The November Aluminum Monthly Metals Index (MMI) fell this month back to June 2017 levels, before MetalMiner called a bull market for aluminum. The current Aluminum MMI index stands at 88 points, three points lower than last month’s reading. Buying Aluminum in 2019? Download MetalMiner’s free annual price outlook LME aluminum prices fell in October. […]

Tag: Aluminum MMI

Aluminum MMI: Aluminum Prices Rise and Fall on Alunorte News

The October Aluminum Monthly Metals Index (MMI) fell two points for an October MMI subindex value of 91 (its lowest since August 2017). Buying Aluminum in 2018? Download MetalMiner’s free annual price outlook LME aluminum prices fell slightly in September. However, the mid-term trend has moved mostly sideways, trading between the $1,970-$2,170/mt level. Movements […]

Aluminum MMI: U.S. Midwest Premium Falls for Second Straight Month

The September Aluminum Monthly Metals Index (MMI) traded sideways this month. The Aluminum MMI index stands at 95 points. Buying Aluminum in 2018? Download MetalMiner’s free annual price outlook LME aluminum prices increased in August. However, so far in September, prices have fallen. Aluminum prices are in a sideways trend within the $1970-$2170/mt band. Buying […]

Aluminum MMI: LME Prices Fall Toward Support Level

The August Aluminum Monthly Metals Index (MMI) fell two points last month. The current Aluminum MMI index now stands at 93 points. Buying Aluminum in 2018? Download MetalMiner’s free annual price outlook LME aluminum prices fell in July. However, the rate of the declines has slowed. Price changes do not appear to be sharp and […]

Aluminum MMI: LME Aluminum Drops, Midwest Premium at Four-Year High

The July Aluminum Monthly Metals Index (MMI) fell six points, falling to April 2018 levels. The Aluminum MMI now stands at 95 points. Buying Aluminum in 2018? Download MetalMiner’s free annual price outlook LME aluminum prices fell in June and have continued to slide so far in July. However, the rate of the declines has […]

Aluminum MMI: LME Aluminum Prices Lead the Way

The June Aluminum Monthly Metals Index (MMI) increased one point. The current Aluminum MMI index now stands at 101 points. Buying Aluminum in 2018? Download MetalMiner’s free annual price outlook LME aluminum prices showed strength in May, and are continuing to increase this month. Aluminum has led the base metals complex due to U.S. tariffs […]

Aluminum MMI: Skyrocketing Prices Power Six-Point Surge

The May Aluminum Monthly Metals Index (MMI) increased six points. Skyrocketing LME aluminum prices drove the subindex value increase. The current Aluminum MMI subindex stands at 100 points, 6.4% higher than in April. Buying Aluminum in 2018? Download MetalMiner’s free annual price outlook LME aluminum price momentum recovered strongly in April. LME aluminum prices reached […]

Aluminum MMI: LME Aluminum Continues Downtrend

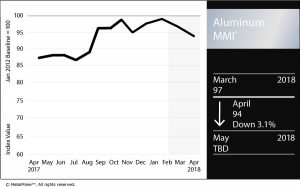

The April Aluminum MMI (Monthly Metals Index) fell three points. A weaker LME aluminum price led to the price retracement. The current Aluminum MMI index stands at 94 points, 3% lower than in March.

LME aluminum price momentum slowed again this month. LME aluminum prices remain in a current two-month downtrend.

Buying Aluminum in 2018? Download MetalMiner’s free annual price outlook

[caption id="attachment_91252" align="aligncenter" width="580"]

Though some may want to declare a bearish market for aluminum, prices are still over the $1,975 level, when MetalMiner recommended buying organizations buy forward. Prices may retrace back toward that level. However, if prices fall below the blue-dotted line, aluminum prices could shift toward bearish territory.

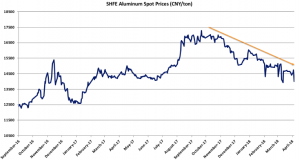

SHFE Aluminum

SHFE aluminum spot prices also fell this month. The degree of the decline appears less sharp than for LME prices. However, SHFE aluminum spot prices started to fall in October 2017.

[caption id="attachment_91253" align="aligncenter" width="580"]

Shanghai Futures Exchange (SHFE) aluminum stocks fell in March for the first time in more than nine months. Decreasing stocks sometimes point to falling inventories of aluminum in China, the world’s biggest aluminum producer and consumer. SHFE stocks dropped by 154 tons in March, according to exchange data released at the beginning of April. However, SHFE aluminum stocks still stand at 970,233 tons.

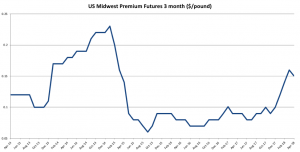

MW Aluminum Premiums

Meanwhile, U.S. Midwest aluminum premiums fell for the first time since November 2017. The $0.01/pound drop at the beginning of April comes after a sharp uptrend in the premium. Despite the lower premium this month, the pace of the increases may continue for some time.

What This Means for Industrial Buyers

LME aluminum price retracement may give buying organizations a good opportunity to buy, as prices may increase again.

However, as prices are currently trading lower, buying organizations may want to wait until the market shows a clearer direction. Therefore, adapting the “right” buying strategy becomes crucial to reducing risks.

Given the ongoing uncertainty around aluminum and aluminum products, buying organizations may want to take a free trial now to our Monthly Metal Buying Outlook.

