Aluminum MMI: Aluminum Prices on the Rise After Sideways Trend

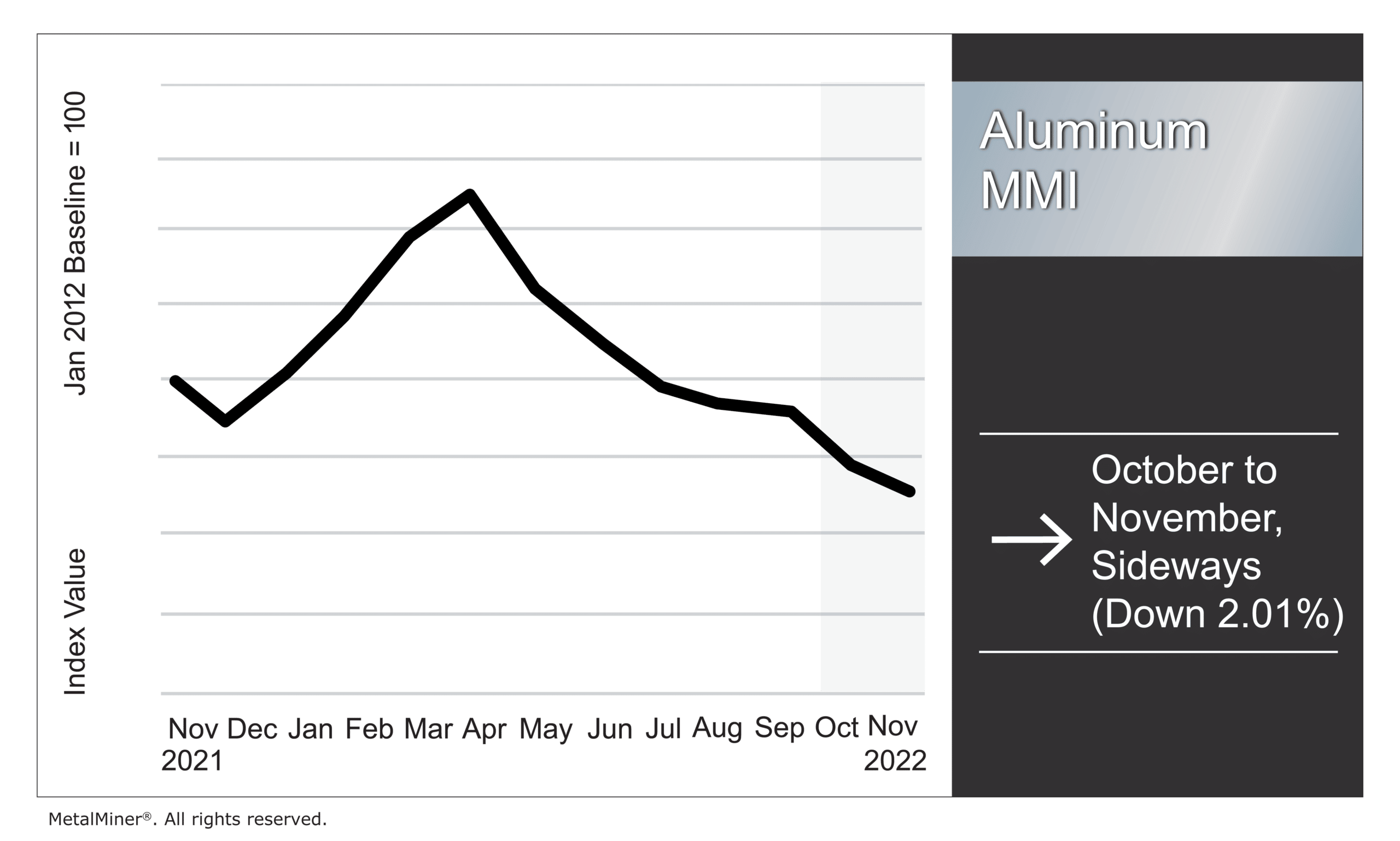

Aluminum prices consolidated last month within a range formed between late September and early October. The index’s unclear direction posed a higher risk to buyers, as prices could either reverse to the upside or continue downward. However, by early November, prices seemingly turned bullish. Shortly after, they enjoyed a steady climb toward the top of last month’s range.

The Aluminum Monthly Metals Index (MMI) fell 2.0% from October to November.

The MetalMiner Insights platform includes global aluminum prices, premiums, forecasts, and specific monthly buying strategies. Request a 30-minute demo of the MetalMiner Insights platform now.

Potential Russian Bans Present Bullish Risk for Aluminum Prices

Markets currently await a decision from the U.S. regarding bans on Russian metal. Indeed, sanctions largely avoided Russia’s metal industry at the start of the war in Ukraine. This was due, in part, to tight supplies, which underpinned historic uptrends for industrial metals. By early March, however, price trends began to invert. The market dynamics appeared vastly different than at the beginning of Russia’s invasion.

