Automotive MMI: U.S. Automakers Grapple with Metal Supply Complications

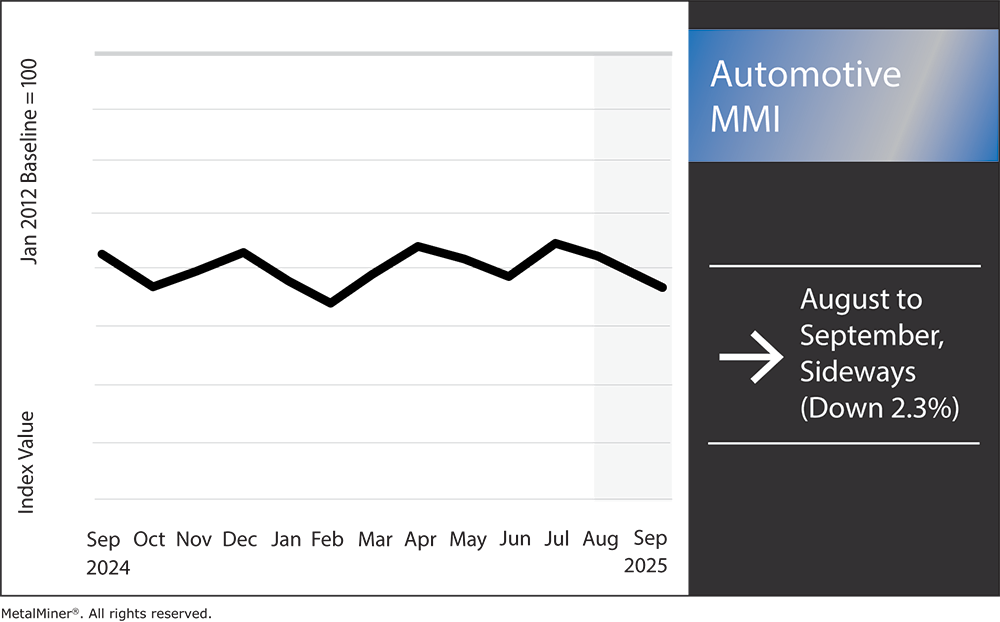

The Automotive MMI (Monthly Metals Index) moved sideways, dropping a slight 2.3%. This comes as the US automotive market, manufacturers in particular, are facing a one-two punch of rising costs and potential shortages in their metal supply chains. A big reason for this is steep tariffs on steel, aluminum and other inputs, which are driving up raw material costs.

How Are Tariffs Driving Up Costs for the US Automotive Market

The US government has expanded its metal tariff (initially 25%) to a hefty 50% on a broad range of imports, including automotive-grade steel and aluminum. These duties essentially act as a tax on every car built with imported material. Automotive Dive reports that the 25% steel tariff alone could add up to $1,500 to the cost of a typical vehicle, and the burden climbs higher as tariffs double. Industry-wide, that means significant added expenses, which directly threaten automakers’ margins and could eventually push up car prices for consumers.

Even companies that primarily rely on US-sourced steel aren’t spared, as domestic producers have raised prices in tandem with tariff-fueled market increases. In effect, automakers encounter rising costs even when purchasing “Made in America” steel.

This leaves companies with two choices: absorb the added expense or pass it along to buyers through higher vehicle prices. MetalMiner’s weekly newsletter provides free price updates about tariffs and pass-it-along-to-consumers costs to help manufacturers make proactive purchasing decisions rather than reacting to volatility within its newsletter.

What About Critical Minerals?

Tariffs are not the only issue facing the US automotive market. Critical EV minerals like lithium and rare earth elements have their own supply risks. In early 2025, China halted exports of certain rare earth metals needed for EV motors, which quickly led to significant issues. According to Automotive Logistics, the move underscores how vulnerable the auto supply chain is to geopolitical shocks. And because China controls about 90% of global rare earth refining capacity, automakers now face critical material shortages.

Amid these changes, firms across the US automotive market are racing to secure more reliable sources for these minerals. For instance, EV maker Lucid Group recently launched a collaboration with several US mining and refining companies, aimed at boosting domestic output of battery metals and reducing reliance on overseas suppliers. The coalition’s members are pursuing new mines and processing facilities to build an American battery-material supply chain.

Facing challenges in tracking in automotive industry price trends? Access monthly price trends for 7 different metal industries by signing up for MetalMiner’s Monthly Metals Index Report, ensuring you’re always ahead in your sourcing strategy.

How Are Automakers Responding to Mitigate These Risks?

So far, automakers are employing several strategies to weather the storm. One approach is locking in longer-term contracts for key metals at fixed prices, which serves as a buffer against cost spikes. For instance, General Motors and others have already signed two- to three-year steel supply deals with Cleveland-Cliffs, providing cost predictability amid tariff volatility.

Manufacturers are also diversifying suppliers and increasing local sourcing where possible, with some firms redesigning parts to use less imported metal and investing in recycling to help reclaim more scrap. As previously mentioned, a few automakers have struck direct deals with mining companies for lithium and other battery minerals, allowing them to secure supply at the source. Another strategy is leveraging better market intelligence. For example, procurement teams are using specialized resources like MetalMiner Select to track price trends, trade actions and forecasts in real time.

What is the Outlook for 2026, and How Can Procurement Leaders Navigate It?

Some analysts predict that metal prices could stabilize or even fall as the initial tariff shock is absorbed, giving buyers a breather. However, with EV demand still growing, volatility isn’t likely to go away.

Success in this environment calls for a proactive strategy. For example, leading firms use forecasting and benchmarking to guide their buying plans, which can provide additional protection. It’s also crucial to stay alert to policy shifts, since trade rules can change on short notice. Internally, US automotive market procurement leaders should stress that building more resilient supply lines through dual sourcing or extra inventory may entail upfront costs, but will ultimately protect the business from disruptions down the road.

US companies sourcing metals in 2025 find themselves at the nexus of trade policy and the clean energy transition, presenting a challenging scenario. However, with solid market intelligence, diversified sourcing and strategic partnerships, procurement leaders can mitigate the turmoil.

Automotive MMI: Noteworthy Price Shifts

MetalMiner covers price points, correlation charts and price forecasting for a full suite of industrial and precious metals. See our full metals catalog.

- Hot-dipped galvanized steel moved sideways, dropping 0.85% to $1,045 per short ton

- Chinese lead prices moved sideways, rising by 2.05% to $2,345.56 per short ton

- Lastly, Korean 5052 aluminum coil premium over 1050 dropped by 5.69% to $4.18 per kilogram.