The Global Precious Metals MMI (Monthly Metals Index) saw a sharp rise in price action, jumping by 14.44%. This comes as all four major precious metals prices spiked in early October. Gold recently notched all-time highs again, while silver briefly hit $54/oz before a steep pullback. Meanwhile, platinum and palladium are also near multi-year highs. […]

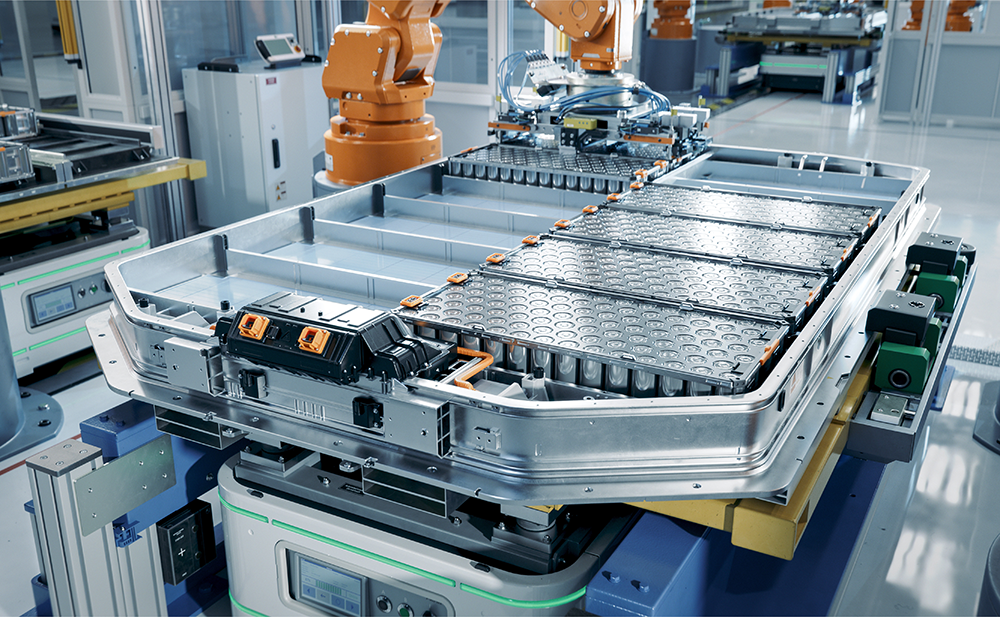

Automotive MMI: Critical Mineral Restrictions Shake US Auto Supply Chains

The Automotive MMI (Monthly Metals Index) moved sideways, rising a slight 1.39%. As a whole, the US automotive market is facing a number of challenges necessitating both innovation and resilience. Why Are Critical EV Minerals in Short Supply? Automakers are grappling with shortages of critical minerals needed for electric vehicles and high-tech components. Rare earth minerals […]

Global Precious Metals MMI: The Fed Cuts Rates by .25%. How are Precious Metals Prices Reacting?

The Global Precious Metals MMI (Monthly Metals Index) moved sideways, trending up by a slight 1.14%. Despite the sideways movement, precious metals prices have been anything but stale. The past two weeks have been dramatic for the precious metals market, as gold set new records, silver touched levels not seen since 2011 and palladium and […]

Automotive MMI: U.S. Automakers Grapple with Metal Supply Complications

The Automotive MMI (Monthly Metals Index) moved sideways, dropping a slight 2.3%. This comes as the US automotive market, manufacturers in particular, are facing a one-two punch of rising costs and potential shortages in their metal supply chains. A big reason for this is steep tariffs on steel, aluminum and other inputs, which are driving […]

Global Precious Metals MMI: Bulls and Bears Quarrel Over Gold Price Projections

The Global Precious Metals MMI (Monthly Metals Index) finally lost bullish steam and moved sideways, rising only 0.81%. The past month has seen significant swings in precious metals prices. Safe-haven demand drove several metals to multi-year highs in late July, followed by partial pullbacks in August as market winds shifted. Gold and silver, in particular, […]

Automotive MMI: Tariffs Fuel Turbulence in Auto Metals, U.S. Automakers Face Summer Price Spikes

The Automotive MMI (Monthly Metals Index) moved sideways, dropping by 0.84%. The U.S. automotive sector is reeling from recent developments that are dramatically altering the landscape for metal sourcing and procurement. Over the past month, new metal tariffs and trade deals, wild swings in aluminum and copper prices and frank warnings from automakers have converged […]

Copper Tariff U-Turn Sends Both Relief, and Shockwaves Through U.S. Supply Chains

In an 11th-hour reversal, the White House has exempted refined copper products, including cathodes, scrap and concentrates, from a looming 50% import tariff. Effective August 1, 2025, copper tariffs will only apply to semi-finished copper goods The surprise exemption caught metal markets off guard and sent U.S. copper prices into freefall. COMEX copper futures plunged […]

Global Precious Metals MMI: Precious Metals Prices Rise as U.S. Buyers Brace for Volatility

The Global Precious Metals MMI (Monthly Metals Index) rose by 6.18% month-over-month. The past 30 days have seen precious metals prices climb steadily, underscoring a volatile commodities environment for U.S. manufacturers and metal buyers. Gold remains near record highs, while silver, platinum and palladium each enjoyed strong rallies from mid-June to late July. These moves […]

Construction MMI: Tariffs Set to Drive Up Metal Costs as U.S. Construction Still Grapples with High Interest Rates

The Construction MMI (Monthly Metals Index) traded flat month-over-month, with no noteworthy price movement in either direction. Meanwhile, the U.S. construction industry is bracing for fallout from a new round of tariffs on key building materials. Industry groups warn that these tariffs, alongside persistently high interest rates, threaten to squeeze project budgets. Missing out on […]

Automotive MMI: Trump’s 50% Copper Tariff Sends Shock Through Auto Supply Chains

The Automotive MMI (Monthly Metals Index) moved sideways, inching up by 2.29%. While the index has maintained a mostly sideways trend over the past year, short-term volatility may be on the way. President Trump recently announced a 50% tariff on imported copper, a move expected to impact U.S. automotive manufacturing firms that source the red […]