Ukrainian iron ore producer Ferrexpo recently reported a 59% increase in its commercial production for H1. This figure, derived by comparing current numbers to the previous six months, has the potential to significantly impact global iron ore prices. Indeed, the total production of pellets and commercial concentrate for the first six months of 2023 came […]

Ukraine’s Metinvest to Build Steel Plant in Italy

Ukraine’s Metinvest plans to build a new steel manufacturing facility in Italy. Indeed, an official for the group recently confirmed reports of plans to build a plant in either that country or Bulgaria. “Many people talked about the fact that we are considering the possibility of building a new plant in Italy. Indeed, this is the […]

Liberty Steel Victorious, Acquires Hungary’s Dunaferr for $61 Million

Liberty Steel recently won a bid to take over Hungary’s Dunaferr. According to Hungary’s Ministry of Economic Development, a local court put the integrated flats producer into liquidation in late 2022. Liberty will pay €55 million ($61 million) for the Dunaferr plant, beating out India’s Vulcan Steel, Ukrainian group Metinvest, Swiss-based Trasteel Trading, and local […]

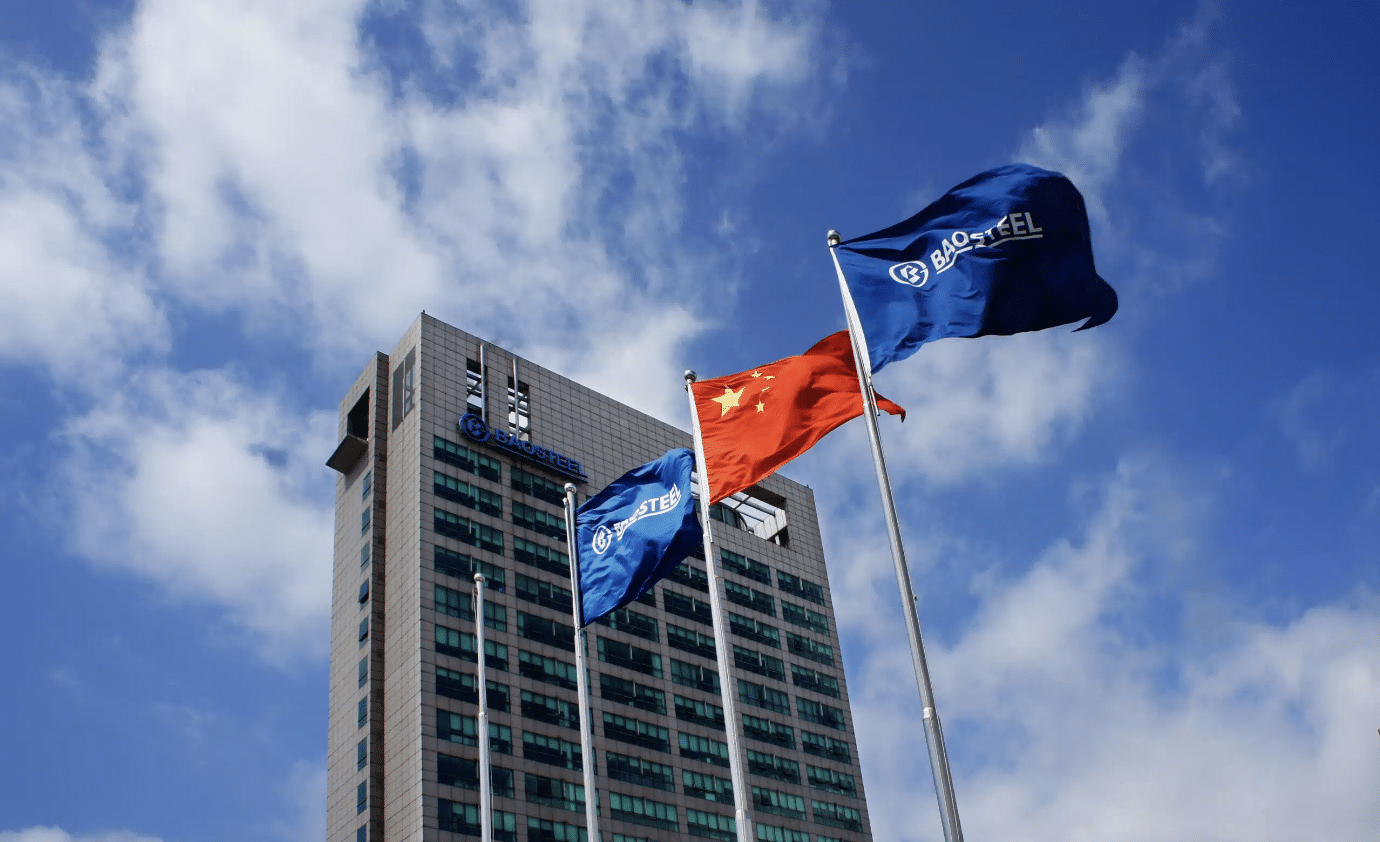

Chinese Mills Brace for Tough H2 Amid Insufficient Consumption, Falling Steel Prices

China’s major steelmakers recently warned of a “very challenging” H2 that could impact steel prices. As noted in news reports quoting the China Iron & Steel Association (CISA), this goes against earlier expectations of improvement in the sector. According to a June 30 report from Bloomberg, officials from China Baowu Steel Group, Ansteel Group, Hesteel, […]

Boliden’s Tara Zinc Mine on Hold Due to Dwindling Profits, Escalating Expenses

Plummeting zinc metal prices and rising energy costs recently prompted Boliden to place its Tara zinc mine on care and maintenance until further notice. “The business is currently cash flow negative due to a combination of factors,” the Swedish metals producer said. Officials went on to specify that these operational challenges included “a decline in […]

Amid Declines, China Tops Global Steel Production Charts Again

China was the largest end-user of steel in 2022. According to the World Steel Association’s (Worldsteel) “2023 World Steel Report,” the country consumed 51.7% of the 1.78 million metric tons of finished products rolled last year. That percentage was unchanged from the previous year. At that time, China’s apparent steel consumption was 954 million metric […]

Steel Consumption in the EU Projected to Rise

A recent European Steel Association (Eurofer) report said that apparent steel consumption within the European Union is likely to improve by 5.4% in 2024. That said, the organization indicated that this figure depends on there being more favorable developments in the bloc’s industrial outlook. Either way, steel prices will likely see some impact from this […]

ArcelorMittal Kriviy Rih Halts Steelmaking After Dam Rupture

Ukrainian steelmaker and longs producer ArcelorMittal Kriviy Rih (AMKR) recently stopped steelmaking and rolling operations. A spokesman for the company told MetalMiner that the halt stems from a rupture of the Kakhovska Hydropower Plant’s dam after a suspected Russian operation. So far, there is no consensus on how this might affect steel prices. The source […]

Imports Put Bearish Pressure on European Steel Mills

Market participants report that prices for hot rolled coil in northern Europe continues to decline. The cause for the alarming steel news mainly concerns pressure from imports. Additionally, low demand and oversupply have been contributing factors in price fluctuations, with the problem persisting since early April. “The problem is not with Germany, but rather with […]

Ukrainian Steel Mills Suffer 54% Drop in Steel Production Amidst Russian Invasion

Ukrainian steel mills reported a 54% drop year-over-year in crude steel production for the first four months of 2023. That figure comes directly from a report published by local association Ukrmetalurgprom. The association noted that operating mills in the country poured about 1.81 million metric tons of the liquid metal from January 1 to April […]