As far as the U.S. is concerned, reports suggest a potential ban would exclusively impact Russian aluminum imports. Although there is no decision yet, restrictions could range from increased tariffs on imports to an outright ban to targeted sanctions. The latter would likely target Russia’s largest producer, United Co Rusal, most of all. When news of the White House’s consideration broke on October 12, aluminum prices spiked over 6% in one day.

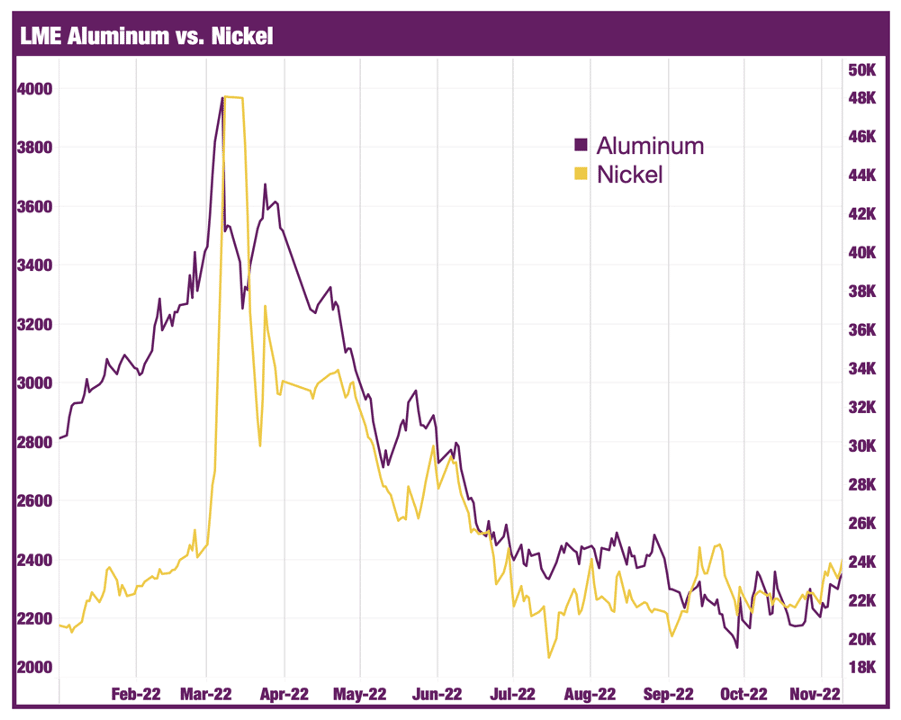

On the other hand, a ban by the LME would have likely impact all metals sourced from Russia. Late last week, the LME published its findings and will continue to operate the exchange with the “status quo.” According to a recent LME discussion paper, the organization laid out a range of options from softening volume limits rather than impose an outright ban. Russia accounts for 6% of global aluminum production, as well as 7% and 5% of nickel and copper production, respectively. The real concern began when multiple companies opted to self-sanction. Therefore, the concern was that continuing to allow delivery will lead to a surplus of unwanted, discounted Russian metal. This would likely result in heavily distorted LME prices. But based on a survey of 42 market participants, the LME concluded most companies will accept Russian material, thus the concerns remain unfounded.

Don’t miss out on learning the 5 best practices when sourcing metals like aluminum. Sign up for MetalMiner’s December workshop 5 Best Practices – Metal Sourcing Strategies.

Reactions to the Possible Ban Already Having Effects

As expected, metal producers like Alcoa resoundingly support such a ban. Meanwhile, manufacturers, especially those in Europe, continue to warn it will threaten business viability amid a number of other price pressures. While aluminum prices traded sideways last month, the possible cut off of Russian aluminum supply helped prices break upwards during the first weeks of November.

The jump occurred immediately following the LME’s member feedback deadline on October 28. Should either the U.S. or LME choose to enact restrictions, this would likely provide enough bullish momentum to continue the rally.

Does your company have an aluminum buying strategy based on current aluminum price trends?

