK Government & Tata Steel Reach Tentative Agreement on Port Talbot Plant, Risking 3,000 Jobs

The UK government and Mumbai-headquartered Tata Steel have reached a preliminary agreement over a funding package regarding the Port Talbot plant in South Wales. The package is part of a £1.25 billion ($1.55 billion) plan to decarbonize Port Talbot’s operations. However, concerns over jobs and the potential effect on local steel prices remain. A September […]