Want to see an Aluminum Price forecast? Take a free trial!

Actual Aluminum Prices and Trends

Aluminum MMI: Markets React to 10% Aluminum Tariff Proposal

After last month’s increase, the March Aluminum MMI (Monthly Metals Index) fell two points for this month’s reading. A weaker LME aluminum price led to the retracement. The current Aluminum MMI index stands at 97 points, 2% lower than in February.

LME aluminum price momentum slowed this month. Despite the price retracement, trading volumes still support the current uptrend. The long-term uptrend remains in place.

Buying Aluminum in 2018? Download MetalMiner’s free annual price outlook

[caption id="attachment_90675" align="aligncenter" width="580"]

Domestic Aluminum Market

February brought much uncertainty to the domestic aluminum market with the release of the Trump administration’s Section 232 reports and recommendations vis-a-vis aluminum and steel imports. That release, together with President Trump’s announcement last Thursday of a 10% aluminum tariff on all imports have activated price warning systems for all aluminum and aluminum products.

LME aluminum reacted to the news, increasing only slightly.

Additional information about Trump’s announcement, combined with specific buying strategies, can be found in the MetalMiner team’s Section 232 Investigation Impact Report.

On top of that, the U.S. Department of Commerce announced its final determination on the Chinese aluminum foil import case initiated in March 2017. The aluminum foil investigation includes all Chinese aluminum imports, and the anti-dumping margins vary from 48.64 to 106.09%, while the countervailing margins vary in the 17.14-80.97% range. This case may also add some support for LME aluminum prices in the short term.

MW Aluminum Premiums on the Rise

U.S. Midwest aluminum premiums moved again at the beginning of March and are currently trading at $0.16/pound. The U.S. Midwest Premium has now reached the same levels from March 2015; the pace of the increases appears to have accelerated since the Section 232 report release.

[caption id="attachment_90677" align="aligncenter" width="580"]

The Section 232 outcome and President Trump’s comments around possible import remediation measures have caused increased volatility in the U.S. Midwest premium.

What This Means for Industrial Buyers

LME aluminum price retracement may give buying organizations a good opportunity to buy, as prices may increase again.

In bullish markets, buying organizations still have many opportunities to forward buy. Therefore, adapting the right buying strategy becomes crucial to reducing risks.

Given the ongoing uncertainty around aluminum and aluminum products, buying organizations may want to read MetalMiner’s Section 232 special coverage.

Want to see an Aluminum Price forecast? Take a free trial!

Actual Aluminum Prices and Trends

Aluminum MMI: Aluminum Demand Gets Boost from Automotive, Aerospace Sectors

After last month’s sharp increase, the February Aluminum MMI (Monthly Metals Index) inched up one point.

The basket of metals increased despite the slight retracement of LME aluminum prices.The current Aluminum MMI index reads 99 points, 1.0% higher than in January.

In January, MetalMiner anticipated a possible retracement in aluminum prices, as aluminum — and, generally, all base metals — increased sharply at the end of the month. LME aluminum prices fell by 2.8% in January from the previous 2-year high closing price in December.

Buying Aluminum in 2018? Download MetalMiner’s free annual price outlook

[caption id="attachment_90155" align="aligncenter" width="580"]

Aluminum prices inched lower during the first few days of February. Aluminum prices broke out of their previous sideways trend back in August, providing a strong buying signal. As prices may continue to increase, buying organizations may want to understand how to better purchase aluminum, reducing both risks and costs.

U.S. Domestic Aluminum Market

The U.S. Department of Commerce sent the Section 232 report for aluminum products to President Trump in January. President Trump has 90 days (from January 22) to review and announce actions regarding the probe for aluminum products.

Meanwhile, domestic aluminum demand received a boost from stronger U.S. automotive and aerospace sectors.

Despite the fall in U.S. auto sales in January, aluminum producers see increased demand. Demand has increased so significantly that Novelis Inc., the biggest flat-rolled products maker, announced the investment of a new plant in Kentucky to support growing automotive demand.

[caption id="attachment_90156" align="aligncenter" width="580"]

Chinese Aluminum Market

SHFE aluminum prices currently trade lower than LME prices. Although the trends appear to be similar, SHFE aluminum prices fell further in January. Lower SHFE prices relative to LME aluminum prices lead to increased Chinese exports to Asia.

[caption id="attachment_90157" align="aligncenter" width="580"]

According to the latest Chinese customs data, Chinese exports of unwrought aluminum and aluminum products increased by 12.8% in December compared to December 2016 data. December exports also increased on a monthly basis by 15.8% over November’s figures.

Aluminum Premiums

U.S. Midwest aluminum premiums moved again at the beginning of February, and currently trade at $0.12/pound. The Section 232 investigation and uncertainty around the outcome has increased the volatility in the U.S. Midwest premium.

Other aluminum delivery premiums also increased this month. The CIF Japanese spot premium increased 12% over January, to $98.50-$110/mt from the previous $90-96/mt. The European duty-unpaid premium jumped by 8.1%, while the Brazil CIF duty-unpaid premium increased by 3%.

What This Means for Industrial Buyers

As expected after last month’s sharp increase, aluminum prices retraced in January. In bullish markets, buying organizations still have many opportunities to forward buy. Therefore, adapting the “right” buying strategy becomes crucial to reduce risks.

Want to see an Aluminum Price forecast? Take a free trial!

Actual Aluminum Prices and Trends