The nickel price index continued to trend downward, as it fell to its lowest level since July 2022 by mid-September. Following an over 7% decline during August, prices fell nearly 3% during the first two weeks of September. As prices drop toward historical support zones, they come close to wiping out nearly all gains from […]

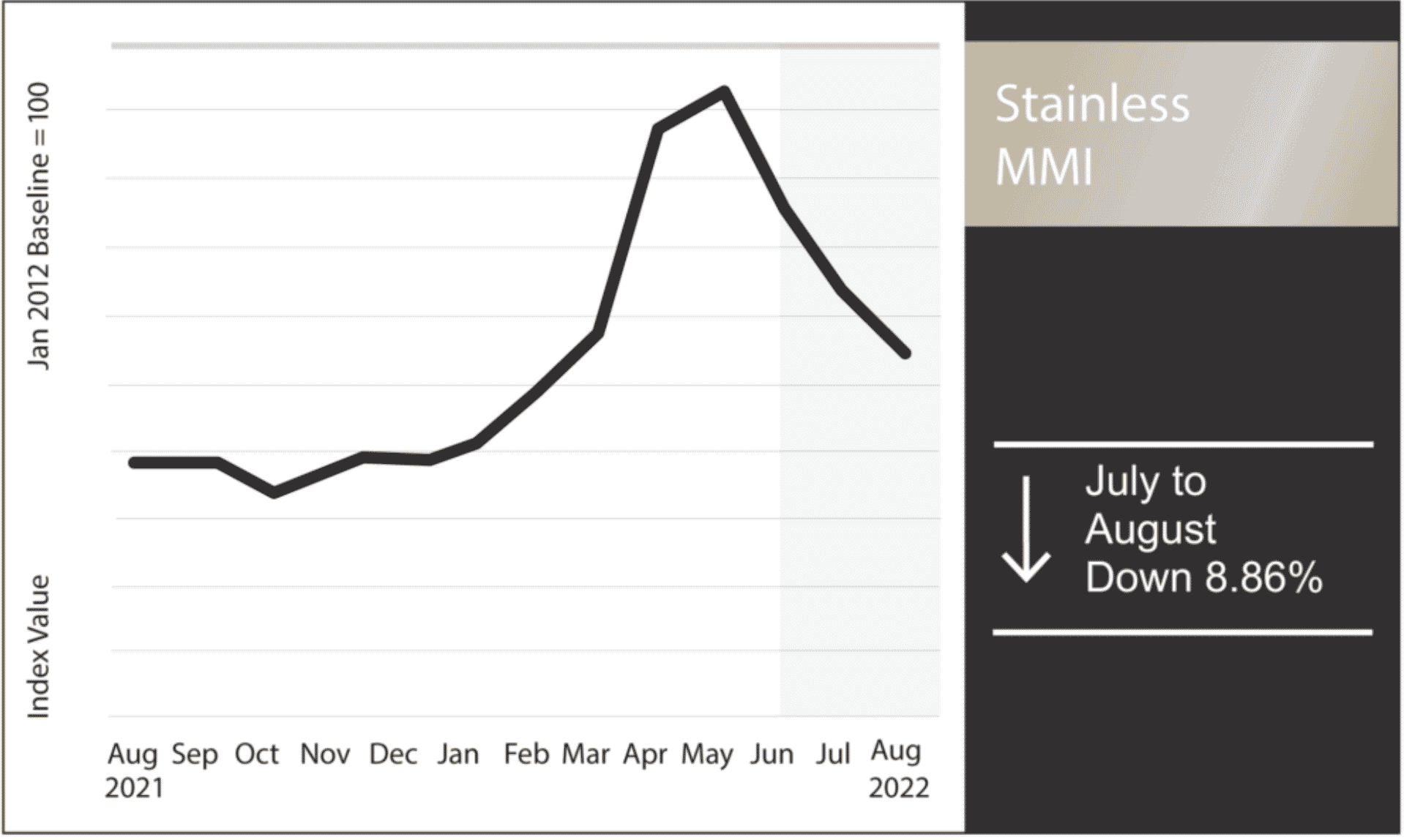

Stainless MMI: Nickel Prices Hit Bottom by Mid-July

The Stainless Monthly Metals Index (MMI) dropped 8.87% from June to July. After nickel prices hit a bottom mid-July, they followed the base metal trend upward. By the beginning of August, however, the rebound had faltered, and prices resumed their descent. Both last month’s increases and this month’s declines were extremely narrow. For that reason, […]