Precious metal prices (especially silver) began a brief rally on July 12 before retreating again. Whether or not the bulls are here to stay is a question up for debate. Many remain optimistic that gold prices will continue upward until the end of 2023. However, gold and other precious metals markets still face some bearish […]

Category: Precious Metals

Global Precious Metal MMI: Precious Metal Prices Losing Momentum

The Global Precious Metals MMI (Monthly Metals Index) traded sideways month-on-month. Overall, the index fell 2.75% as numerous components lost upward price momentum. All parts of the index moved sideways or fell slightly, except for Indian silver ingots and U.S. gold bullions. Though Fed’s hawkishness has managed to impact precious metal prices in the U.S, […]

Precious Metals MMI: Precious Metal Prices Continue to Move Up

The Global Precious Metals MMI (Monthly Metals Index) moved up again month-over-month after a bounce between March and April. The index moved up a modest 3.63%. Every part of the index either trended upward or moved sideways with a slight upward slant. Meanwhile, there are still many factors affecting precious metal prices. Many investors see […]

Global Precious Metals MMI: Investors Trade Cash for Cold, Hard Gold

The Global Precious Metals MMI (Monthly Metals Index) enjoyed its largest month-over-month increase in a year. Between March and April, the index broke out of its tight sideways range and rose by 6.93%. The current talk of the town for precious metal prices today centers around recessionary fears. Indeed, investors are increasingly turning to precious […]

Global Precious Metals MMI: Prices Highly Volatile, Dropping Up and Down Rapidly

The Global Precious Metals MMI (Monthly MetalMiner Index) dropped considerably month-over-month. All in all, the index fell by 8.74%. The market continues to witness bearish pressure on precious metal prices today, just as it did throughout Q1 of 2023. While this led to a significant drop in value, some metals are feeling the effects more […]

Global Precious Metals MMI: Prices Shift Down, Markets Face Bearish Pressure

The Global Precious Metals MMI (Monthly MetalMiner Index) moved sideways last month, inching down a mere 0.37%. Precious metal prices today are trending sideways in general. However, as a whole, the market appears more bearish than bullish in the short term. Gold, in particular, faces bearish pressure from investors due to its correlation with the […]

Global Precious Metals MMI: Prices Rally, Downturn Likely

The Global Precious Metals MMI (Monthly MetalMiner Index) traded upwards by 3% as precious metal prices advanced. Gold, silver, and palladium all began a rally coming into 2023. However, that rally has solid potential for both a short and long-term downturn. The surge in the index price was mainly due to silver and gold bullions […]

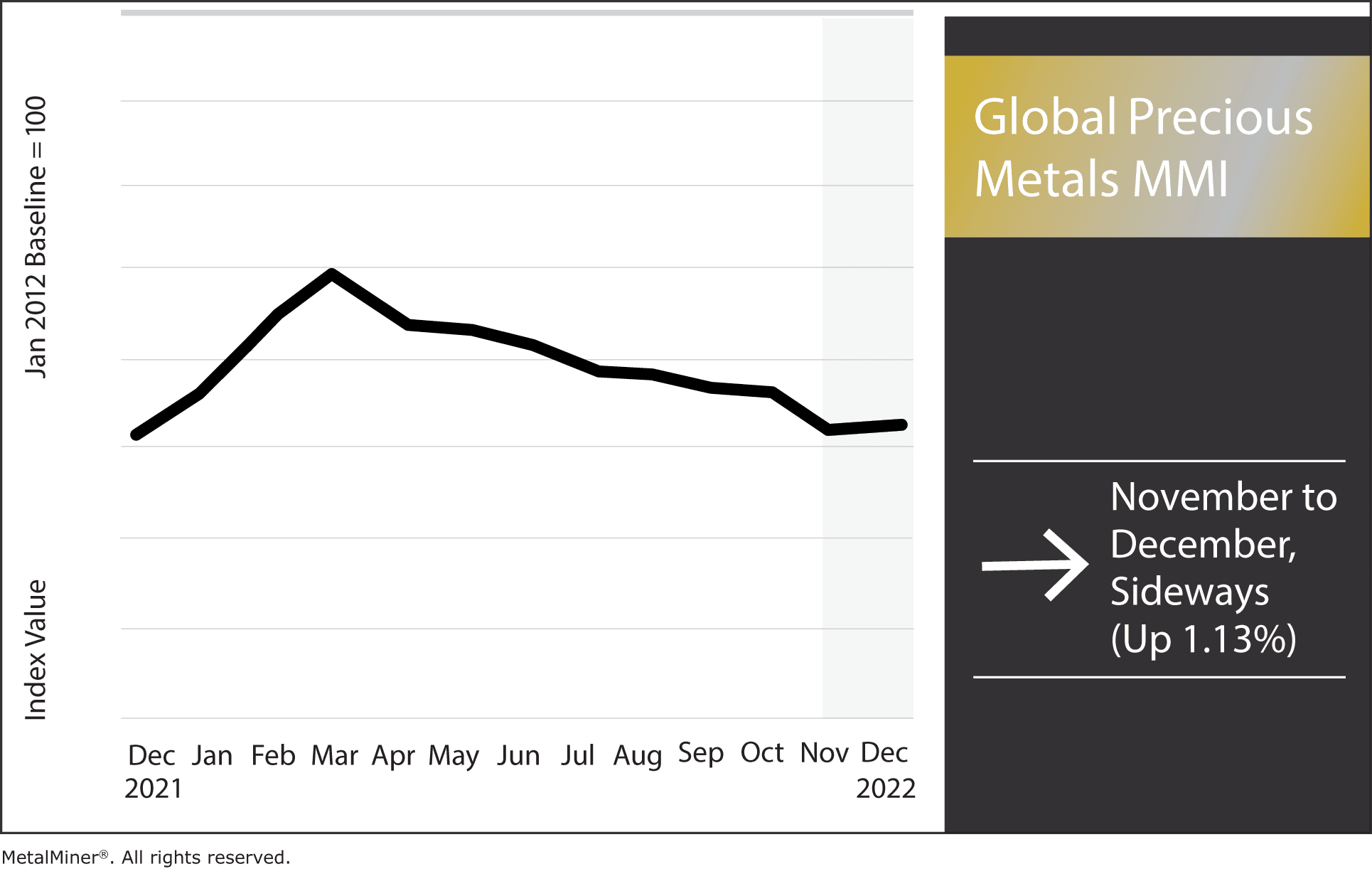

Global Precious Metal MMI: Long Term Price Directions Remain Uncertain

The Global Precious Metals MMI (Monthly MetalMiner Index) stayed within a sideways range this past month. However, precious metal prices did rise by a modest 1.13%. As the US dollar dropped in value over recent weeks, precious metal indexes responded accordingly. Month-over-month, gold, platinum, and palladium all saw a brief rally between Nov 3 – […]

Global Precious Metals MMI – Precious Metal Prices Break Through Short-Term Resistance

The November Global Precious Metals MMI (Monthly MetalMiner Index) dropped by 4.06% (between October 1 and November 1). However, between November 4 and November 10, silver, platinum, and gold prices shot up. Palladium prices also began rising during this period, but not quite to the extent of its three counterparts. Many believe the price surge […]

The Robust US Dollar Puts a Damper on the Gold Price Trends in India

October to December is always an interesting quarter in India, especially regarding gold and silver prices and their associated demand. For several reasons, this October is proving to be a less-than-ideal month for gold dealers around the subcontinent. So far, the gold price trend continues to decline when compared to the previous months. India is […]