Hot rolled coil prices in Europe have remained largely unchanged in the past two weeks. However, a proposal by the European Union to slash import quotas has raised concerns among market participants. Hot Rolled Coil Deliveries Surging into the EU Mills in northern Europe continue to seek €580-600 ($700) per metric ton EXW for the […]

Category: Tariffs

Stainless MMI: Stainless Mill Hold Prices Ahead of Contracting

The Stainless Monthly Metals Index (MMI) showed little volatility during the month as all of its elements, including nickel prices, moved sideways. This translated to an overall 0.12% increase from September to October. U.S. Stainless Steel Prices, Market Holds Flat U.S. stainless prices maintained their sideways trend as mills continued the base price increases instituted […]

Will a 15% U.S. Tariff on EU Autos Reshape Global Car Trade?

In a move with major implications for the global automotive industry, the U.S. federal government has implemented a 15% import tariff on auto imports from the European Union. According to a federal register notice from September 24, the move affects cars as well as auto parts. That notice went on to indicate that the duties […]

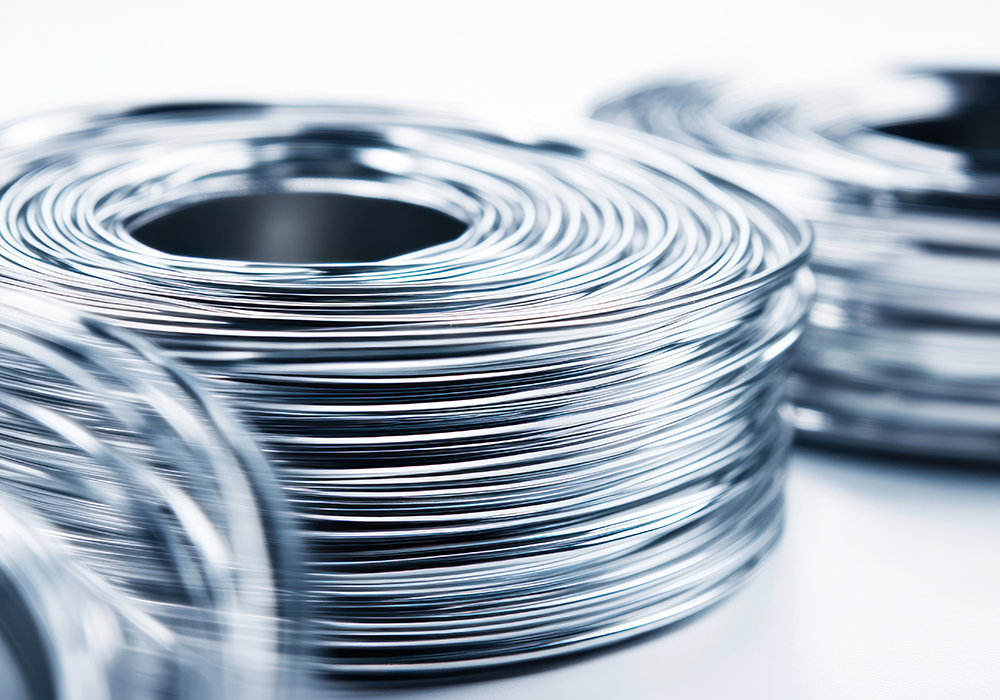

Aluminum MMI: Aluminum Prices Hit 6-Month High

The Aluminum Monthly Metals Index (MMI) remained sideways with an upside bias, rising 0.56% from August to September. Meanwhile, the global price of aluminum reached highs not seen since the beginning of the year. Track other MetalMiner monthly indexes here, and compare how the overall industrial metal market is performing. Worried about the fluctuating price […]

