The United Kingdom’s Trade Remedies Authority (TRA) recently initiated a suspension review on safeguard measures against hot rolled flat and coil steels. Steel news sources report that the move also came alongside a tariff quota review. TRA reported on February 9 that both Tata Steel UK (TSUK) and steel trader Kromat Trading filed applications for […]

Steel Production Declines in December 2023: Factors Impacting the Global Steel Market

Data from the World Steel Association (Worldsteel) released on January 25 indicates that global crude steel production remained largely unchanged year on year. Indeed, steel market analysis says poured liquid steel totaled 1.88 billion metric tons last year, which is similar to the volume poured in 2022. The association also stated that crude steel production […]

Tata Steel Replacing Port Talbot Blast Furnaces with Electric Arc Furnaces

Tata Steel formally announced its plans to permanently blow down the two blast furnaces at its Port Talbot works. Tata’s plan is to replace them with an electric arc furnace. Steel manufacturing analysts say the move will cut the facility’s listed crude capacity 40%. The plant will blow down one blast furnace by mid-2024 and […]

Steel Manufacturing: Uncertainty Looms as Liberty Steel Ostrava Workers Delay Return

Workers at flats producer Liberty Steel Ostrava in the Czech Republic did not return to work on January 16, despite local media reports stating that workers agreed to resume working on this date. The Daily Denik noted that there were a couple of other “return dates” set for the steel manufacturing plant, including January 3 […]

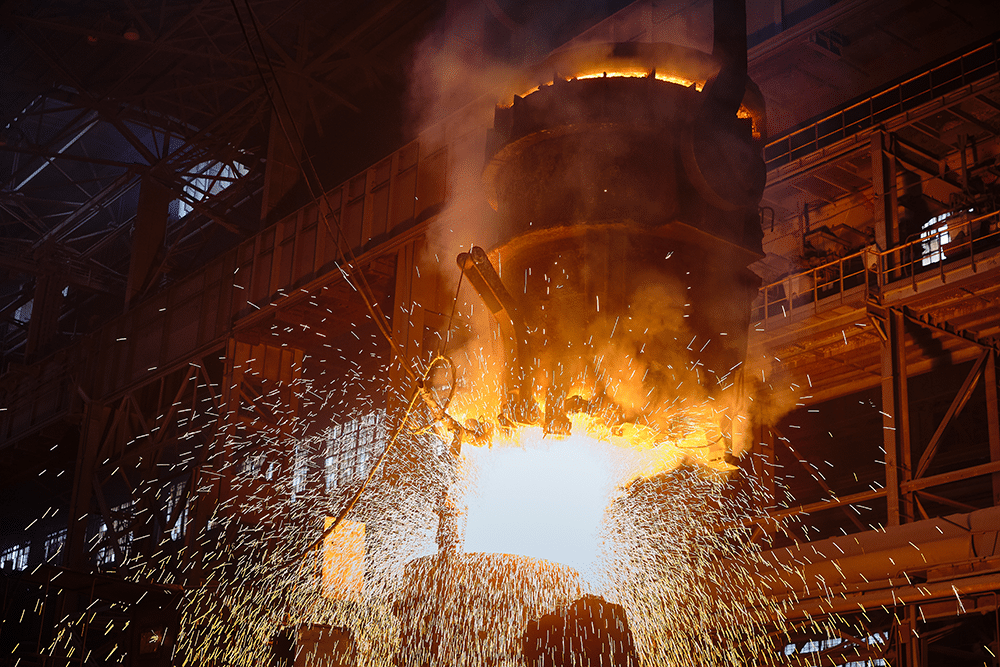

Salzgitter’s Relined Blast Furnace Ready to Produce 2 Million Metric Tons of Pig Iron

German steelmaking group Salzgitter recently blew in Blast Furnace A at its Flachstahl works in Lower Saxony, allowing it to produce up to 2 million MT of pig iron. This came after the company completed a relining that lasted 100 days. On January 3, Saltzgitter noted that the reline included 3,000 metric tons of bricks […]

UK to Impose Carbon Tax for Steel and Aluminum Production

HM Treasury recently announced that the UK plans to enact a carbon tax on certain metals and natural resource imports into the country by 2027. The December 19 announcement said that steel, aluminum, and iron ore will be subject to the tax. This tax is currently known as the Carbon Border Adjustment Mechanism (CBAM). “Goods […]

Habaş Announces 900,000 Metric Ton Downstream Mill in Turkey

Turkish longs and flats producer Habaş recently announced plans to build a downstream cold rolling and tinplate mill. The growing Turkish steel industry brand estimates that the plant will have an annual capacity of 900,000 metric tons. Current plans place the new plant on a greenfield site close to Habaş’ main production facilities at Aliağa. […]

ArcelorMittal Completes Sale of Kazakh Operations Following Coking Coal Mine Blast

ArcelorMittal recently completed the sale of its steel making and mining operations in Kazakhstan. This move came after the Central Asian state’s government demanded its renationalization due to an October blast at a coking coal mine. On December 8, the Luxembourg-headquartered group reported that the state-controlled direct investment fund Qazaqstan Investment Corporation (QIC) acquired ArcelorMittal […]

Ukraine’s Steel Industry Seeks Strategies for Export Revival Amidst Challenges

According to a Metinvest official, Ukraine is currently seeking ways to increase steel industry exports to boost revenues into the country’s coffers. “Steelmakers in the country would require financing for small- and medium-sized steel consumers, simplified customs procedures as well as expansion of the product range in order to facilitate exports” a December 5 announcement […]

Glencore’s $6.93 Billion Acquisition: Majority Stake in Teck Resources’ Steelmaking Coal Business

Multinational commodity trader and mining group Glencore recently announced the acquisition of a majority stake in Canadian mining group Teck Resources’ steelmaking coal business. On November 15, the London and Johannesburg-listed group announced they had previously paid $6.93 billion for a 77% stake in Elk Valley Resources (EVR). They added that the deal was based […]