The Stainless Steel Monthly Metals Index (MMI) jumped seven points this month to 68, translating into an 11.5% increase, the largest monthly increase registered by the MMI since the 10.95% increase in September 2017. Need buying strategies for steel? Request your two-month free trial of MetalMiner’s Outlook LME Nickel LME nickel prices surged in […]

Tag: Stainless Steel

This Morning in Metals: 2019 Could be a Record Year for Antofagasta

This morning in metals news, Chilean miner Antofagasta expects a bumper 2019, the reason why Elon Musk is using stainless steel to build a new SpaceX rocket and China is finding ways to avoid duties to get its stainless steel into India. Need buying strategies for steel? Request your two-month free trial of MetalMiner’s Outlook Antofagasta […]

The January MMI Report: Metals Slump to Close Action-Packed 2018

With the January 2019 Monthly Metals Index (MMI) report, we can close the book on 2018 and what was a wild year in the world of metals and metals price movements. Need buying strategies for steel? Request your two-month free trial of MetalMiner’s Outlook It was a book that closed with a pessimistic chapter for […]

Stainless MMI Loses Nearly 8% as LME Nickel, Stainless Surcharges Fall

The Stainless Steel Monthly Metals Index (MMI) dropped five points this month, losing 7.6% and currently standing at a value of 61. The current index sits just above the August 2017 level of 59 points, when LME nickel prices touched support and rebounded. The drop came as a result of lower LME nickel prices and […]

Stainless Steel MMI: LME Nickel Price Volatility Decreases

The Stainless Steel Monthly Metals Index (MMI) traded sideways in October. The current index stands at 72 points, back at January 2018 levels. Need buying strategies for steel? Request your two-month free trial of MetalMiner’s Outlook The sideways trend was created by a less volatile nickel price and lower domestic stainless steel surcharges, while stainless […]

Stainless MMI: Nickel Prices, Stainless Steel Surcharges Drop

The Stainless Steel Monthly Metals Index (MMI) fell again this month. The slide of six points moved the index to 72 from the previous 78 reading. Lower nickel prices led the fall, while domestic stainless steel surcharges also fell. Need buying strategies for steel? Request your two-month free trial of MetalMiner’s Outlook The drop in […]

The July MMI Report: Metals Markets Post a Down Month as Trade Tensions Rise

It was another busy month in the world of metals. Then again, these days quiet months in metals or in trade, generally, are few and far between. Need buying strategies for steel? Try two free months of MetalMiner’s Outlook Trade tensions continued to rise, as $34 billion in tariffs on Chinese goods went into effect […]

Section 232 and 301, Metal Price Outlooks and More — Webinar June 6

The U.S. Section 232 and 301 probes have made significant waves in global markets this year. In March, the U.S. imposed tariffs on steel and aluminum of 25% and 10%, respectively, as part of the Section 232 probe. Last year, the U.S. launched a Section 301 probe investigating Chinese trade practices, with particular focus on […]

Stainless Steel MMI: LME Nickel Price, Stainless Surcharges Both Rise

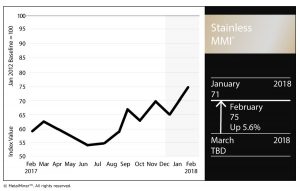

The Stainless Steel MMI (Monthly Metals Index) jumped four points again this month for a February reading of 75.

Need buying strategies for steel? Try two free months of MetalMiner’s Outlook

In January, skyrocketing LME nickel prices drove the Stainless Steel MMI. Nickel prices have climbed above the $13,000/mt level. 304 and 316 surcharges increased this month, returning to their previous levels.

LME Nickel

Nickel prices increased sharply during January. However, prices decreased slightly in early February. As reported previously by MetalMiner, nickel price volatility has increased over the past few months. Therefore, nickel prices may prove quite tumultuous from a short-term perspective and are trading within the orange-dotted band in the chart below.

[caption id="attachment_90272" align="aligncenter" width="580"]

The long-term nickel price uptrend also remains strong. Prices have moved toward June 2015 levels and already breached our October 2017 long-term resistance levels, as per our Annual Outlook. Therefore, nickel prices remain in a strong uptrend and could continue increasing in the coming months.

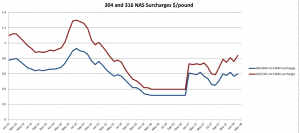

Domestic Stainless Steel Market

Following the recovery in stainless steel momentum, domestic stainless steel surcharges increased this month. Surcharges remain above last year’s lows (under $0.4/pound); they remain in an uptrend, even if their pace has slowed. However, buying organizations may want to look at surcharges closely to reduce risks, either via forward buys or hedging.

[caption id="attachment_90273" align="aligncenter" width="580"]

FerroChrome vs. Chrome Metal

Two months ago, MetalMiner reported on the anomaly between ferrochrome and chrome metal prices.

[caption id="attachment_90274" align="aligncenter" width="580"]

Ferrochrome (FeCr) is a chromium and iron alloy containing 50% to 70% chromium by weight. Historically, Ferrochrome and chrome prices correlate tightly but the high iron ore prices caused ferrochrome to spike. However, both prices (ferrochrome and chrome) have fallen back to their historical trading pattern of moving together.

What This Means for Industrial Buyers

Stainless steel momentum appears in recovery, similar to all the other forms of steel. As both steel and nickel remain in a bull market, buying organizations may want to follow the market closely for opportunities to buy on the dips. To understand how to adapt buying strategies to your specific needs on a monthly basis, take a free trial of our Monthly Outlook now.

MetalMiner’s Annual Outlook provides 2018 buying strategies for carbon steel

Actual Stainless Steel Prices and Trends