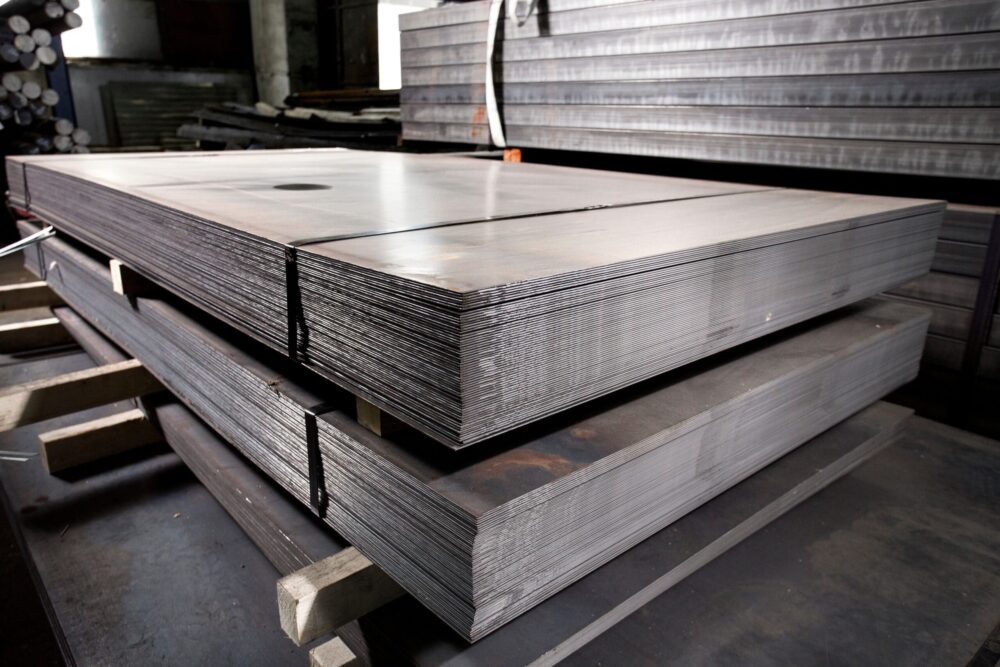

Raw Steels MMI: Steel Prices Search for New Low

The Raw Steels Monthly Metals Index (MMI) moved sideways with a downside bias, falling 0.96% from August to September. U.S. Steel Prices Continue to Unravel U.S. steel prices remain in search of a new bottom. As of early September, hot rolled coil prices sit at their lowest level since February 21, having unraveled much of […]

Stainless MMI: Suppliers Note Weak Q2 Despite Firm Stainless Prices

The Stainless Monthly Metals Index (MMI) moved sideways, with a modest 0.32% increase from July to August. Though it also remained flat for the month, the nickel price continued on an overall downtrend. Stainless Mills Note Weak Demand Despite a round of price hikes in recent months, the stainless market remains weak, with no evidence […]

Raw Steels MMI: Steel Prices Soften, More Tariffs on Deck

The Raw Steels Monthly Metals Index (MMI) accelerated during the month, moving up 3.87% from July to August as steel prices continued to slide. U.S. Steel Prices Continue Slow Downtrend U.S. steel prices have remained within a slow but steady downtrend since their late-March peak. As of mid-August, prices were down 9.49%, falling to their […]

Automotive MMI: Tariffs Fuel Turbulence in Auto Metals, U.S. Automakers Face Summer Price Spikes

The Automotive MMI (Monthly Metals Index) moved sideways, dropping by 0.84%. The U.S. automotive sector is reeling from recent developments that are dramatically altering the landscape for metal sourcing and procurement. Over the past month, new metal tariffs and trade deals, wild swings in aluminum and copper prices and frank warnings from automakers have converged […]

Aluminum MMI: MW Premium Futures Stagger, Aluminum Demand Soft

The Aluminum Monthly Metals Index (MMI) edged higher, but the pace slowed. Ultimately, the index saw just a 0.85% rise from July to August as the price of aluminum seemed to enter a period of flux. Track other MetalMiner monthly indexes here, and compare how the overall industrial metal market is performing. Midwest Premium Futures […]

Copper MMI: LME, Comex Copper Prices Return to Parity, Later Tariffs on Table

The Copper Monthly Metals Index (MMI) moved sideways, rising 1.18% from July to August. This puts the price of copper today just slightly above its April lows. Comex Copper Prices Plummet After Tariff Surprise July proved the most volatile month yet for Comex copper prices. As market surprises often do, the White House’s decision […]