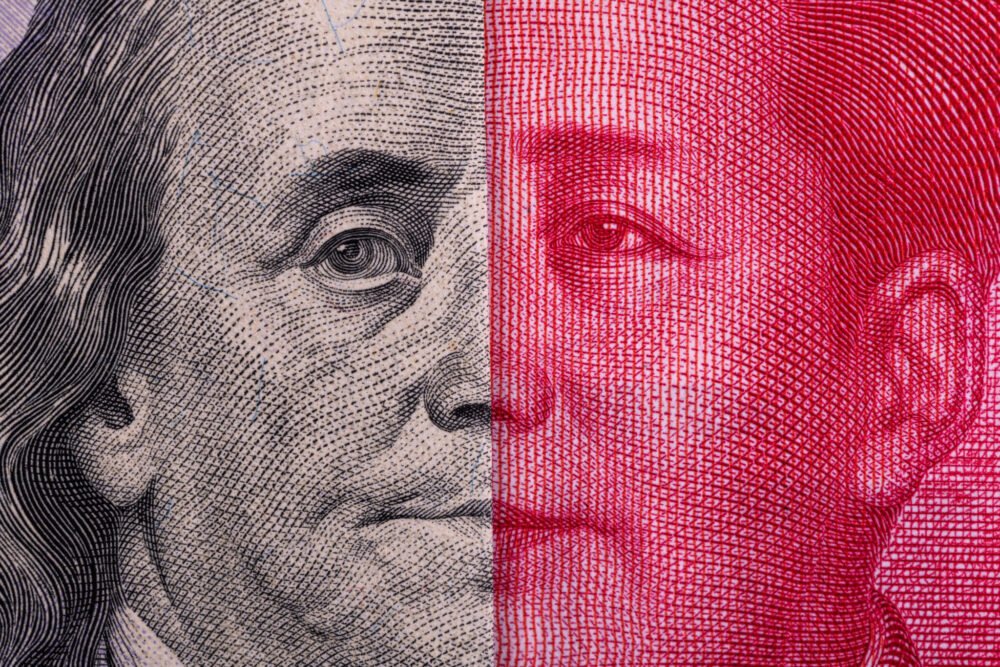

In a landmark move that could reshape global commodity markets and impact iron ore prices BHP Billiton has agreed to settle 30% of its iron ore spot trades with Chinese buyers in Chinese Yuan (RMB). This represents a significant departure from the longstanding U.S. dollar standard. Set to begin in Q4 2025, the shift marks a […]

America’s Rare Earths Pivot: Why Australia is Now Central to Beating China’s Mineral Grip

While geopolitical tensions continue and rare earths supply chain vulnerabilities deepen, the United States is quietly redrawing the global map of critical mineral sourcing, and Australia seems to be emerging as a cornerstone. The latest development on this front is the U.S. Export-Import Bank (EXIM) issuing a letter of interest to fund up to US […]

Global Copper Deficit Balloons as Grasberg Collapse Joins Year of Disruptions

The global copper market has had quite the year. On September 8, approximately 800,000 tons of wet material flooded multiple levels of the Grasberg Block Cave mine in Papua, Indonesia, leading to the suspension of all underground operations. It was just one more event to add to the list of copper mining and supply disruptions […]

World Takes First Steps in Breaking China’s Stranglehold on Rare Earth Magnets Supply

Resource security when it comes to rare earth magnets is something the modern-day world has been desperately trying to get right. This is primarily due to rare earths’ increasing importance in electronics, defense, vehicles, and much more. For years, countries have been seeking ways to secure access to these vital resources. However, 90% of the […]

Iron Ore Prices Rebound Amid Surge in China’s Steel Export Outlook

Iron ore prices rose this week, despite the overall weakness in the steel industry. Analysts are puzzled by this contradiction, particularly as China’s steel production and local consumption are still not recovering at the rate they should be. According to sector experts, the recent surge hints at a gap between actual raw material demand and […]

Iron Ore Futures Slide as China’s Economic Slowdown Deepens

Global iron ore markets are under renewed pressure as futures prices continue to fall, driven by mounting concerns over China’s faltering economy and weakening demand from its steel and property sectors. Meanwhile, current iron ore prices continue to fluctuate. According to reports, iron ore futures fell to their lowest levels in a week on Monday, […]

China Lifts Rare Earth Export Curbs On India

In a move with far-reaching implications for global supply chains and global diplomacy, China has lifted its export restrictions on rare earths to India. The monumental decision also includes key commodities like fertilizers and tunnel boring machines, and follows high-level talks between Indian External Affairs Minister S. Jaishankar and Chinese Foreign Minister Wang Yi, who […]

Will Demand Drive a $126 Billion Bauxite Market by 2033?

Despite a few hiccups and occasional worries of oversupply, the global bauxite market has been growing steadily. Much of this expansion has been fueled by rising demand in the aluminum market, especially from automotive, aerospace and renewable energy sectors. About 60% of EV manufacturers and over 70% of aerospace materials use aluminum in one form […]

China vs. Canada: Steel Showdown Heads to the WTO

China’s decision to file a complaint in the World Trade Organization against Canadian tariffs and the steel tariff rate quota has re-focused the spotlight on what many have dubbed an “already-strained trade relationship” between the two countries. A few years ago, both nations resorted to tit-for-tat measures, including tariffs on everything from canola to electric […]

Critical Metals in the Spotlight as Gallium Takes Center Stage in Global Tech Push

Australia may well emerge as one of the few non-China sources for the supply of gallium metal, a valuable mineral used in electronics, LEDs and semiconductors. In a move toward critical mineral diversification, Alcoa of Australia recently reported that it had signed a Joint Development Agreement with Japan Australia Gallium Associates Pty Ltd (JAGA) to […]