Aluminum Not the Only Base Metal Price Rally

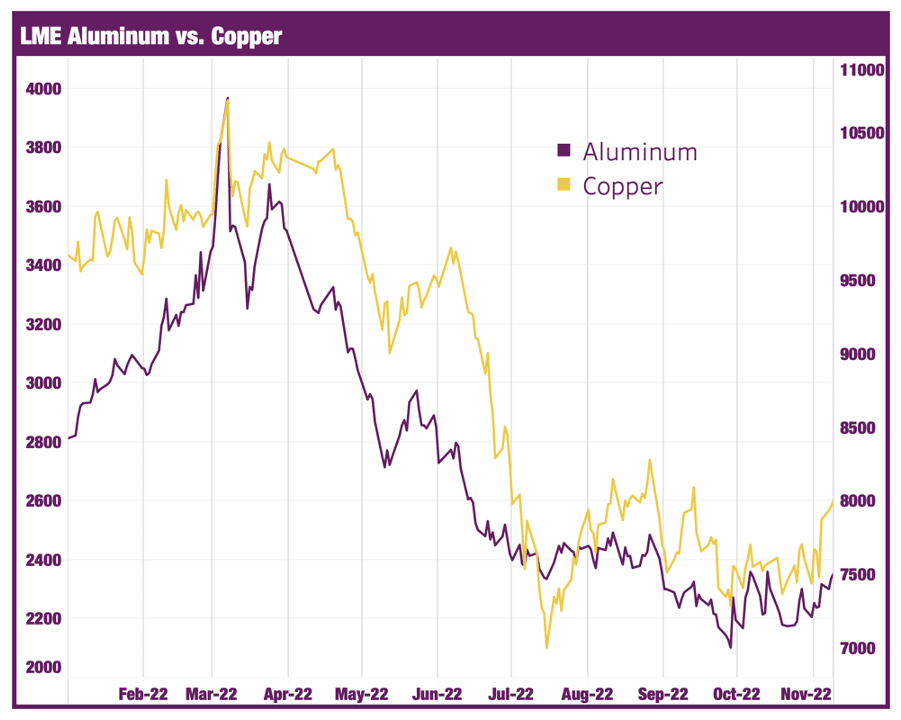

Aluminum prices managed to rise almost 7% since the end of October. Still, the aluminum market is not alone in its bullish price action this month. Both copper and nickel prices traded sideways through October, but began to break upward out of range during the first weeks of November. This suggests the rally may be part of a more widespread shift in market sentiment rather than less meaningful “noise” within an individual metal price trend.

From 2012 onward, aluminum prices maintained an 82.88% correlation with nickel prices. That said, the historic spike in nickel prices associated with the March nickel squeeze caused the overall correlation between the two metals to decline. Since that event, the correlation has both returned and strengthened. For instance, nickel prices traded within a tight range throughout October. Then, just like aluminum, prices bounced upward during the first weeks of November, rising nearly 11%.

The correlation between copper and aluminum prices is even stronger than that of nickel. In fact, copper and aluminum prices enjoy a 90.61% correlation – one that started back in 2012. In 2022 alone, that correlation managed to increase to 94.44%. Since the end of October, prices have risen almost 8%.

Enjoying this article? MetalMiner’s monthly MMI report gives you price updates, market trends and industry insight for aluminum and 8 other metal industries. Sign up for free.

Global Economic Pressures Mean Downside Risks Remain

While metal prices like aluminum continue to climb once again, global economic pressures are sure to provide a strong counterweight. For one, the energy crisis is far from over, which will continue to pressure metal demand significantly. And while energy prices are up worldwide, the crisis has undoubtedly hit Europe hardest. Prices saw some relief last month due to higher temperatures across the continent, but the core supply problems remain.

Germany recently resorted to burning coal to meet the energy gap. Meanwhile, France, which generates roughly 70% of its electricity from nuclear plants, lost over half of its nuclear capacity due to corrosion problems, technical issues, and maintenance. Moreover, high power costs will further pressure Europe’s already-beleaguered manufacturing sector in 2023. Fixed power contracts expiring will only exacerbate this. As manufacturing contracts, so too will the sector’s demand for metal.

China’s Priorities Shift

China, on the other hand, appears to be shifting its priorities away from economic growth and toward ideology. This is evident in a recently-submitted draft amendment to the Legislation Law, which regulates lawmaking activities. The amendment removed a key statement that dictated lawmaking should revolve around an open economy, economic growth, and reform.

In its place, the amendment stated that lawmakers should “adhere to the leadership of the Chinese Communist Party, adhere to the guidance of Marxism-Leninism, Mao Zedong Thought, Deng Xiaoping Theory, the Theory of Three Represents, the Theory of Scientific Development, and Xi Jinping Thought on Socialism with Chinese Characteristics for a New Era, to develop a system of socialist rule of law with Chinese characteristics.”

The amendment appears to pave the way for a continuation of the economically restrictive zero-COVID approach. It may even indicate a leadership that fully expects continued declines within the country’s property sector. Moreover, this shift in priorities will undoubtedly affect metal demand, as China represents half of global consumption.

Biggest Drops in Aluminum Prices

- European 5083 aluminum plate prices rose a modest 2.43% to $5,525 per metric ton as of November 1.

- European commercial 1050 aluminum sheet prices rose 2.25% to $3,681 per metric ton.

- Meanwhile, Chinese aluminum billet prices fell 4.98% to $2,447 per metric ton.

- Chinese aluminum scrap prices declined by 5.07% to $2,048 per metric ton.

- Lastly, Chinese primary cash prices fell 5.42% to $2,472 per metric ton.

Does aluminum content call your name? We’re rolling out more on LinkedIn. Give us a follow!

Leave a Reply